Pound Sterling Up against Euro and Dollar Following Strong Wage, Employment Data

- Written by: Gary Howes

- UK wage growth at record high

- Heaping pressure on Bank of England to act

- GBP supported by expectations for higher interest rates

Image © Adobe Images

The UK economy added more jobs than expected in November while wages grew faster than expected, maintaining pressure on the Bank of England to continue raising interest rates.

The British Pound rose after the ONS reported 27K jobs were created in the three months to November, which was unchanged on the previous month but stronger than consensus expectations for a slowdown to 5K.

The unemployment rate remained unchanged at 3.7% while those signing up for out-of-work benefits rose 19.7K, which was fewer than the 19.8K markets were expecting.

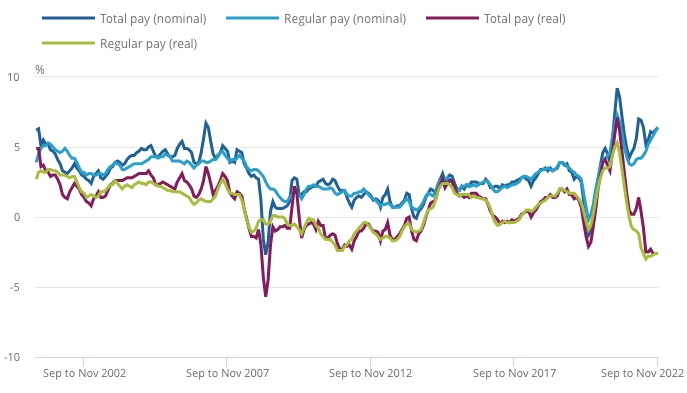

Average earnings with bonuses included advanced 6.4%, which is up on October's 6.2% and ahead of expectations for another 6.2% print. Without bonuses the rate of wage increases also stood at 6.4%.

"The British pound is trending modestly higher this morning after a mixed UK jobs report was released. Despite falling vacancies, labour shortages are forcing companies to increase pay for staff with wages rising at the fastest pace since records began and thus piling the pressure on the Bank of England (BoE) to continue hiking interest rates," says analyst George Vessey at Convera.

Above: Real and nominal pay dynamics. Source: ONS.

The ONS said of the wage numbers, "outside of the height of the coronavirus pandemic period, this is the largest growth rate seen for the private sector."

For the Bank of England to consider end its policy of raising interest rates, wages and employment must come down as this would be symptomatic of a cooling economy and easing domestic inflation pressures.

The figures are therefore likely consistent with another 50 basis point hike in February, followed by further increases.

"The latest labour market data maintain the pressure on the MPC to raise interest rates by another 50bp next month, rather than slow down," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics. "Wage growth still has strong near-term momentum."

The Pound to Euro exchange rate (GBP/EUR) has come under pressure in 2023 but there was a noticeable bid following the labour data, suggesting markets see these statistics as suggesting the UK economy is in better shape than they had expected. GBP/EUR is at 1.1289 in the hours following the data and was as low as 1.1254 ahead of the release.

The Pound to Dollar exchange rate (GBP/USD) was at 1.2168 ahead of the release but rose to 1.22 in the hours following the release.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

These data suggest the labour market is nevertheless cooling somewhat with the number of vacancies continuing to fall. In the October to December 2022 period the number of vacancies was 1,161,000, a decrease of 75,000 from July to September 2022.

The ONS does however caution that despite six consecutive quarterly falls, the number of vacancies remains at historically high levels, suggesting that the labour market remains historically 'tight' and consistent with ongoing inflationary wage pressures.

This underscores a view that the Bank of England can push interest rates higher, thereby offering support for the Pound. The market's reaction at the time of writing is broadly consistent with this theme.

With GBP/EUR spot back at 1.1268 bank payment rates are at approximately 1.1046, competitive cash and holiday money rates at 1.1170, competitive transfer rates at 1.1240. GBP/USD spot at 1.2190 takes bank payment rates to approximately 1.1947, competitive cash and holiday money rates to around 1.2080 and competitive money transfer rates to around 1.2154.

"We continue to expect a combination of slowing job-to-job moves and a rapid fall in CPI inflation in the second half of this year will ensure that year-over-year growth in wages slows to about 3.5% by the end of this year. But the MPC will have to be willing to bet that emerging signs of increasing labour market slack will translate into slowing wage growth, if they are to stop hiking Bank Rate in March," says Tombs.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes