Hunt Stabilises Pound Sterling and Bonds

- Written by: Gary Howes

- GBP firms at start of week

- Hunt to make new statement today

- In effort to restore UK fiscal credibility

- As investors watch bond market reaction

Above: The Chancellor Jeremy Hunt working with Treasury officials on the Medium-Term Fiscal Plan in his offices in HM Treasury. Picture: Gov.uk.

UPDATE: Hunt has announced plans to fully reverse the 'mini budget' and GBP is higher. Full story, here.

The British Pound and UK bonds were firm on Monday as markets gave their initial verdict on the new Chancellor, Jeremy Hunt.

Hunt has committed to restoring market confidence in UK finances by overturning the tax cuts announced by his predecessor, Kwasi Kwarteng, and committing to further measures.

Hunt is to detail further measures at 11AM Monday, according to a statement put out by HM Treasury treasury ahead of the UK market open.

"The Chancellor will make a statement today, bringing forward measures from the Medium-Term Fiscal Plan that will support fiscal sustainability," said the Statement.

Hunt said at the weekend, "hard decisions" lie ahead, including spending cuts and further tax rises.

"The pound has started off the week on a stronger footing supported by further efforts from the UK government to regain confidence in the public finances," says Lee Hardman, Senior Currency Analyst at MUFG.

Markets had grown concerned the tax cuts announced by Kwarteng would destabilise the UK's fiscal outlook, prompting a sizeable selloff in bonds and the Pound.

But the Pound was firmer on Monday amidst signs of a concerted effort by Hunt to restore UK fiscal credibility, above all else.

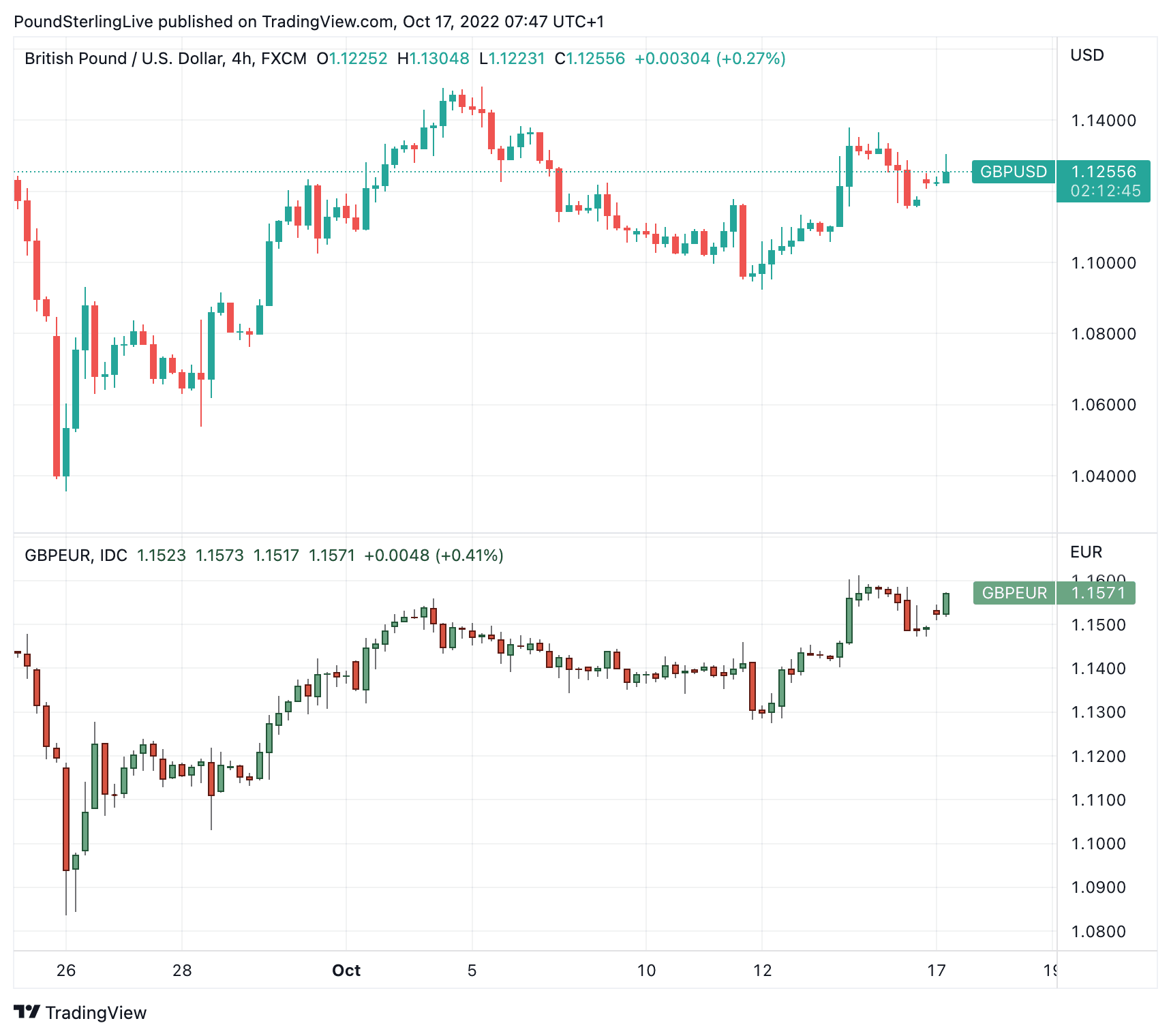

The Pound to Euro exchange rate was three-quarters of a percent up on the day at 1.1578.

The Pound to Dollar exchange rate was up nearly a percent at 1.1280.

"The GBP is trying to recover some ground back close to 1.13 after last Friday’s UK government reshuffle. Investors remain prudent about the efficacy and the credibility of the new fiscal measures being announced after the policy U-turn. Selling interest might therefore emerge," says Roberto Mialich, FX Strategist at UniCredit Bank.

(If you are looking to secure your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The British Pound was sold into the weekend as investors judged Prime Minister Lizz Truss has not done enough to restore confidence in UK assets.

Owing to "current market issues" Prime Minister Liz Truss announced the government would proceed with 2023's corporation tax hike, reversing a major policy pledge to cancel the hike, which was made during her campaign to be elected as Conservative party leader.

The move forms the latest attempt by Truss to restore market confidence in her government. Corporation taxes will now rise to 25% for profits above £50k.

But the Pound was lower and UK yields higher, suggesting markets demanded more.

A round of media interviews over the weekend, followed by Monday's Treasury statement, confirms the government is still nervous about an adverse market reaction.

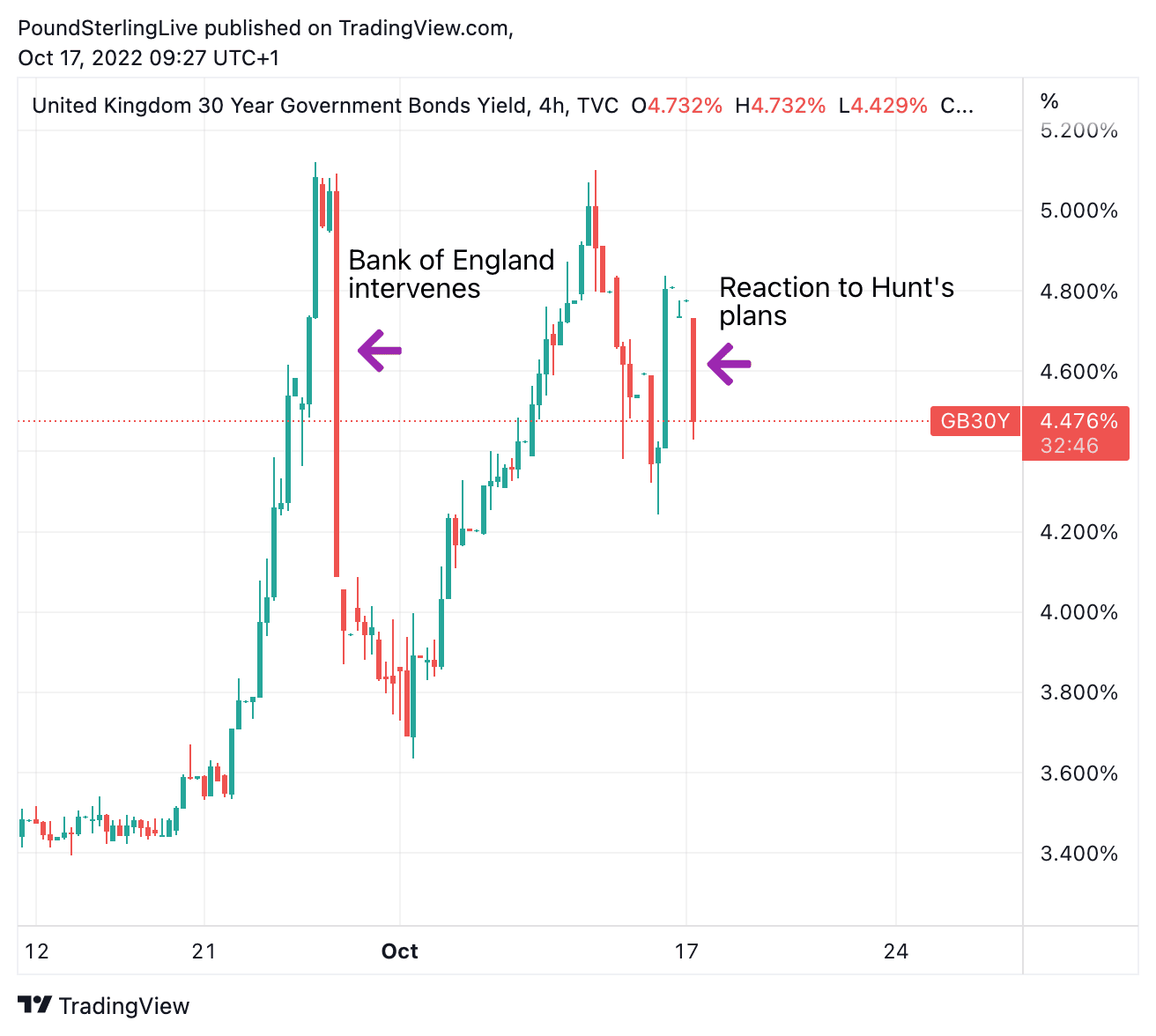

UK bonds (gilts) were bought on Monday, sending their yields lower:

Above: UK 30-year bond yields, a key market of investor sentiment and a benchmark for borrowing.

With the bond market's reaction in mind, Hunt met with the Governor of the Bank of England and the Head of the Debt Management Office last night to brief them on the new plans.

The Treasury statement confirms Hunt will deliver a more comprehensive Medium-Term Fiscal Plan, published alongside a forecast from the independent Office for Budget Responsibility, on 31 October.

Above: GBP/USD (top) and GBP/EUR (bottom) at four-hour intervals, showing performance since the illustrious 'mini budget' of Sept. 23. To better time your payment requirements, consider setting a free FX rate alert here.

The government has already confirmed that it has scrapped the plan to remove the top rate of income tax, saving £2BN/year and will now revert back to prior plans to raise the rate of corporate tax from 19% to 25% from April 2023 raising around £18BN/year.

"As a result, the government is already well on course to reverse over half of the unfunded tax cut measures from the mini-budget," says MUFG's Hardman.

The Bank of England has been active in UK bond markets over recent days, providing a backstop against a more severe selloff in bonds, as market confidence in the UK was tested.

But the Bank's intervention ended last week, therefore bond markets face a sizeable test this week.

If the market does not believe Hunt has done enough, further selling pressure might emerge, raising yields.

This in turn pushes up the cost of domestic finances, including corporate loans and mortgages.

The Pound would come under pressure too.

But, if bonds are supported by a recovery in sentiment, the Pound would rally.

"Overall, it promises to be another volatile week for the pound. We continue to believe that risks are more skewed to the downside for the pound especially against the US dollar heading into year-end. The pound has already fully reversed all of the losses following the mini-budget which should limit further upside on the back of further government measures to regain market confidence in the gilt market," says Hardman.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes