Pound Sterling in "Surprise Drop", Early Month-End Moves are Main Suspect

Image © Adobe Images

![]() - Spot GBP/EUR rate at time of writing: 1.0822

- Spot GBP/EUR rate at time of writing: 1.0822

- Bank transfer rates (indicative): 1.0540-1.0620

- FX specialist rates (indicative): 1.0700-1.0720 >> More information![]() - Spot GBP/USD rate at time of writing: 1.1686

- Spot GBP/USD rate at time of writing: 1.1686

- Bank transfer rates (indicative): 1.1377-1.1460

- FX specialist rates (indicative): 1.1540-1.1580 >> More information

After a strong start to the mid-week session the British Pound has suffered a sudden and unexpected decline against the Euro, Dollar and other major currencies in the London afternoon / New York trading session.

The Pound had been trading higher in sympathy with an ongoing recovery in global stock markets; we had noted that Pound is highly correlated with global market sentiment and any upturn in stocks would therefore inevitably prove supportive.

However, the sudden capitulation by Sterling has left foreign exchange market professionals scratching their heads as to cause of the latest bout of Sterling weakness.

Jeremy Boulton, an FX Analyst at Thomson Reuters says the selloff in Sterling is "out of sync with other major pairs that are barely moving."

"It's been a long time since I've seen cable move in such a schizophrenic fashion," says Michael Hewson, Chief Market Analyst at CMC Markets, referencing the GBP/USD exchange rate.

"This could be month-end buying conducted early," says Boulton, "those who execute the flow would be wise to take advantage of liquidity. Likely that liquidity at month-end will be stretched."

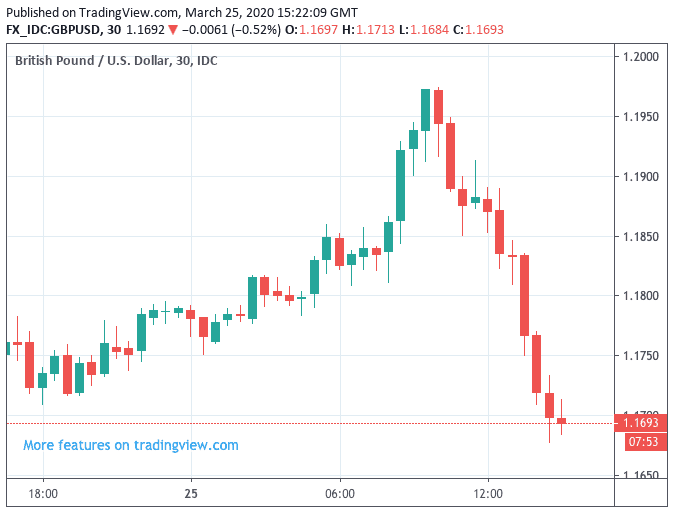

The Pound-to-Dollar exchange rate traded at a high of 1.1974 before capitulating to trade lower at 1.1693:

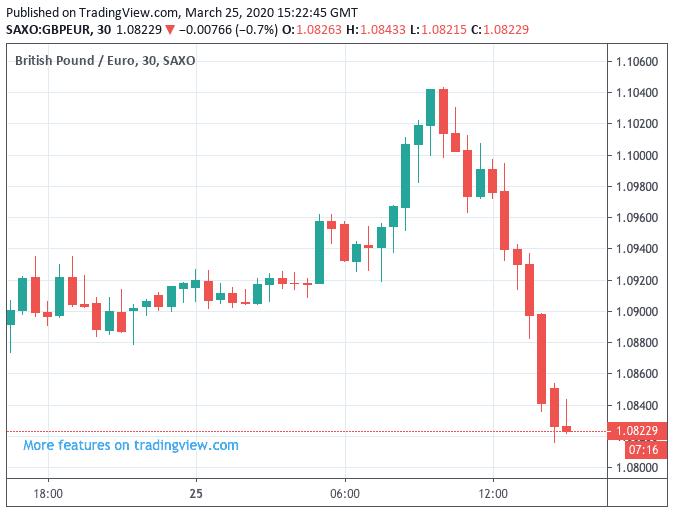

The Pound-to-Euro exchange rate had traded as high as 1.1043 before falling back to 1.0822:

Brent Donnelly, Spot FX Trade at HSBC, said it is time to be "cutting the bullish GBP trade."

One reason cited for the stance - as did Boulton - is the approaching month-end period, "as we near month-end, the market will get more and more nervous about holding USD shorts," says Donnelly.

Month-end sees the recalibration of equity funds which can in turn prompt significant and unexplained flows of currency. As a result currencies can experience unexplained movements that are ultimately short-term in nature towards the end of a calendar month.

Donnelly does say there are other reasons he is turning bearish on Sterling once more following the recent period of recovery.

One is the Pound's correlation to stock markets, something we mentioned earlier in this piece and something we have been repeating throughout the month of March as Sterling is battered by the coronavirus outbreak.

Donnelly says Sterling-Dollar currently has a 40% correlation with S&P 500 this month "and also trades very weak in the New York session" as a result. It is interesting to point out that today's declines accelerated in the New York session, suggesting the U.S. market might have a hand on Sterling downside.

The Pound tends to benefit when markets are rising as it suggests increasingly confident investors are once again dipping their toes into UK-based assets; as foreign capital flows into the UK economy the Pound is bid higher.

Therefore, if stocks tank again, there is a good chance Pound Sterling will follow suit.

Donnelly is bearish on stocks, believing the market has become too bullish, too soon in their belief that global central banks and governments have ultimately killed the coronavirus problem by flooding the market with money.

"An unprecedented bout of stimulus is helping prop up global equities, with investors hoping to pick up some staple travel firms in the hope of a long-term recovery," says Joshua Mahony, Senior Market Analyst at IG. "We find ourselves in the midst of an unprecedented bout of global fiscal stimulus, there is plenty of good news helping to overshadow the inevitable economic difficulty that lies ahead."

WATCH: What conditions might indicate a market trough? Goldman Sachs Research’s Kamakshya Trivedi explains in our new video series this week, The Daily Check-In: https://t.co/UYRNSKY2o4 pic.twitter.com/A89WUADYpM

— Goldman Sachs (@GoldmanSachs) March 24, 2020

But Donnelly is not buying this enthusiasm, "I am worried about stocks from here. Everyone is bullish and all the good news is out for now; not a good set up."

The Pound had been clawing back value amidst the market's surged higher over the past 48 hours after U.S. President Donald Trump's administration struck a deal with Senate Democrats and Republicans on a fiscal rescue package that would make available more than $2TRN in spending and tax breaks, aimed at softening the impact of the coronavirus outbreak on the U.S. economy.

"At last we have a deal," Senate Majority Leader Mitch McConnell said following the passing of the deal. "I’m thrilled that we’re finally going to deliver to the country."

The plan will see $500BN made available to back loans and other aid to businesses, the delivery of $1.2K to most citizens and more than $350BN for small businesses to maintain their payrolls.

Another analyst we follow does not believe the markets have yet bottomed.

"I do not see this as the bottom as what is going on does not represent the reality of the economic situation and so I am still staying out," says independent research analyst Richard Windsor, who specifically covers the technology sector.

Windsor says markets are at danger of a significant dislocation from reality thanks to the decision by the Fed and other central banks to pump trillions of easing money into the global economy.

A jump in share prices over recent days belies the reality that the global economy is in for a severe recession, that will by no means be followed by an economic surge.

Windsor uses the example of Google and Facebook share prices - which rallied 7% and 9% respectively yesterday - as examples of market dislocation. The share price gains for the technology giants comes despite dire predictions for digital advertising.

Windsor's research suggests advertising demand may have fallen by as much as 50% across the board and up to 90% in the hardest-hit industries (transportation and hospitality). The net result is the analyst expects Q1 2020 and Q2 2020 earnings to be hard hit and they might decline over the year as a whole.

"The Fed has said that there are no limits to how much money it will print, and the likelihood is that this bailout will have to be extended beyond investment-grade and government-backed debt in order to prevent the first domino from falling and setting off all the rest," says Windsor.

The former Nomura analyst, who now publishes research on his Radio Free Mobile blog, says central banks such as the Fed are now "printing money and creating liquidity out of thin air".

"The net result is a huge increase in the money supply which has not been backed by any physical asset since 1971," says Windsor. "The Fed is fighting against the free market by pumping cash into the system to prevent interest rates from rising and stocks from crashing."