Pound Sterling Gains vs. Euro and Dollar Extend: Labour and Lib Dems Set Out Positions for Caretaker Govt. to Avoid 'No Deal' Brexit

Above: Liberal Democrat Leader Jo Swinson today proposed Ken Clarke or Harriet Harman as potential leaders of a 'stop no deal' Governing coalition. File photo © Liberal Democrats. Licensing: Creative Commons.

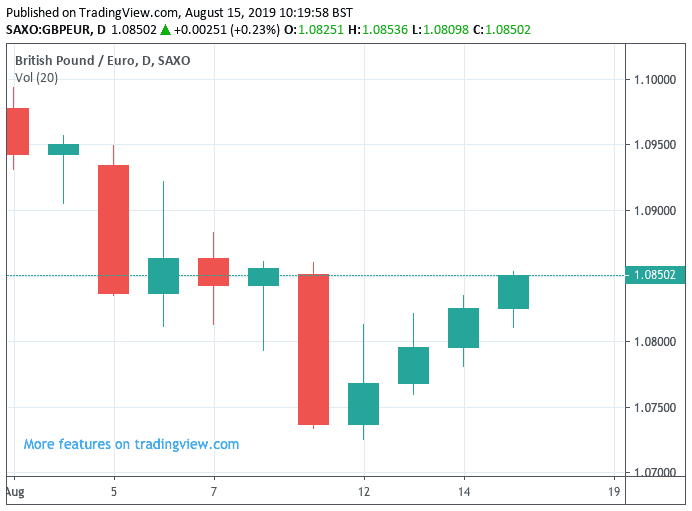

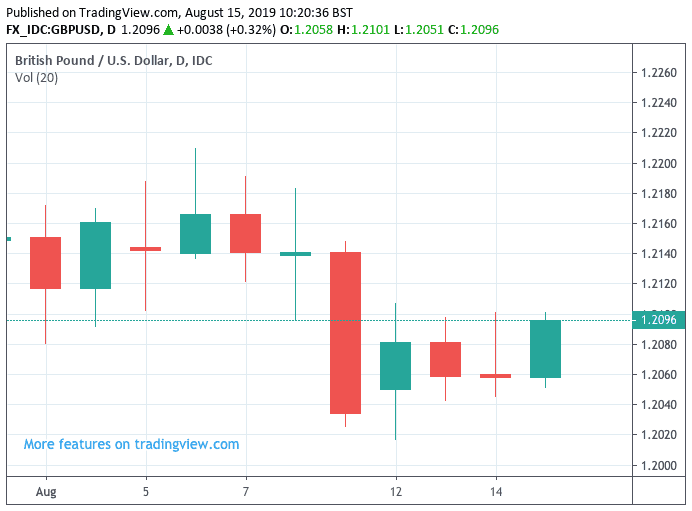

The British Pound is looking to record a fourth successive day of gains against the Euro while coming off recent multi-year lows against the Dollar, amidst signs of a strong appetite for a cross-party Government being formed to stop a 'no deal' Brexit amongst the Labour and Liberal Democrat parties.

Labour leader Jeremy Corbyn has commenced his quest to wrest control of the Government from Boris Johnson, proposing to MPs a caretaker Government that would seek to prevent a 'no deal' Brexit and deliver a second EU referendum.

According to media reports, Corbyn sent a letter to MPs on Wednesday night where he proposed building a cross-party coalition Government, one that he would lead.

The alternative government would call a General Election in which, Corbyn says, Labour would campaign for a second referendum.

The coalition government's lifespan would be “strictly time-limited,” says Corbyn, adding the coalition would “work in Parliament together to prevent a deeply damaging no-deal being imposed on the country”.

Sky News reports Thursday four senior Conservative lawmakers who are opposed to a 'no deal' Brexit are open to discussing Corbyn's plan to try to bring down Prime Minister Boris Johnson.

The report says the four lawmakers told Corbyn they were open to discussing options, although one - Caroline Spelman - later told the broadcaster she could not back a Corbyn government in any circumstances.

On the margin, avoiding a 'no deal' Brexit would be good for Sterling and some might point to the Pound's gains on Thursday as evidence: the Pound-to-Euro exchange rate is at 1.0848 up from Monday's low at 1.0724 and the Pound-to-Dollar exchange rate is at 1.2093, up from Monday's low of 1.2016.

However, Liberal Democrat leader Jo Swinson told an audience in London Thursday that she would reject any coalition government that had Jeremy Corbyn as its head.

Instead, she proposes that either Harriet Harman or Ken Clarke assume the role of Prime Minister under such an administration, noting them to be the Mother of the House and Father of the House. She said both had the ability to reach across party lines.

It therefore looks like the establishment of a new cross-party government following a vote of no-confidence would be a difficult task.

Regardless, a General Election is almost certain before 2019 is out, and for Sterling this is not supportive for sustained gains.

"There is growing speculation that there will be a general election in the autumn and this will add to the uncertainty for the Pound and Britain’s economy," says Nigel Green, CEO of deVere Group, a financial advisory firm.

“The situation will get even more serious should a Jeremy Corbyn-led Labour government win that election. His high tax and low-profit policies and anti-business rhetoric would deliver a hammer blow to the already floundering economy,” adds Green.

Above: GBP/EUR is looking to record its fourth day of gains and overcome last Friday's sharp drop

The news comes amidst reports that another Conservative MP - Phillip Lee - would be defecting to the Liberal Democrats within weeks, and in the process depriving the Prime Minister of a majority in Parliament.

Lee has long been opposed to the current Government's stance on Brexit, and said he would spend the summer considering a switch to the Liberal Democrats.

According to Alex Wickham, Senior political correspondent at Buzzfeed UK, the move would happen during the conference season.

Without a majority, Johnson cannot effectively govern and he would likely lose a no-confidence vote.

A General Election therefore looms, and with it the kind of political uncertainty that will likely keep Pound Sterling under pressure.

"A no-confidence vote could bring down the government and possibly line the way for a National Unity government as an alternative to a general election," says Jane Foley, an analyst at Rabobank. "September is thus shaping up to be an eventful month for GBP investors."

Recent polls suggest the Conservatives would likely secure the highest vote share, but they are not likely to secure a majority. There is much uncertainty as to how seats will be split in the event that the Brexit Party fields a full set of candidates that will almost certainly deprive the Conservatives of a majority.

"For markets, either outcome—an election of a Conservative party pushing an uncompromising hard Brexit or the possibility of a Labour administration if Johnson’s strategy fails—presents an unfavourable outcome," says Meera Chandan, an FX strategist with JP Morgan in London.

The view at Rabobank is Brexit will likely be delayed beyond October. "This is likely to bring a sigh of relief from investors and a modest reprieve for the Pound," says Foley.

However, a delay is not equivalent to a solution, and any strength in Sterling is expected to be shallow.

Rabobank's 3-month forecast for the Pound-to-Euro exchange rate is 1.11.

Should a 'no deal' Brexit occur, Rabobank see the Pound-to-Euro exchange rate falling to parity.

“Should the UK leave with no-deal, the pound is likely to remain weak for several years until the country and the EU readjusts,” says deVere's Green.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement