Sterling's General Election Losses Could Mirror ‘No Deal’ Decline show ING Forecasts

- Written by: James Skinner

Image © Chatham House, Accessed Flickr, image subject to CC licensing.

- Pound-to-Euro exchange rate @ 1.1157 | Pound-to-Dollar exchange rate @ 1.2429

- GBP losses in election scenario near as large as 'no deal' decline.

- Tory majority seen whittled down to one post-August byelection.

- Brexit rebels loom over EU talks EU, threaten no-confidence vote.

- Economic outlook, Corbyn policy, Scottish independence to weigh.

Pound Sterling will be punished severely if a seemingly-likely general election is called over the summer months, with losses likely to be almost as large as they would be under a 'no deal' Brexit scenario, according to forecasts from ING Group.

A general election is rapidly becoming a credible risk on the radar of currency analysts now that Boris Johnson has assumed his new post as Prime Minister, following a landslide victory in the Conservative Party leadership election this week, with the UK's exit from the EU the key fault line for MPs.

The Conservative majority is slim and likely to be whittled down to just one on August 01 when the Brecon and Radnorshire byelection takes place on August 01, assuming polls are right, and opponents of Brexit within the party have claimed they'll work with the opposition to bring down the government if a 'no deal' Brexit begins to look likely.

"A general election is getting more likely - perhaps even inevitable," says Petr Krpata, a strategist at ING, in a note to clients. "All of this uncertainty makes for a tricky few months for the economy, and this has sparked talk of a UK rate cut later this year. Markets see a 50% chance of easing in 2019, although we're yet to be convinced. Even so, the risks for the pound are intensifying."

Above: GBP/EUR at daily intervals, with 2-year UK-German yield spread (green line, left axis). Difference indicates Brexit-related 'risk premium'.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Peter Schaffrik, Analyst at RBC Capital Markets says Johnson’s early speeches as Prime Minister suggest he is gearing up for a snap General Election, and his bank assigns a 60% probability to such an outcome and the probability has, if anything, even increased following this week's developments."

The Brecon and Radnorshire by-election takes place on August 01, it is widely expected to see the Conservatives lose the seat and cede it to the Liberal Democrats.

This leaves Johnson with a working majority of one MP in parliament: clearly, this is not what any kind of legacy can be built on.

"The new Prime Minister is unlikely to be blind to these parliamentary numbers he faces. October is primed, therefore, for another showdown between the government and MPs over Brexit, one that we think is likely to end in a general election," says Schaffrik.

Johnson's promise to immediately get to work on putting 20K extra police on the streets is another clear signal that he does not intend to make the same mistake as his predecessor who went into the 2017 snap General Election with a strong focus on Brexit but was hit hard by Labour on domestic bread-and-butter issues.

In his opening speech Johnson also touched on social care, particularly social care for the elderly, again suggesting he knows where a core Conservative vote comes from.

Theresa May tried to break the so-called 'triple-lock' on pensions in her 2017 manifesto; this proved to be the first major campaign mistake, and she was unable to recover and ultimately lost her a parliamentary majority.

Johnson is playing the right cards, early.

"This is a government already gearing up for the election campaign that we believe is coming before the end of this year," says Schaffrik. By appointing prominent leave supporters to the most high-profile jobs the government is, in effect, brandishing its pro-Brexit credentials ahead of that contest hoping to stem the rise of the Brexit Party, in particular."

Awaiting the Mutiny

There are two routes to a snap poll: 1) the House of Commons votes with a two-thirds majority to dissolve itself, or 2) the Government loses a no-confidence vote.

The latter is the most likely: with the EU withdrawal agreement rejected three times by parliament, PM Johnson has committed to securing changes to it but he's also said the UK will depart the bloc on October 31 regardless of whether a revised deal with the EU has been struck. That means a 'no deal' exit at the end of October if the EU refuses to discuss changes to the withdrawal agreement, which could be enough to get at least some Conservative MPs in the House of Commons to follow through on threats to bring down their government.

Conservative Party MPs including former attorney general Dominic Grieve and Conservative grandee Ken Clarke have claimed they'll vote with the opposition in a confidence ballot. Former Chancellor Philip Hammond has also hinted that he might do the same. And the opposition Labour Party as well as the Liberal Democrats have long champed at the bit for an election.

Tory rebels, as well as the opposition, say their intentions are motivated by fears over the damage that a 'no deal' Brexit would do to the economy.

"Our base case is that new negotiations will not prove successful, and this could set up an almighty battle in October as Parliament races to try and prevent the new government pursuing a ‘no deal’ exit. While a 'no deal' is possible (we see a 20% chance at the moment), all of this is more likely to culminate in a no-confidence vote in the government. One way or another, a late 2019 election is getting increasingly likely," Krpata says.

Above: GBP/USD at daily intervals, with 2-year UK-U.S. yield spread (green line, left axis). Difference indicates Brexit-related 'risk premium'.

A general election would see all of the UK's main parties compete with each other to offer manifestos that, with Brexit aside, are likely to win votes. In the current political climate that could see parties seeking to outdo each other with pledges over increased budgets for various priorities. It would also risk installing opposition leader Jeremy Corbyn in 10 Downing Street, who markets fear almost as much as Brexit, while creating wider scope for another Scottish independence referendum.

Richard Pace, an options analyst at Thomson Reuters says the structure of the options market confirms traders and investors are nervous about events other than a 'no deal' Brexit.

"Demand for GBP options with late September and October expiries, in preference to those falling after Octobrt 31, reflect the volatility risk to GBP from factors other than a no-deal British departure from the European Union .... A UK general election has been the talk of political watchers for weeks – it's considered the only way to break the Brexit deadlock without a second referendum (which isn't the favoured option)," says Pace.

Markets know Johnson won't get a new Brexit deal without an Irish back-stop, and parliament will stop him from forcing his threatened no-deal Brexit on the UK.

"To force any legislation through parliament with his tiny party majority of two (if the DUP stay on board) is unworkable, and that's why a general election looks like the only way to break this deadlock. Political watchers also suggest some of his cabinet choices, and his social spending promises since he won the premiership, are more in line with an impending election than a Brexit battle," says Pace.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Strategic Advantage

The new Prime Minister will sense a strategic imperative in going for a snap General Election if polling appears to be headed in the right direction.

The Times reported in mid-July that Johnson's team want to hold a General Election in the summer of 2020, and has started raising funds to hire more staff and prepare the Conservative Party for the contest.

One senior member of Johnson’s leadership team told The Times: “there’s a desire to get this done while Corbyn is still around. Labour is utterly divided — Brexit is killing them. Labour is in no fit state to fight a general election.”

At the time of writing, odds at bookmaker Ladbrokes are showing a 58% implied probability that an election takes place in 2019 with William Hill offering odds suggesting a 55% implied probability.

"What we expect and can imagine that the new leader of the Conservative party is hoping for is a return of voters from the Brexit party back to the Conservatives thanks to their pledge to achieve Brexit by 31 October “Do or die.” This would increase the risk of a snap election to regain a majority in the House of Commons that was lost in the 2017 election," says Jordan Rochester, a currency strategist at Nomura.

Forecasts for the Pound

The threat of a Corbyn-lead government is expected to keep the pressure in Sterling, after all Corbyn is a long-standing advocate of socialism. He has an openly Marxist shadow chancellor on the Labour frontbench, his commitment to free markets is nonexistent and his respect for private property rights has been questioned by some due to previous economic proposals that risked seeing utility companies nationalised at prices below their market value.

In addition, Corbyn and the Labour Party have recently swung behind the idea of a second Brexit referendum that would see voters forced to choose between whatever exit arrangements his remain-leaning party would be able to agree with the EU if in office, and remaining in the EU. That would risk setting a precedent for Scottish MPs, some of whom have never given up on the idea of independence from the UK, to demand another referendum.

"Recent polling suggests that an election might not actually be a bad thing for Mr Johnson - but given that an election would almost certainly require another Article 50 extension, his party's renewed popularity could falter by the time the vote occurs," Krpata writes. “Despite the bad news already being reflected in Sterling, there is still scope for further GBP decline."

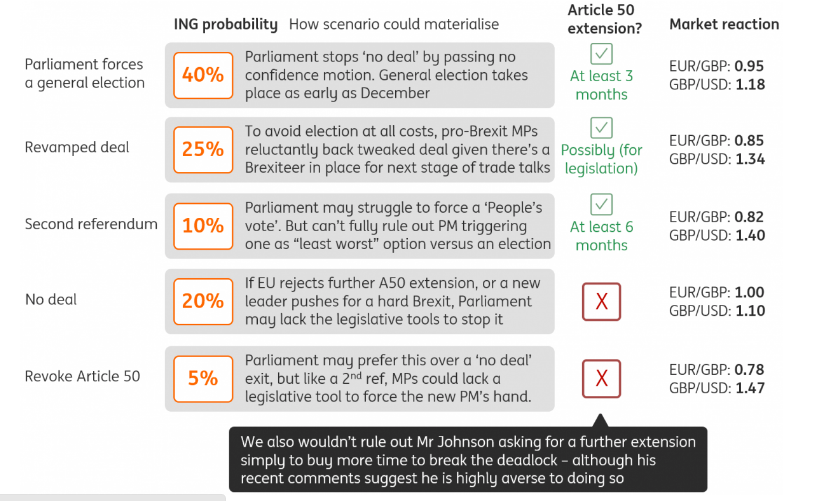

Krpata and the ING team forecast the Pound-to-Euro rate will fall to 1.0869 before the end of September and the Pound-to-Dollar rate will decline to 1.22 as political uncertainty rises and fears for the economic outlook grow further. However, he also says the Pound-to-Euro rate will drop to 1.0526 in the event that a general election is called, which is not far off ING's forecast of parity with the single currency in the event of a 'no deal' Brexit.

Above: ING graphic showing Pound-to-Euro, Pound-to-Dollar forecasts for different Brexit scenarios.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement