Pound Sterling is Forecast "a Fair Bit Weaker"

- Written by: James Skinner

Image © Adobe Images

- GBP eyes return to January lows amid Conservative leadership contest.

- Deal or No Deal the key fault line as candidates vie to replace PM May.

- Uncertainty to drive GBP lower until Brexit outlook clearer.

Pound Sterling continues to stabilise after a volatile May, but the British currency is on the verge of another slide that could soon take it all the way down to January's lows, according to analysts from multiple financial institutions eyeing a difficult few weeks in British politics ahead.

Market concerns over the trajectory of the Brexit process had been rising for weeks now but escalated on Friday when Prime Minister Theresa May announced her pending resignation, setting off a process that has created scope for a 'hard Brexiteer' to lead the government.

Perhaps more significant for the Pound's outlook are the implications on the future Brexit policy the government will adopt under its new leader following the sudden and rapid rise of the Brexit Party whose stated aim is to deliver a WTO or 'no deal' Brexit.

The Brexit Party and UKIP combined collected just under 35% of the vote share in the recent EU elections, while those parties supporting a second referendum (the Liberal Democrats, Greens, SNP, Plaid Cymru and Change UK) amassed just over 40% of the vote.

The Conservative and Labour parties collectively only captured just over 23% of the vote.

According to Simon Derrick, Chief Currency Strategist with BNY Mellon, the results of the EU elections "has significant implications for UK politics and, as a result, GBP".

"If the Conservative Party needs to pivot towards a more clearly defined stance on Brexit then so too does the Labour Party given that much of the collapse in support is being blamed on their failure to back a second referendum," says Derrick.

What we expect is a shift away from a Brexit built on a deal to a more clear-cut outcome that involves a WTO-style Brexit, or a General Election leading to a 2nd referendum and a potential remain victory.

"The outcome of Brexit has become more binary, with a reduced chance of a compromise negotiated outcome," says Jacob Nell, Economist with Morgan Stanley in London. "We think the success of the Brexit party is likely to put the Conservatives under pressure to support a harder version of Brexit, while the success of the parties who support staying in the EU is likely to put Labour under pressure to support a second referendum."

For now, it is clear the prospect of political uncertainty is to remain elevated creating a difficult environment for Sterling.

Should analysts be right and the political uncertainty surrounding the leadership race prompts declines to 2019 lows, then there remains a chunky amount of selling as current levels remain relatively elevated to where the Pound began the year.

The Pound-to-Dollar exchange rate is quoted at 1.2658 at the time of writing, the January low is set at 1.2442 while the Pound-to-Euro exchange rate is quoted at 1.1338, the January low is at 1.0998.

"The European election results in the UK highlight a growing support for both hard Brexit and pro-EU parties in the UK. With Theresa May set to resign as PM soon, uncertainty over the future of the UK’s relationship with EU is high. Ongoing uncertainty around Brexit will continue to weigh on GBP," says Kim Mundy, a strategist at CBA.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Pound Forecast "a Fair Bit Weaker"

The next steps to selecting a new Conservative leader will firstly see Conservative MPs nominate their preferred candidates, with nominations closing in the week of June 10.

What follows is a successive rounds of votes that will whittle the field down to two, this should be completed by around the end of June.

Hustings with local Conservative associations around the UK then take place ahead of a vote.

The party membership will then deliver a result ahead of the summer break and a new Prime Minister should be in place by mid-July.

Thirteen Conservative Party MPs are now vying for the nominations of their parliamentary colleagues ahead of voting that's set to begin in June, although only two of them will make it through to a grassroots membership ballot. The winner inherits the party and 10 Downing Street.

The contenders' views on how best to get the UK out of the EU before an October 31 deadline are top of the agenda for both the parliamentary party as well as grassroots members.

The views will in turn impact on markets which remain highly sensitive to political headlines when trading the Pound.

It is for this reason that we expect a summer of volatility for the currency.

Some candidates including former foreign secretary Boris Johnson, Esther McVey and Andrea Leadsom have all hinted they could pursue a 'no deal' Brexit rather than support PM May's proposals or a request further extension of the Article 50 period.

Former Brexit minister Dominic Raab has said the UK must get on and leave the EU, even if that means without a deal.

Meanwhile foreign secretary Jeremy Hunt has come out against such a thing, claiming it would be "economic suicide" for the party.

Meanwhile, some ministers are said to be attempting to block Boris Johnson's candidacy over his Brexit views while MPs like Dominic Grieve have threatened an attempt to bring down the government if a future leader attempts to leave without a deal.

Other candidates including the secretary for international development Rory Stewart have come out strongly against a 'no deal' exit.

As a result, 'deal or no deal' is the fault line upon which the leadership battle will be fought.

"A big election win for the Brexit party echoes the UKIP success in 2014 – which prompted Cameron to buy-off the UKIP vote with the offer of a Brexit referendum. Tory PM leadership candidates are therefore being dragged to the right again - making a 'no deal' Brexit more likely. Cable vulnerable to 1.25 again," says Chris Turner, head of FX strategy at ING Group.

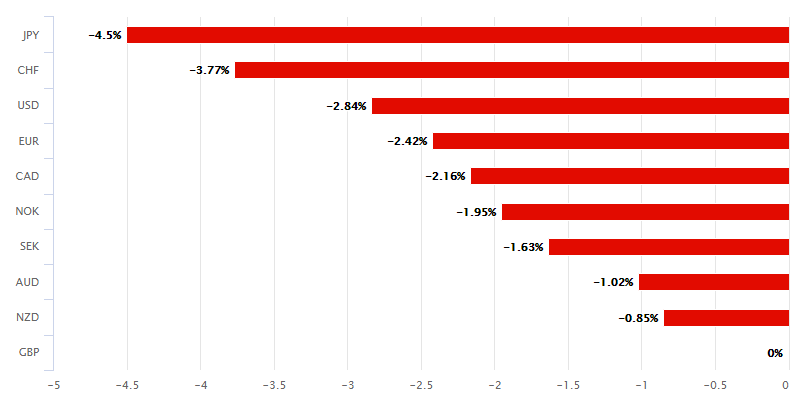

Above: Pound Sterling performance against G10 rivals in May.

The buildup to PM May's resignation and the uncertainty thrown up by it helped knock Sterling off its perch as the best-performing currency in the G10 universe for 2019 last week.

"The rise of the Brexit Party seems to be hardening the view that the Conservative Party can't afford to fail to deliver an exit from the EU. Of course, the standoff between those who want to leave without a deal if necessary and those who would rather stay than leave without a deal, will remain in place but the Pound could be a fair bit weaker by the time either side is forced into a rethink. There's upside to EUR/GBP towards 0.90, and downside in GBP/USD to 1.25 as a result," says Kit Juckes, chief FX strategist at Societe Generale.

EUR/GBP at 0.90 gives a GBP/EUR exchange rate of 1.111.

Some analysts have said a 'no deal' exit would send the Pound close to parity with the Euro, while a cancellation of Brexit might yield substantial gains for the currency.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement