GBP/EUR Week Ahead Forecast: Looking Oversold

- Written by: Gary Howes

- GBPEUR nursing wounds following another weekly loss

- But starting to look oversold says ING

- Watch for divergence in Eurozone and UK PMIs Tuesday

- ECB interest rate decision is key event Thursday

Image credit: Luke Andrew Scowen. Sourced: Flickr. Reproduced under CC licensing 2.0.

Pound Sterling fell to its lowest levels in five months against the Euro last week, and unless UK PMI figures burn bright relative to those of the Eurozone, and the ECB drops a clanger, the odds of any meaningful rebound remain limited.

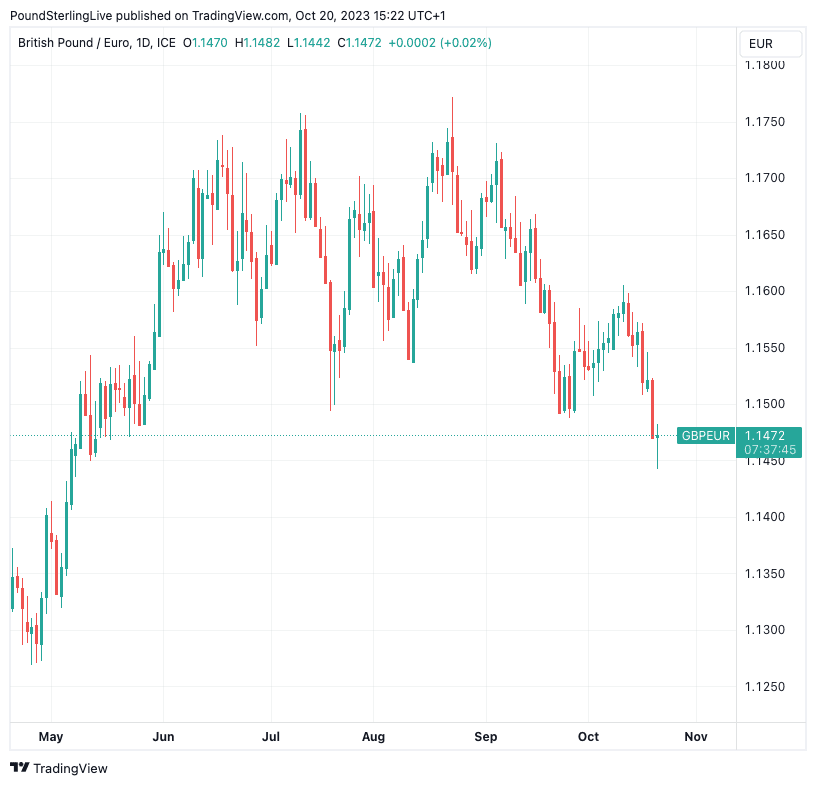

Short-term momentum indicators on the charts currently advocate for a continuation of weakness in the Pound to Euro exchange rate over the coming days, with a test of the 1.14 area coming into view.

But one analyst we follow cautions the recent selloff is now starting to look excessive, given the market has adequately adjusted its expectations for another interest rate rise at the Bank of England in November.

"We have seen EUR/GBP rally above 0.8700 recently, which starts to look slightly overdone as market expectations for Bank of England tightening at the 2 November meeting have dropped to almost zero," says Francesco Pesole, FX Strategist at ING Bank.

The 0.87 in EURGBP referenced in the above quotation equates to GBPEUR at 1.15.

Above: GBPEUR's daily chart may be messy from a technical perspective, but one obvious takeaway is that the Euro has been favoured of late. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Tuesday should prove a crucial day for the Pound-Euro conversion, given the release of PMI survey data for October in both the UK and Eurozone.

The foreign exchange market will be on alert for signs of divergent fortunes, favouring the currency belonging to the economy which puts in a better-than-expected performance relative to the other.

First up is the release of flash Eurozone PMI survey figures at 09:00 BST, where the market expects a composite figure of 47.4, with manufacturing expected at 43.7 and services at 48.6. Sentiment towards the Eurozone economy has been firmly negative since July and we therefore see scope for a rally in the Euro should the PMI beat expectations.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

A services PMI of 49.5 is expected from the UK in the 09:30 BST release, with the manufacturing PMI anticipated at 44.6. The rule of thumb is that the Pound will move according to whichever side of expectation the data lands: higher on a beat, lower on a miss.

"If the forward-looking balances in recent activity surveys are anything to go by, October's flash S&P Global/CIPS PMI surveys are likely to signal a further contraction in private sector output," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

But again, for the Pound-Euro in particular, we will be benchmarking against the Eurozone numbers from just 30 minutes prior.

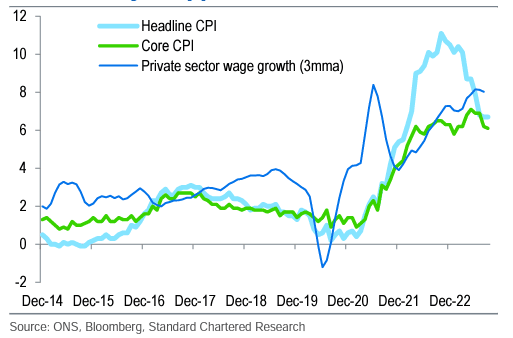

Above: UK CPI and wages, % y/y. Standard Chartered says the Bank of England has ended its rate hiking cycle as the key data heads in the right direction. Last week Standard Chartered raised its growth forecasts for the UK.

The British Pound found itself under pressure following the release of a tranche of domestic figures that pointed to a slowing economy, but the currency could find redemption should this week's PMI figures beat expectations.

"We still have... flash PMIs and labour market data to be published. As has been seen in past meetings, singular data points can have the power to influence a rate decision (even if they are then revised). The risks are certainly tilted towards a further hike from the Bank of England," says Ellie Henderson, an economist at Investec.

Should expectations for a further hike build, it could prove supportive of Pound Sterling.

UK employment figures were due last week but were delayed by the ONS for technical reasons and are now set for release on Tuesday at 07:00 BST, and investors will be looking for signs of 'slack' in the labour market to back a growing expectation that the Bank of England has completed the rate hiking cycle.

The headline unemployment rate is expected to be unchanged at 4.3% in August. Meanwhile, the rolling three-month employment figure is expected to show a contraction of 195K workers.

Should the numbers beat expectations, the Pound could find itself supported, but we would expect gains to be limited simply by observing the Pound's inability to rally on upbeat data (the inflation beat last week is a case in point). Analysis from Goldman Sachs confirms the FX market remains asymmetrically responsive to softer incoming data from the UK.

"This dynamic was on full display this past week. When UK wage data disappointed expectations on Tuesday, November BoE pricing moved lower and GBP underperformed; then, when core services inflation surprised to the upside on Wednesday, November pricing was largely unchanged and GBP failed to rally," says the FX strategy team at Goldman Sachs in a regular weekly briefing.

Image © European Central Bank, reproduced under CC licensing

The European Central Bank (ECB) is due to deliver its latest policy decision on Thursday at 13:15 and the market is poised for Frankfurt to leave rates unchanged in view of both softening economic activity and inflation.

This would not be a surprise to the market and won't impact Euro exchange rates; instead, it falls to the guidance issued by ECB President Christine Lagarde and the Governing Council to move the market.

The general rule of thumb is that 'hawkish' guidance would prove supportive of the Euro, and this would most likely come in the form of a clear message that a further hike might still be required to get a firm grip on inflation.

Here, commentary on the economy would also be optimistic, emphasising the likelihood of a 'soft landing' scenario whereby inflation is brought down with a minimal hit to growth, prompting investors to push back the expected timing of the first rate cut in 2024.

A 'dovish' guidance would likely result in Euro weakness, this would potentially involve a clearer signal that the Bank is confident enough has been done in order to bring inflation down. It would likely involve the ECB placing great emphasis on the slowdown in the Eurozone economy, allowing investors to raise bets for a rate cut.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes