Pound-Euro Exchange Rate Pushes Above 1.16, Johnson to Launch Conservative Campaign

Above: Boris Johnson. © Number 10 Downing St. | Gov.uk

- Pound pushes to top of range

- Upside to remain limited in current environment

- Shift in polls could shift Sterling

- Johnson to launch Conservative election campaign today

Pound Sterling has made a fresh push higher against the Euro over the past 24 hours, allowing the Pound-to-Euro exchange rate moving above the key 1.16 level once more.

At the time of writing the pair is quoted at 1.1631, the 2019 high is at 1.1661, a level reached on October 17. However, the exchange rate closed yesterday at 1.1634, this is the highest closing level in five months.

That the Pound has on numerous occassions over the past month managed to go well above 1.1634, but only closed here once, suggests we are in a region of strong resistance that could prevent the Pound from making substantive moves higher.

While Sterling is certainly trading with an upside bias readers must note that volatility in the currency has plummeted since Prime Minister Boris Johnson pulled his Brexit deal from Parliament and a General Election was called.

Foreign exchange markets have adopted a wait-and-see stance on the Pound, and we believe this will keep the currency relatively benign. Therefore, strength and weakness are likely to be faded and we believe that a reversion back towards the 1.16 pivot will ultimately be likely.

"The further extension of the Brexit deadline and the electoral contest in Britain could leave sterling stuck in a sort of limbo where the currency may become more sensitive to electoral polls rather than to the ongoing Brexit debate. Therefore, the chances of a further GBP rally towards the end of the year are looking pretty slim," says Roberto Mialich, FX Strategist, UniCredit Bank.

UniCredit are forecasting further GBP/USD stabilisation below 1.30, and GBP/EUR stabilisation below 1.1764.

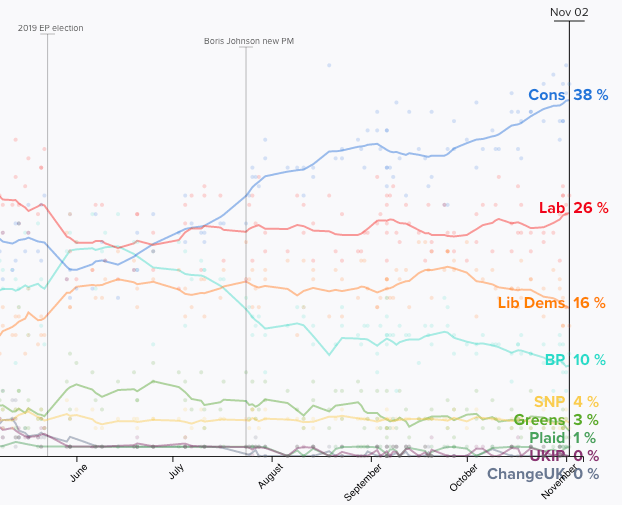

Above: Poll of Polls chart from POLITICO

We believe the Pound is currently positioned for a Conservative victory in the December 12 General Election, in line with the current trend in the polls.

Therefore, we would expect the Pound to react and break out of its current range should the polls shift as markets prepare for a different set of scenarios to those posed by a future Conservative government. "The market is now comfortable with Conservative win and Boris Johnson’s soft-Brexit deal, suggesting that a smooth transition should be constructive for GBP," says Peter Rosenstreich, an analyst with Swissquote Bank.

A Conservative majority would see the Brexit deal passed in a relatively speedy manner, proving markets with some certainty to the Brexit process. Furthermore, the party's economic policies are already 'factored in' by the market.

"GBP has scope to edge higher against most major currencies. Recent polls of voting intentions show the Conservative party’s lead is widening and they could achieve a majority government. This raises the likelihood the Withdrawal Agreement that PM Johnson reached with the EU becomes the most likely future Brexit path," says Kim Mundy, a foreign exchange strategist at CBA.

If the Conservatives were to slip in the polls this suggests a hung parliament is likely, and the outlook for Brexit therefore becomes all the more difficult to predict.

We would imagine Sterling would shift lower under such a scenario.

"In the event of a hung Parliament, uncertainty will likely persist. This outcome could lead to a further Brexit delay, a ratification of Johnson’s Brexit withdrawal deal, or even a second Brexit referendum. In any event, we view a no-deal Brexit as a very low probability event, with only one party (the Brexit party) likely to campaign on a no-deal platform," says Ketish Pothalingam, Portfolio Manager, U.K. Credit, at PIMCO.

On Tuesday we note that the odds of no party obtaining an overall majority is now odds-on with a 51% implied probability.

There is a 43% implied probability of a Conservative majority.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Prime Minister Boris Johnson will on Wednesday launch the Conservative's election campaign at a rally in the West Midlands,

In a preview of his speech, shown to the press, he will say the time has come to "change the dismal pattern of the last three years and to get out of our rut".

Johnson's pitch on Brexit will perhaps be the most straightforward of all the major parties as he will say a Conservative majority will allow him to finally pass the deal struck between the EU and UK last month.

Looking to counter the Labour Party's expected assault on domestic issues, Johnson is expected to speak at length about the NHS, education and policing. Johnson will reiterate a promises to build 40 new hospitals, increase funding for every school and make the streets safer with more beat bobbies and a greater use of stop and search.

Labour leader Jeremy Corbyn is meanwhile expected on Wednesday to set out his own election priorities with a list of ten policies on which he should be "judged" after five years in power.

"Parliament will be dissolved today, paving the way to the December 12 election and leaving markets to focus on opinion polls and election predictions for the next five weeks," says Adam Cole, a foreign exchange strategist with RBC Capital Markets.

It appears markets are preoccupied with the damage to the Conservatives that will likely be inflicted by the Brexit Party who have committed to standing 600 candidates.

The 10% the Brexit Party are commanding in the polls is likely to heavily impact the Conservative's chances, as such a percentage swing away from the Conservatives to the Brexit Party allows either the Liberal Democrats or the Labour Party through under the first-past-the-post electoral system.

Cole uses bookmaker betting market prices as a proxy for how the market sees the elections playing out. Cole notes that "market confidence in a strong Conservative government has begun to wane slightly in the last few days, reflecting Labour’s rebound in most opinion polls."

Cole says the implied probability of a Conservative majority government has slipped from 50% at the end of last week to 44% while the probability of a Conservative government of any kind (including minority and in coalition with another party) has slipped from 71% to 66%.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement