Mortgage Rate Forecast: Act Now as Rates Could Rise Again, Says Expert

- Written by: Sam Coventry

Image © Adobe Images

Mortgage rates could creep up in the coming weeks as money markets accept the Bank of England won't be cutting interest rates anytime soon.

This is according to a new analysis following Thursday's Bank of England interest rate decision, which saw the Bank indicate that it could be some time before it cuts the Bank Rate.

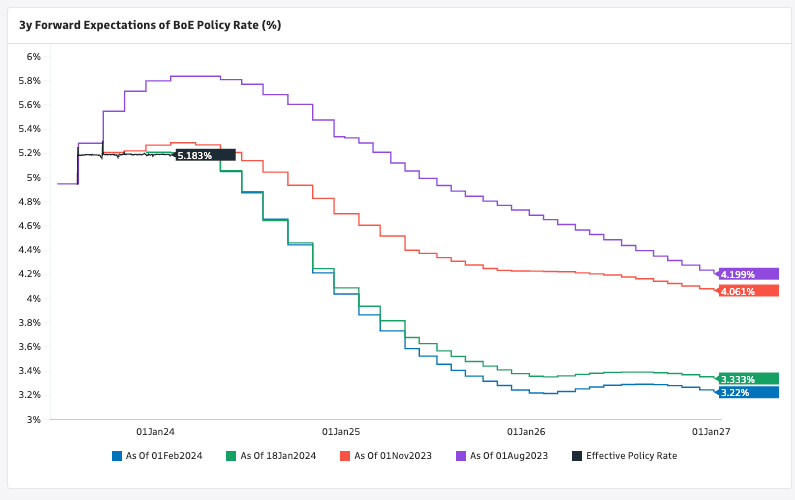

In fact, since the start of the year, money market pricing shows investors have been steadily paring expectations for the number of rate cuts to fall in 2024.

This has the effect of raising the cost of borrowing across the financial sector and could mean a tick higher in mortgage rates.

Kevin Mountford, a financial expert from Raisin UK, says swap rates reflect expectations for Bank of England policy and are used to price fixed-rate mortgage deals.

Jonathan Samuels, CEO of specialist property lending experts Octane Capital, is urging borrowers to take advantage of the reduction in mortgage rates seen in recent weeks, as they might not last following the Bank of England’s decision to keep the base rate held at 5.25% for the fourth consecutive time.

The Bank emphasised that it needs more evidence that inflation will return to the 2% inflation target in the long run before it raises interest rates.

The market now sees a 50/50 chance of a May rate cut, but these expectations can be reduced further if it becomes apparent the Bank will cut rates in summer, as many economists now expect.

Any further decline in expectations would likely have a knock-on impact on mortgage rates, reversing some of the declines of recent months.

Above: Expectations for the level of Bank Rate have fallen sharply since mid-2023, bringing mortgage rates down.

Octane Capital's analysis found that the average one-year swap rate fell for five consecutive months between July and December last year, reducing from 6.09% to 5.2%.

Five-year swap rates had fallen by an even greater extent, reaching an average of 4.32% in December, down from 4.48% in November, having also fallen consistently from an annual high of 5.25% in July.

This reduction in swap rates resulted in a fall in mortgage rates, with the average rate currently offered on a two-year, fixed-rate term at a 75% LTV, for example, falling from 5.43% to 5.03% over the course of the last year.

"In turn, this has enticed buyers back to the market and the latest data on mortgage approvals shows that there have been three consecutive months of positive growth following the first decision to hold the base rate at 5.25% in September of last year," says Samuels.

However, the decision by the Bank of England to hold the base rate at 5.25% and suggest no cuts are imminent could have the opposite effect, according to Samuels.

He points out the initial expectation from the market was that interest rates would fall in January, but despite this expectation, Octane's latest analysis shows that five-year swap rates have increased by a daily average of 0.27% so far this year.

Over the same time period, prior to the start of 2024, Octane's analysis shows that they had been declining at a daily rate of -0.77%.

"Now that the market's expectation has changed with rates being held for a fourth consecutive time, the recent increase in swap rates is only likely to continue. As the lead market indicator of mortgage rate movement, we can only anticipate that mortgage rates will start to follow suit in February," says Samuels.

As a result, "there’s certainly no guarantee that mortgage rates will come down any further, or even remain at their current levels. For buyers, this means acting with urgency now if they do wish to secure the rates currently on offer."