House Prices Set to Rise Further, Say Experts

- Written by: Gary Howes

Image © Adobe Images

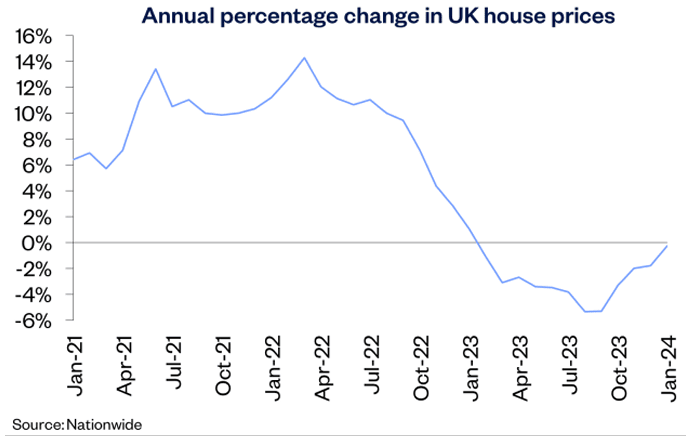

The Nationwide House price index shows property prices rose 0.7% month on month in January, and further resilience is seen ahead amidst expectations for lower interest rates at the Bank of England.

The annual rate of house price growth rose from -1.8% in December to -0.2% in January, which makes for the strongest outturn since January 2023.

Nationwide says there have been some encouraging signs for potential buyers recently, with mortgage rates continuing to trend down.

Ruth Beeton, Co-Founder of Home Sale Pack, says she has seen buyers tempted back to the market with a carrot of increased mortgage affordability in recent weeks.

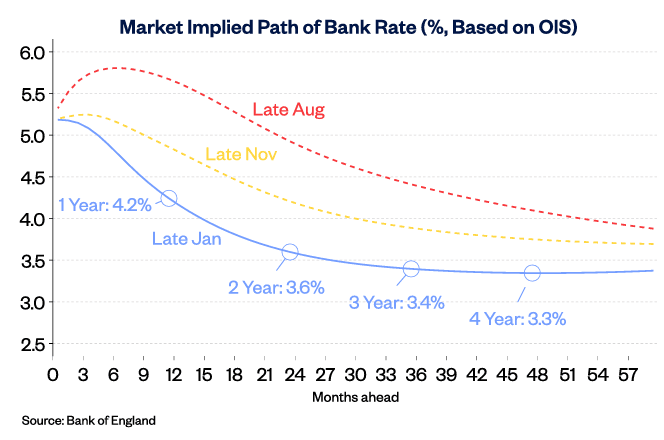

This follows a shift in view amongst investors around the future path of Bank Rate, with investors becoming more optimistic that the Bank of England will lower rates in the years ahead.

"Today's data shows that the property sector is beginning to show signs of recovery. With a decline in inflation YoY and the peaking of interest rates, the overall outlook has considerably improved," says Daniel Austin, CEO and co-founder at ASK Partners.

Interest rate expectations declined steadily through the latter part of 2023 as lower inflation outturns suggested the Bank of England would be in a position to cut intrest rates in 2024.

The Nationwide findings also come amidst a background of improved consumer confidence, with survey firm GfK reporting confidence is rising amidst improved personal finances.

"Prices are stabilising in many areas, the number of homes coming onto the market is slowly ticking up and we’re seeing would-be buyers who held back last year begin their property search in earnest," says Jonathan Hopper, CEO of Garrington Property Finders.

The firm outturn in the January data suggests to some property market experts that the bottom for house prices is in, and further rises are likely from here.

"Nationwide's latest data adding to the sense that prices have bottomed out, increasing numbers of buyers have decided to act now before prices start to pick up again," says Hopper.

But Nationwide warns that the outlook will remain bumpy, with an uptick in inflation in December leading markets to pare back expectations for the scale of rate cuts to come from the Bank of England in the year ahead.

"This growth is being driven by an increasing level of buyer confidence," says Jason Harris-Cohen, CEO of Open Property Group. "We expect this confidence will grow further should the Bank of England hold rates again this week and while the decision to do so may cause mortgage rates to creep back up, it’s unlikely to dent the appetite of the nation’s buyers."