The Fed Could Yet Hike Rates Again As Inflation is Set To Pick Up Warns Truflation

- Written by: Gary Howes

Image © Adobe Images

Independent economic data aggregator Truflation says U.S. core inflation is becoming "entrenched" amidst a strong labour market, and investors should not rule out interest rate hikes.

The call stands out amongst a tranche of institutional research takes issued following Tuesday's U.S. inflation release that reveal analysts are not expecting further rate hikes, with the debate resting on when the first rate cut will fall in 2024.

The market has 'priced out' further rate hikes and sees cuts starting as early as the first half of 2024, meaning if Truflation's warning is fulfilled, a notable financial market readjustment awaits over the coming months.

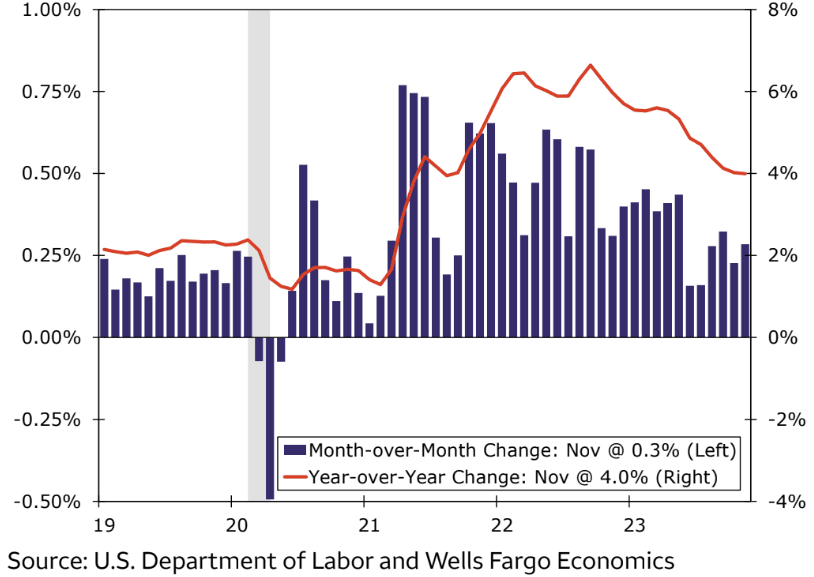

The U.S. reported CPI inflation was at 3.1% year-on-year in November, down from 3.2% in October.

But the month-on-month figure rose to 0.1% from 0%, which surprised the market. Core inflation was stuck at 0.3% m/m.

And it is with core inflation that potential problems for the Federal Reserve lie: "with services sector inflation now entrenched, and the labor market continuing to run incredibly hot, we expect to see inflation spike to 3.5% in December," says Oliver Rust, head of product at Truflation.

Above: U.S. core inflation, chart courtesy of Wells Fargo.

Truflation compiles U.S. CPI inflation by collating over 18 million data points in real-time, providing a reliable indicator of where U.S. inflationary winds are blowing. (For reference, the BLS uses 80,000 data points, reported around 30 days after collection.)

"We expect the strong employment situation will continue to put upward pricing pressure on services. As a result, we see the headline CPI index rising again to 3.5% by year-end. It will likely remain elevated for longer than anyone anticipates, so bringing the index down to the 2% target will be a difficult task for policymakers," says Rust.

Truflation do not currently see any signs that the jobs market will cool in the next few months.

"This could still lead the Federal Reserve to hike rates again – contrary to the market’s almost unanimous expectation that the US has now reached its terminal interest rate for this cycle," says Rust.

He says markets should prepare for a potential monetary policy shock in early 2024 if the current dynamics persist, as another hike may be the only way to cool the overheated labour market and fight off sticky services inflation.