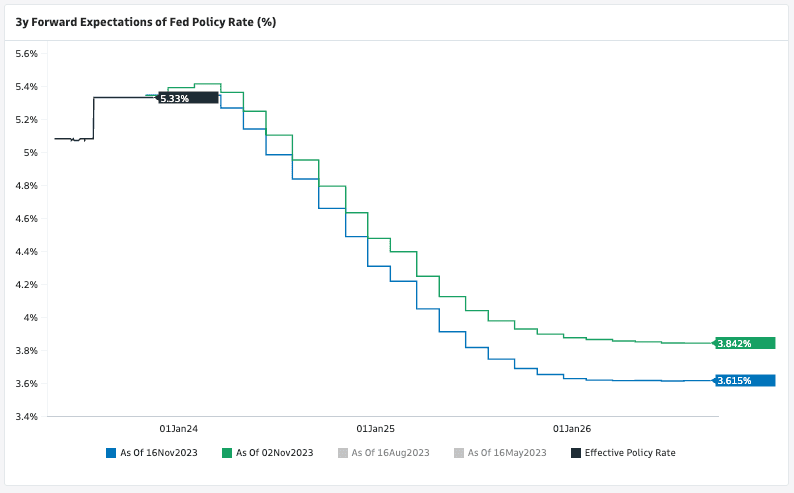

Fed Expected to Cut by 100bps in 2024

Image © Adobe Images

Written by Raffi Boyadjian, Lead Investment Analyst at XM.com. An original version of this article can be viewed here.

Federal Reserve tightening expectations suffered a further blow on Thursday after some weak data releases in the United States put the final nail in the coffin on the likelihood of another rate increase.

More importantly, investors ratcheted up their bets of aggressive rate cuts in 2024, pricing in about a 100-bps reduction in the Fed funds rate.

Market expectations of what the Fed will do next have been swinging back and forth all year, and only this week did investors panic when the soft CPI report was followed up by some positive economic numbers on Wednesday.

However, yesterday’s uptick in weekly jobless claims was interpreted as a much more powerful indicator of where US growth is headed, with disappointing industrial production figures further supporting the view that the economy is cooling off.

Above: Fed rate cut expectations, image courtesy of Goldman Sachs.

With the latest Fed rhetoric signalling some hesitancy about additional rate hikes, investors are more convinced than ever that the next move will be down. The problem, though, isn’t if the markets are wrong about further tightening; it is whether investors have gotten ahead of themselves by pricing in so many rate cuts.

But for now, bond markets are in agreement, and Treasury yields are extending their decline on Friday, with the 10-year yield slipping below 4.40%.

The US dollar, on the other hand, is wavering today following a choppy session on Thursday.

Although the US economy appears to be slowing down, other major economies are either stagnating or already in a recession. Moreover, oil prices have come back under pressure this week, boosting central banks in their fight against inflation.

Concerns about a possible supply glut have been building up for some time, pushing oil futures lower even with the lingering risk of a major escalation in the Israel-Hamas war. But investors are nevertheless downbeat about demand prospects amid the slowdowns in Europe and China.

If other central banks, such as the ECB, begin to cut rates at the same time as the Fed, yield differentials won’t widen in favour of the dollar’s rivals. What’s even more striking is that many traders think the first ECB cut could arrive as early as April versus May for the Fed.

Such expectations could keep the dollar supported against currencies like the euro and pound, but when it comes to the yen, the Bank of Japan is only now starting to debate a potential exit from ultra-easy monetary policy.

In remarks made earlier today, Governor Kazuo Ueda again offered no firm exit timeline, but the fact alone that the BoJ is openly talking about an exit marks a significant shift in policy and this is helping the yen find some footing as the end of a dismal year for the currency approaches.

The dollar was last trading at 149.55 yen, down from a high of 151.92 yen at the start of the week.

The pound was flat around $1.2408 despite worse-than-expected retail sales numbers out of the UK, while the euro was steady around $1.0850 after Eurozone headline CPI was confirmed at 2.9% in today’s final estimate for October.

Gold, meanwhile, continued to advance, climbing to two-week highs above $1,990/oz on the back of the softer dollar and drop in yields.

On Wall Street, futures were marginally higher after a mixed session yesterday. Worries about the earnings outlook as well as a selloff in energy stocks weighed on US indices, offsetting the lift from lower bond yields.

Walmart was one of the companies that sparked concern about future earnings prospects as it didn’t sound too optimistic about the holiday quarter even as its Q3 earnings topped estimates.