UK Retailers Shed Jobs at Fastest Rate Since 2009, But Price Rises to Remain Elevated

- Written by: Gary Howes

UK retailers are shedding jobs at the fastest rate since the recession of 2009 in a sign slack is starting to build in labour force, however the Bank of England won't welcome findings price rises are expected to continue at an elevated price into May.

The CBI said its Distributive Trends Survey showed employment in the year to May fell for the third quarter running at UK retailers (-48% from -12% in February), and at the fastest pace since February 2009.

Retailers meanwhile said they expect headcount to continue to contract next month.

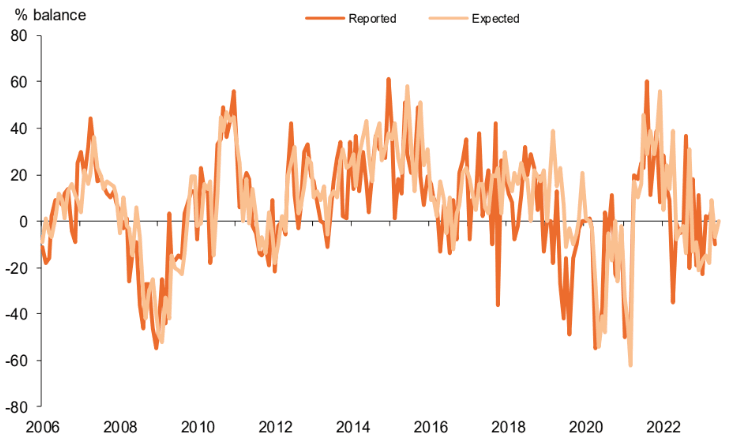

Above: Volume of sales compared to a year earlier - CBI.

"Retailers continue to face a challenging trading environment, with firms reporting disappointing sales and formidable inflationary pressures. As a result, they are having to cut back on the size of their workforce and investment plans," says Martin Sartorius, Principal Economist at the CBI.

The Bank of England has been raising interest rates to cool inflation and said it would only be in a position to stop when the labour market starts to unwind its recent tightness and allow upside pressures in wages to decline.

The assumption is that this would lead to cooling domestic inflationary pressures. The survey data from the CBI suggests this process might finally be underway, at least in the retail sector.

Although the employment component of the CBI's survey might offer the Bank of England some hope inflation can come down at a faster rate over the coming months, there were some concerning findings on prices.

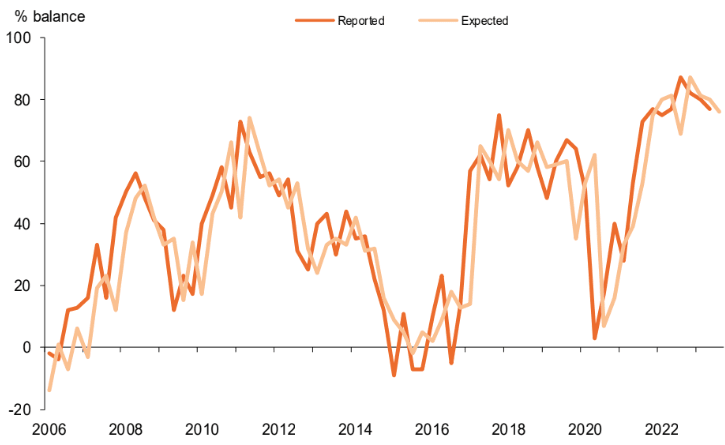

The CBI said price growth in the year to May remained near multi-decade highs (+77% from +80% in February) and next month, prices are expected to increase at this rapid pace again (+76%).

Above: Average selling prices - CBI.

Rising prices are said to have contributed to retail sales volumes falling slightly in the year to May (weighted balance of -10% from +5% in the year to April), even if they are expected to stabilise next month (0%).

Nevertheless, the CBI report finds retailers expect a modest improvement in their business situation over the next three months which amounts to the first optimistic outlook print since November 2021 (+6% from -6% in February).

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics says the reduction in the energy price cap in July announced by Ofgem today will boost households' real disposable incomes by 0.8%.

"There are some reasons for retailers to be more optimistic about the outlook. Consumer sentiment has been improving and households’ energy bills are set to decline from July. The resulting boost to incomes should help support retail sales going into in the second half of this year," says Sartorius.