Why the BoE's New Forecasts Could be the Peak of Optimism On UK Economy

- Written by: James Skinner

"Economic activity has been less weak than expected in February, and the Committee now judges that the path of demand is likely to be materially stronger than expected in the February Report, albeit still subdued by historical standards" - Bank of England.

Image © Adobe Stock

The Bank of England (BoE) announced the most significant upgrade to its economic outlook for a quarter of a century this week but scope for further optimism about UK growth prospects is limited by residential mortgage costs that could soon swallow two-thirds of take-home pay for some borrowers.

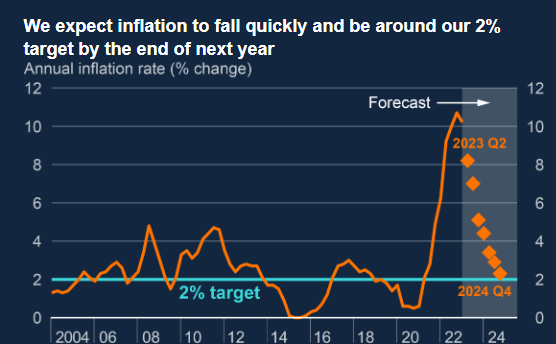

Forecasts unveiled in Thursday's Monetary Policy Report saw the Bank of England scrap its projection for a year-long recession following steep declines in the price of energy and other imported items as well as what has generally been a more resilient showing from the global economy.

"Bank staff expect all of the UK’s main trading partners to have performed more strongly than previously forecast. Staff expect world GDP growth in 2023 Q2 to be around 0.4%, slightly stronger than the February Report," the BoE's report says.

"Oil prices are now broadly unchanged from their February levels. Among non-energy commodities, agricultural goods prices have risen slightly since February while industrial metals prices are around 6% lower," it adds soon after.

Office for National Statistics data suggested on Friday that economic output fell -0.3% in March after expanding by 0.1% during the first quarter.

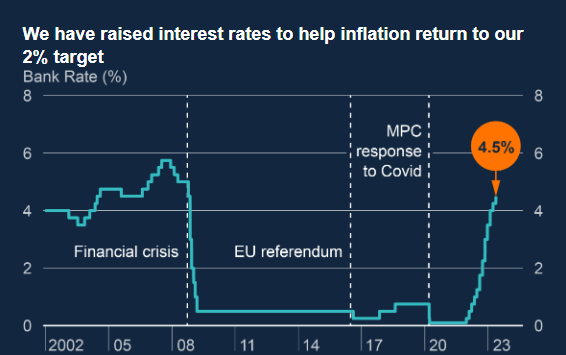

Source: Bank of England. Click the image for closer inspection.

Previously, the BoE forecast last August that the economy would enter recession in the final quarter with the downturn enduring through much of this year.

"Headline GDP is projected to be broadly flat in the first half of 2023 but, adjusting for temporary factors, growth is slightly positive and stronger than projected in the February Report," the May Monetary Policy Report says.

But while the pessimistic outlook was abandoned entirely this Thursday, on the other side of the same coin, the BoE's forecasts for inflation were also raised and the prospect of further increases in interest rates was acknowledged.

Assumptions embedded in the new economic forecasts suggested Bank Rate is likely to rise to 4.75% sometime later this year, after being raised from 4.25% to 4.5% on Thursday, before being cut to around 3.5% sometime late next year.

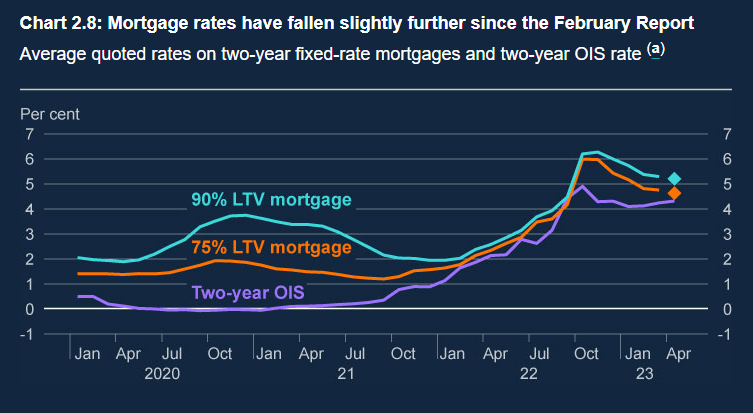

The likelihood, however, is that mortgage costs put a stern brake on consumption across the economy as interest rates work to bring down inflation: and the risk is of that this brake turns out to be hard or significant enough to leave Thursday's forecast upgrade appearing ill-fated in hindsight.

Source: Bank of England. Click the image for closer inspection.

Mortgage interest rates are often fixed over a number of years in line with funding costs in a financial derivative market and these now sit near to 5%.

"Our staff, certainly when they do calculations, suggest that by the end of next year something like 50% of mortgages will have repriced," Governor Andrew Bailey told the House of Commons Treasury Select Committee in November.

"The mortgage market is still an important part of the transmission system. That of course will as a result, and I have to be very frank here, increase the mortgage burden for households, for those households that are either on variable rate or coming up to a fixed reset," he added in response to a question.

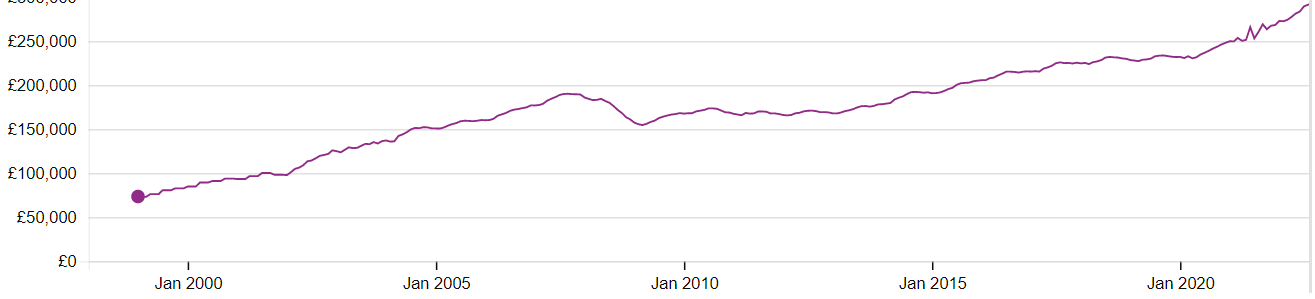

As far as the author calculates, this will eat around two-thirds of take-home pay for some borrowers earning a median income of £640 per week.

This assumes a 75% loan-to-value mortgage for an average home, which was estimated to be priced at £287,506 in February, and an interest rate of 4.75%.

Source: Land Registry, UK Government. Click the image for closer inspection.

In these sorts of circumstances, mortgage borrowers would pay more in interest each month than they spend on principal repayment for a 25-year mortgage.

Here, interest payments would come in at something like £853.53 per month while the principal repayment comes in around £718.76.

That would tally monthly repayments of £1,572.29 before any other costs, bills or outgoings; an amount equal to 70.79% of take-home pay for Mr or Mrs Median.

"I would expect to see fewer repossessions going forward because the banks have an obligation now to treat customers differently, and they have the capital resources to do so," Governor Bailey also told the Treasury Select Committee.

"One of the problems we had with the financial crisis was that they were absolutely up against the wall, let alone the borrowers. All of those things are important and I hope will help those households that are affected," he added.

Source: Bank of England. Click the image for closer inspection.