"It is Clear that the Eurozone Economy is Struggling" - Reactions to Eurozone 0% GDP Reading

- Written by: Gary Howes

Official figures show the Eurozone's economy flatlined in the final quarter of 2022, but the headline masks a more troubling picture of an economy that is clearly struggling, say economists.

"Stagnating eurozone GDP is worse than it seems," says Bert Colijn, Senior Economist for the Eurozone at ING Bank. "Poor household consumption and investment data show that underlying developments are weaker than expected, adding concern about eurozone economic performance."

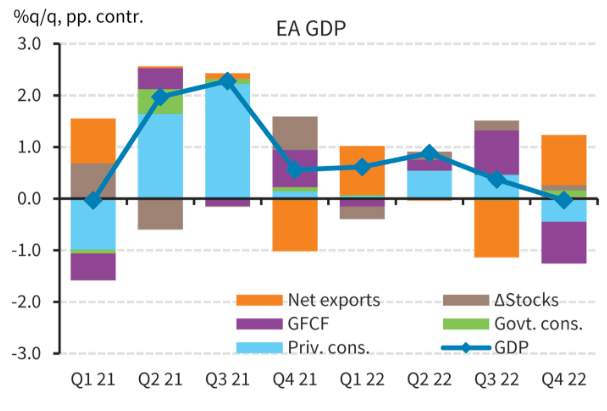

Eurozone GDP flatlined at 0% quarter-on-quarter in the final quarter of 2022 said Eurostat, which is below an expectation by economists for 0.1% growth and below the previous quarter's 0.3%.

In the year to the end of the final quarter, growth stood at 1.8%, less than the 1.9% economists were expecting and the previous quarter's reading of 2.3%.

"This in itself is concerning, but when we look deeper into the GDP release a bleaker picture is revealed," says Colijn.

The GDP data show broad contraction across consumption (-0.9% q/q), construction (-0.9% q/q) and business investment other than IPP (-1.1 %q/q), reflecting numerous headwinds.

"Household consumption in the fourth quarter of 2022 saw the largest decline since the start of the eurozone in 1999, with the exception of during the Covid-19 pandemic," says Colijn.

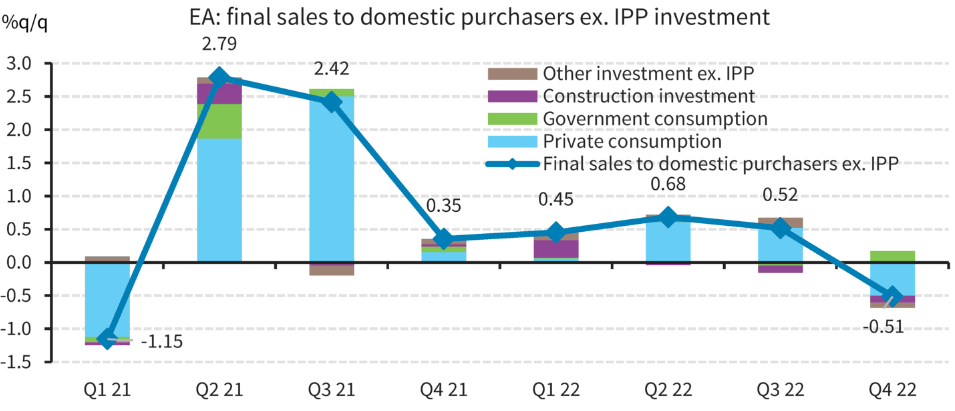

Analysis of the figures from Barclays finds although headline GDP was flat in the final quarter, this overstates underlying domestic demand, which contracted.

Above: "Headline GDP was flat in Q4, but this overstates underlying domestic demand, which contracted" - Barclays. Chart: Final sales to domestic purchasers = GDP less change in inventories and net trade. IPP = intellectual property products. Source: Eurostat, Haver Analytics, Barclays Research.

Economists have long been wary of the headline Eurozone GDP figure as it can be prone to distortions, often related to intellectual property transfers involving the Irish economy, long used by major multinationals to park intellectual property assets for tax purposes.

"In our view, the key signal from this data is substantial and broad weakness in underlying domestic demand," says Mark Cus Babic, Europe Economist at Barclays.

Headwinds to the economy come from a household real income shock, monetary policy tightening, high energy prices and uncertainty.

"There have been some positive signs in the past couple of months, but policy tightening is likely to push the eurozone into recession this year," says Jack Allen-Reynolds, Deputy Chief Euro-zone Economist at Capital Economics.

ING expects another quarter of stagnating GDP.

Likewise, Barclays expects "another roughly flat GDP print" in the first quarter.

Above: "IPP investment led to a large drag from fixed investment, offset by falling services imports" - Barclays. Source: Eurostat, Haver Analytics, Barclays Research.