Unexpected Budget Surplus Driven by Bumper Self-Assessment Income Tax Receipts

- Written by: Gary Howes

The UK unexpectedly recorded a budget surplus in January, as markets had been expecting another deficit to be recorded on the national accounts.

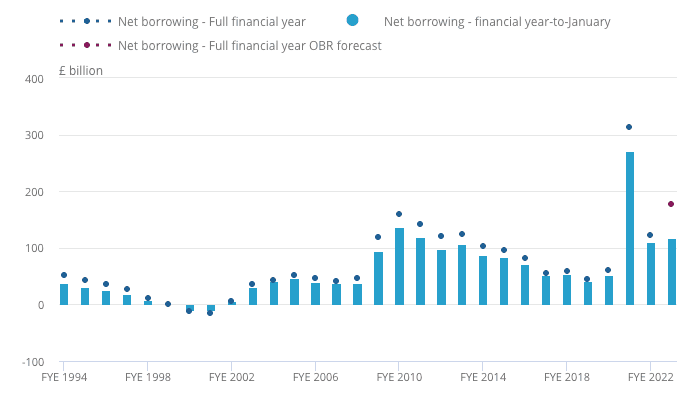

Public sector net borrowing (excluding banks) in January 2023 was in surplus by £5.4BN said the ONS, the consensus was looking for a -6.95BN reading.

Although the surplus is smaller than last January's figure of £12BN it is nevertheless £5.0BN larger than forecast by the Office for Budget Responsibility.

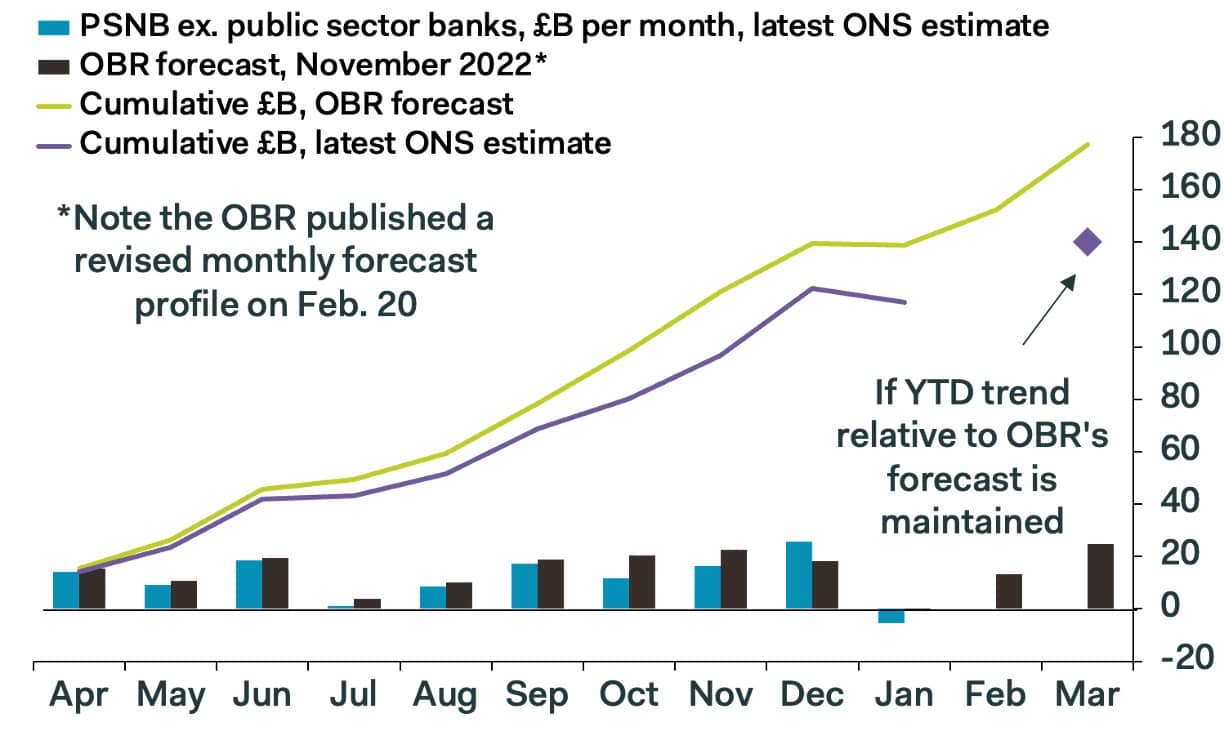

Above: The UK's public finances are evolving better than the OBR had predicted in November. Image source: ONS.

The government's financial position is therefore greatly improved ahead of the March budget.

In fact, in the financial year to January 2023, the public sector borrowed £116.9BN, which was £7.0BN more than in the same period last year but £30.6BN less than forecast by the OBR.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics points out that the OBR assumed that borrowing in December would be depressed by an £8.6BN capital transfer from the private sector to central government, as a result of an upward revaluation of the stock of student loans.

"The ONS has decided to wait for more data before incorporating this estimate. On a like-for-like basis, then, YTD borrowing is a massive £30.6B lower than the OBR expected. Borrowing in 2022/23 as a whole will come in at £140B—well below the OBR’s £177B forecast—if the YTD trend is maintained," says Tombs.

"Much lower than expected borrowing this year broadens the Chancellor’s options," says Tombs.

Above: "The chart shows that public borrowing is tracking a much lower path than the OBR expected" - Pantheon Macroeconomics.

"January's public finances figures suggest the Chancellor will have scope for some giveaways in his Budget on 15th March," says Ruth Gregory, Deputy Chief UK Economist at Capital Economics.

Also driving the surplus was a bump in self-assessed income tax receipts were up 18.4% on the same time last year, raking in £21.9BN for the Treasury in January 2023, which was the highest January figure since monthly records began in April 1999.

Pay As You Earn (PAYE) receipts were up 10.9% and corporation tax receipts were up 16.7% year-on-year.

Although the Treasury will welcome the boost to tax revenues it was also the smaller-than-expected expenditure on the government's Energy Price Guarantee that did much of the heavy lifting.

The ONS said less was spent on subsidising household bills than was previously anticipated. But spending on energy subsidies was still "substantial" said the ONS, adding that a further drag came from a large one-off payment relating to historic customs duties to the EU.

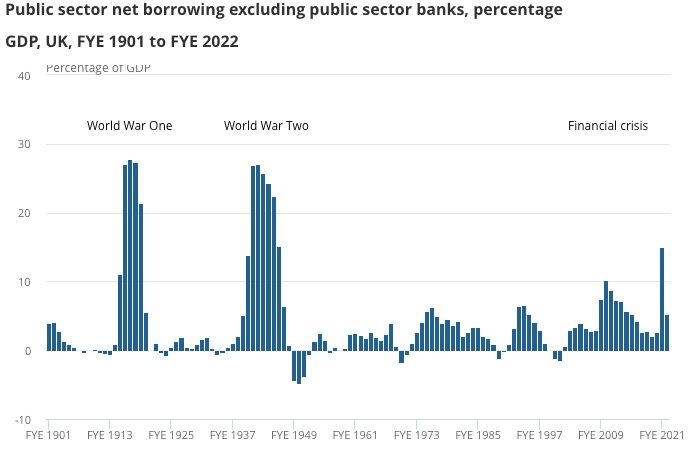

Image source: ONS.

Nevertheless, borrowing for the previous nine months of the 2022/23 fiscal year was revised down by a sizeable £5.8BN.

The government also paid significant interest on its debt, to the tune of £6.7BN in January 2023, which was the highest January figure since monthly records began in April 1997.

The ONS said the recent increases are largely because of the effect of Retail Prices Index (RPI) changes on index-linked gilts.

Looking ahead, the government will scale back sharply its Energy Guarantee Scheme from April, which should ease spending requirements in the year ahead. The UK's growth prospects are meanwhile greatly improved by falls in wholesale gas prices which means household energy bills will fall from July.

"It looks as though the deficit will undershoot the OBR’s forecast of £140bn in 2023/24 by a significant margin too, due to the recent falls in market interest rate expectations and energy futures prices," says Gregory.