OPEC's Inflationary Production Cut Further Darkens the Grim UK Economic Outlook

- Written by: James Skinner

"They're totally right but it's also something that should have been entirely foreseeable when the US led an effort to put a price cap on Russia oil," - ForexLive.

Image © Adobe Images

The Organization for Oil Exporting Countries (OPEC) and allies such as Russia agreed this week to cut production of oil by an amount equivalent to two percent of global supply in a cartel decision that means more inflation and comes as further grim news for an already-dark UK economic outlook.

OPEC agreed with Russia on Wednesday to "adjust downward the overall production by 2 mb/d from the August 2022 required production levels," while citing "the uncertainty that surrounds the global economic and oil market outlooks, and the need to enhance the long-term guidance."

"What’s unprecedented is that the group decided to take barrels off global markets amid one of the tightest oil markets on record and ahead of a potential decline in Russian exports later this year," writes Ehsan Khoman, head of commodities at MUFG, in a Wednesday response to the decision

"The ability for OPEC to conduct such a large cut is entrenched in the lack of any supply elasticity, with US shale activity showing signs of slowing, negligible spare capacity outside of core-OPEC+ producers (Saudi Arabia, the UAE and Kuwait) and with Russia’s production set to decline," he added.

Above: Brent and West Texas Intermediate crude oil futures prices shown at weekly intervals.

Above: Brent and West Texas Intermediate crude oil futures prices shown at weekly intervals.

Commodity analysts and others around the financial markets have described Thursday's decision as an attempt to prevent prices from falling with demand in the global economy, which is heading toward a recessionary iceberg due to recent energy price increases.

This potentially has significant further adverse implications for inflation and the overall economic outlook in many countries including the UK, which is already facing an anticipated five-quarter-long recession if Bank of England (BoE) forecasts are anything to go by.

"It is the biggest cut in output since the onset of COVID in 2020 and represents a concerted effort by the alliance to maintain high oil prices, increasing global stagflation risk," writes Eimear Daly, an emerging markets macro strategist at Natwest Markets, in a Wednesday market commentary.

While the OPEC cartel itself implied a desire to prop up prices even in the face of a global economic downturn for a decision that exploits its domineering influence over global oil supply, others have speculated about the possibility of a different motive and an entirely geopolitical one.

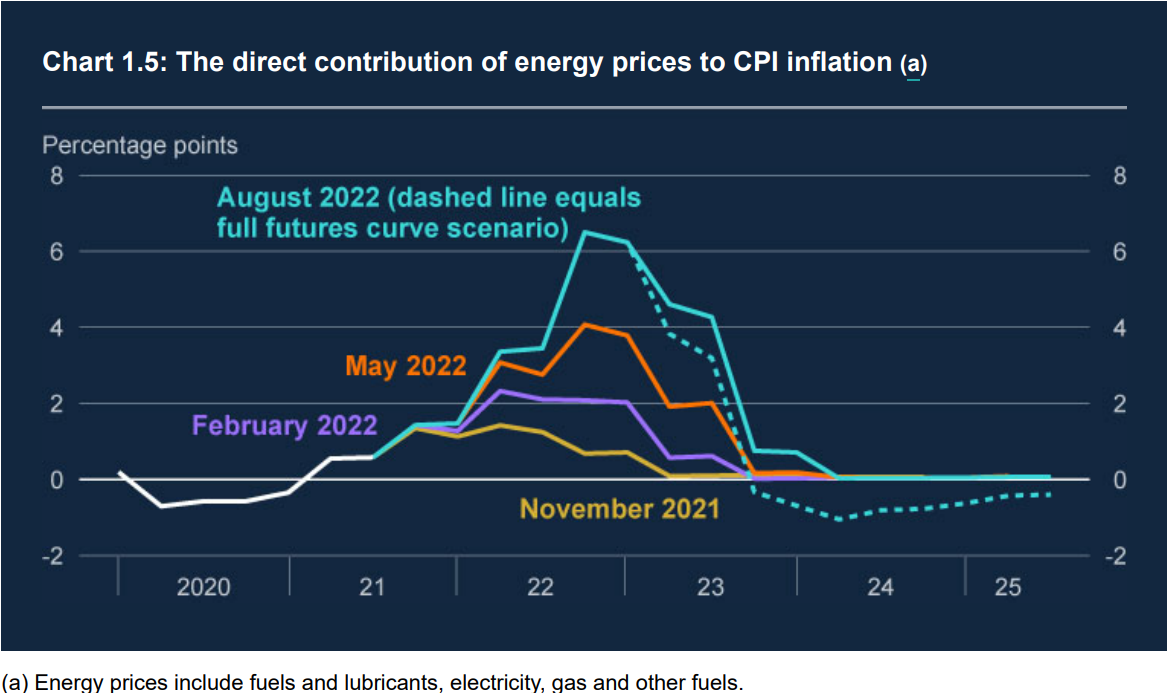

Source: August Monetary Policy Report, Bank of England.

Source: August Monetary Policy Report, Bank of England.

"The White House is out with a comment saying that the OPEC+ production cut is a 'clear' indication that the bloc is 'aligning with Russia'. They're totally right but it's also something that should have been entirely foreseeable when the US led an effort to put a price cap on Russia oil," writes Adam Button, chief FX analyst at ForexLive, in a Wednesday article.

"If you're Saudi Arabia's Mohammed bin Salman -- who is still reeling from the Khashoggi fallout -- why would you tolerate a price cap? If it works on Russia, why couldn't it be used on you? OPEC is full of countries that aren't friendly with the United States and allowing a Russian price cap to work would set a terrible precedent for them," he added.

OPEC's decision does come as G7 countries finalise plans for a pending attempt to 'cap' Russian oil prices, which have been weaponised by the Kremlin, in an action that could impact global prices and may be being interpreted by OPEC as a behaviour similar to that of the customer in the below video.

The video contains two British-Indian shopkeepers and two uses of language that some listeners may find offensive.

— No Context Brits (@NoContextBrits) August 17, 2022

"Finally, today’s announcement is a reminder of why it is so critical that the United States reduce its reliance on foreign sources of fossil fuels," says Jake Sullivan, national security adviser to the White House.

"With the passage of the Inflation Reduction Act, the U.S. is now poised to make the most significant investment ever in accelerating the clean energy transition," he added in a Wednesday statement.

While the White House response and strategy for addressing the energy price and inflation problem has not won plaudits from anybody at all, there had not been even a comment from any minister of the UK government as far as could be ascertained at the time of writing.

"The Saudis have moved from swing producers who help the US at times of trouble to ones who cut to keep prices high; under a leader building Western-style tourist resorts and holding raves(!) That’s testimony to a staggering US geopolitical and geoeconomic error, compounded by its multi-layered domestic energy policy failures," says Michael Every, a global strategist at Rabobank.

"The near-term US policy responses underway are to double down on what is not working," Every wrote in a Thursday market commentary.