Bank of England's MPC Could Vote for Charge of the Light Brigade in September

- Written by: James Skinner

"I do very much welcome the fact that there will be, as I understand it, announcements this week because I think that will help in a sense to frame policy and that’s important. I think it’s important there’s a clear way forward on policy," BoE Governor Andrew Bailey.

Statue of Arthur Wellesley, 1st Duke of Wellington, sits in the foreground of the Bank of England. Image © Adobe Stock

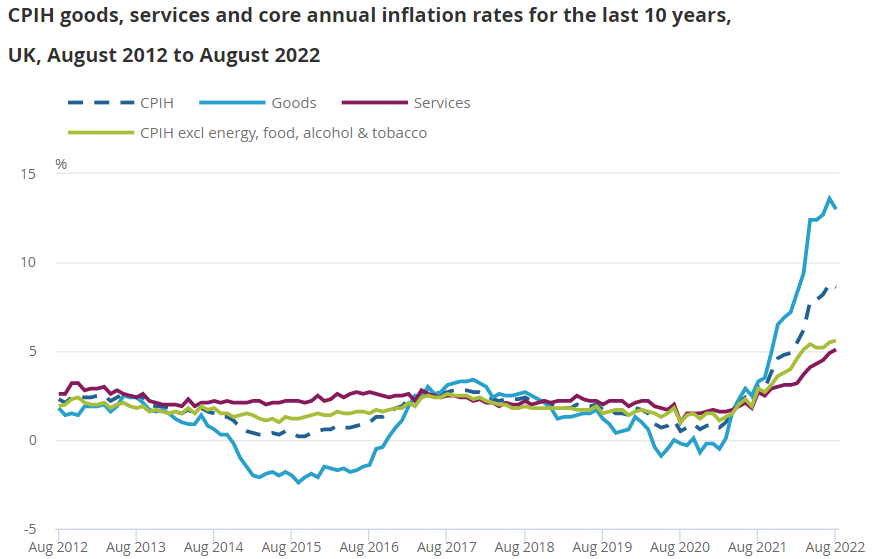

The main UK inflation rate ebbed in August but core inflation reached a new high as price pressures broadened out across the economy, adding to the risk of the Bank of England (BoE) Monetary Policy Committee voting for something like its own modern day Charge of the Light Brigade in September.

The Charge of the Light Brigade is described in some parts as a "disastrous British cavalry charge against heavily defended Russian troops" during the Crimean conflict but there are parrallels between that and what is possibly the most likely next step of the BoE's interest rate setters on September 22.

This is partly because of where much of the UK's recent inflation has originated from, which is now overwhelmingly the Russian invasion of Ukraine and its impacts on energy prices, but also because of the lengths the BoE may have to go to and the risks it may have to take with the economy in order to address it.

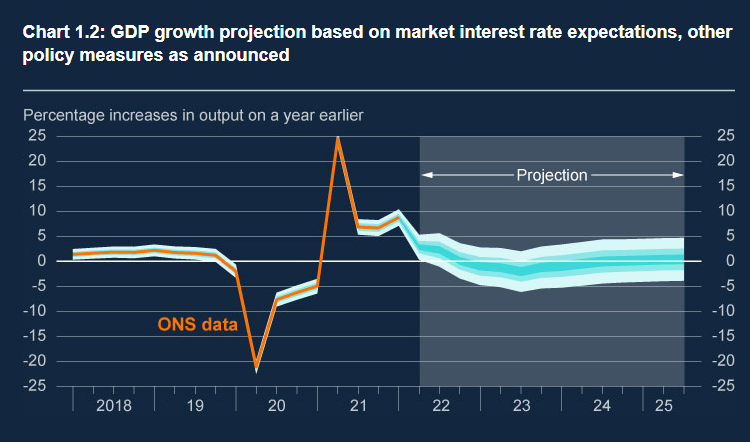

"In the face of materially higher gas prices stemming from the war in Ukraine, inflationary pressures in the UK and the rest of Europe have increased further, and global GDP growth has continued to slow. In response to the elevated outlook for inflation, many central banks have raised policy rates and are expected to tighten policy further," the August Monetary Policy Report said.

Source: Office for National Statistics.

Source: Office for National Statistics.

While much of the UK's inflation originates from elsewhere, there is a risk that high levels of inflation would become a permanent feature of life in the UK economy without action by the BoE, although this would be action that could have adverse implications for the economy in the short and medium-term.

If anything, the lengths the BoE may go to were made longer by Wednesday's inflation data for August and this is a part of why the markets may be mistaken to expect the BoE to raise Bank Rate by only 0.5% or 0.75% next Thursday, which would take the benchmark up to either 2.25% or 2.5%.

The risk may well be of the BoE announcing an even larger rate step and forecasters who don't realise this may be overlooking the extent to which the BoE has been restrained so far by information delays created by the energy 'price cap' system and the recent absence of a fully functioning government.

Neither of these are any longer inhibitors of Bank of England rate setters.

"I do very much welcome the fact that there will be, as I understand it, announcements this week because I think that will help in a sense to frame policy and that’s important. I think it’s important there’s a clear way forward on policy," BoE Governor Andrew Bailey told the House of Commons Treasury Select Committee last week.

Source: August Monetary Policy Report, Bank of England.

Source: August Monetary Policy Report, Bank of England.

In the meantime, the government of new Prime Minister Liz Truss has set out plans to use public funding to limit energy bills to £2,500 per year, which shields households from further increases that would otherwise have lifted the typical energy bill to more than £6,000 per year.

This limits the extent of the coming winter economic calamity but it will also deepen the budget deficit and could have the effect of preventing inflation from falling back to the 2% target in future years, hence why there may be a risk of the BoE responding in a quite aggressive manner next week.

That might surprise economists and markets because many are accustomed to slow and steady interest rate steps from the BoE, although they may be overlooking that for the bank to have acted aggressively before now it would have been shooting from the hip in a crowded room with the lights turned out.

Only time could tell what the September 22 interest rate decision of the Monetary Policy Committee will be although there is evident risk of a "shock and awe" kind of decision that would, for all of the reasons set out above, be somewhat like the BoE's very own modern day Charge of the Light Brigade.