U.S. Economy’s Slower-for-Longer Recovery Vindicates Fed’s Stayed Policy Course

- Written by: James Skinner

“In the second quarter, government assistance payments in the form of loans to businesses and grants to state and local governments increased, while social benefits to households, such as the direct economic impact payments, declined.”

Image © Adobe Images

The U.S. economy’s recovery from last winter’s economic closures has been slower than was widely assumed, according to Bureau of Economic Analysis data released on Thursday, and effectively vindicates the Federal Reserve (Fed) for its cautious continuation of emergency monetary support.

Fed monetary policy programmes have been matters of great and increasing controversy in some parts of the market and financial commentariat lately, and more so this year with U.S. inflation rates rising as far as they have done, although Thursday’s preliminary estimate of growth during the second quarter argues that the bank’s policymakers have been right not to be induced into a hasty withdrawal of support for the economy.

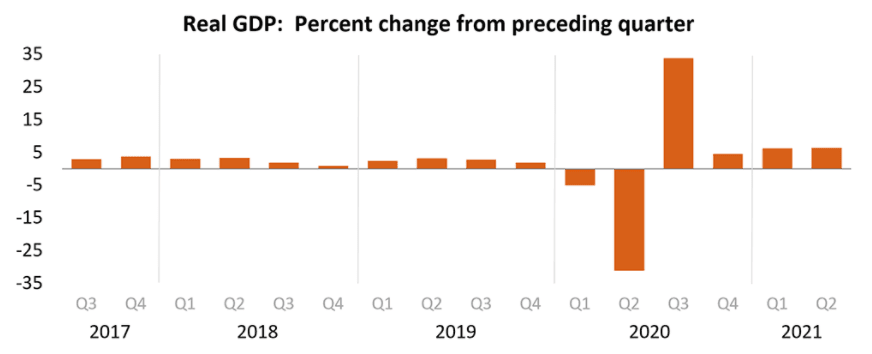

Consensus had looked for a sharp step-up in the pace of GDP growth last quarter, from an annualised 6.4% to some 8.5% yet on the day the BEA’s estimate of the first-quarter expansion was downgraded to 6.3% while the preliminary outcome for the second quarter missed expectations by a mile.

“The increase in real GDP in the second quarter reflected increases in personal consumption expenditures (PCE), nonresidential fixed investment, exports, and state and local government spending that were partly offset by decreases in private inventory investment, residential fixed investment, and federal government spending,” the BEA said on Thursday. “Imports, which are a subtraction in the calculation of GDP, increased.”

Above: Annualised rates of U.S. GDP growth per quarter. Source: Bureau of Economics Analysis.

U.S. GDP growth was a still-respectable 6.5% annualised last quarter, but also far below the expectations of an economist consensus that had been elevated in recent months by swift progress in making coronavirus vaccines available to households and significant increases in government spending.

Some of that government spending was less than previously thought however, hence the BEA’s downgrade to the first quarter number, while other spending has since begun to ebb also.

Meanwhile, the much-vaunted as well as often maligned spending plans for infrastructure remain little more than Washington’s fault lines and footballs.

“The downside surprise in the GDP numbers is mostly in the inventory component; final demand was a bit stronger than we expected,” says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

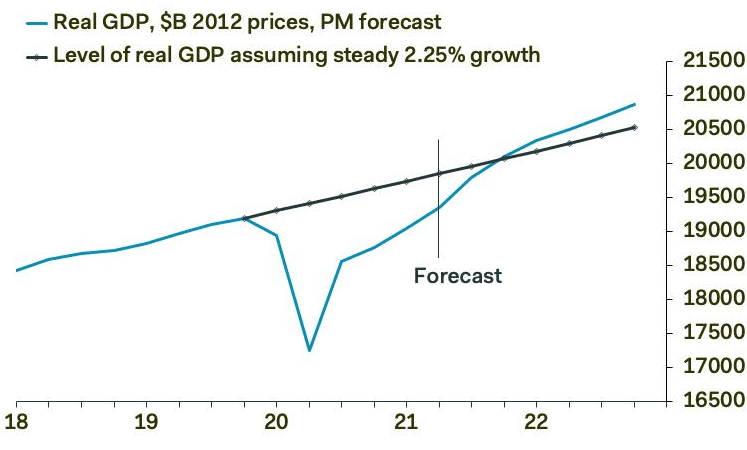

Source: Pantheon Macroeconomics.

“In short, then, we are not disappointed by the headline GDP growth miss. We expect a big rebound in Q3 inventories - the Q2 numbers could be revised up too - and our forecasts for Q3 final demand are not affected by this report. We look for 8%-plus Q3 growth,” Shepherdson adds.

Pantheon’s Shepherdson notes that Thursday’s data leaves U.S. economy 0.8% larger than it was before the onset of the coronavirus crisis, but some -2.5% smaller than it might have been had coronavirus containment measures not led to the closure of the world’s largest economy previously.

Thursday’s data doesn’t change the fact that the U.S. economy is still in recovery mode and likely growing faster than all other advanced economies, although it does challenge ideas and suggestions that Fed officials and talking heads in Washington could be guilty of having done too much.

Recent months have witnessed a rising clamour among forecasters and commentators for the U.S. central bank to pare back its $120BN per month quantitative easing programme, with some even suggesting it should raise interest rates, though Thursday’s data disappointment is a cautionary tale for them all and something of a vindication of the Fed for its stayed course.