September's Rise in Joblessness the Calm before Storm as Turmoil Awaits in Final Quarter

- Written by: James Skinner

© IRStone, Adobe Stock

Britain's labour market showed signs of life in September but not enough to reverse the damage done by earlier coronavirus containment efforts and with the economy now slowing again as more virus-related restrictions come into effect, some economists are warning of a perfect winter storm ahead.

There were an additional 20,000 in employment during September than in the prior month, building on the 32.59 million who were employed in August, while the number of hours worked each week saw a record increase and the number of available vaccancies began to rise again.

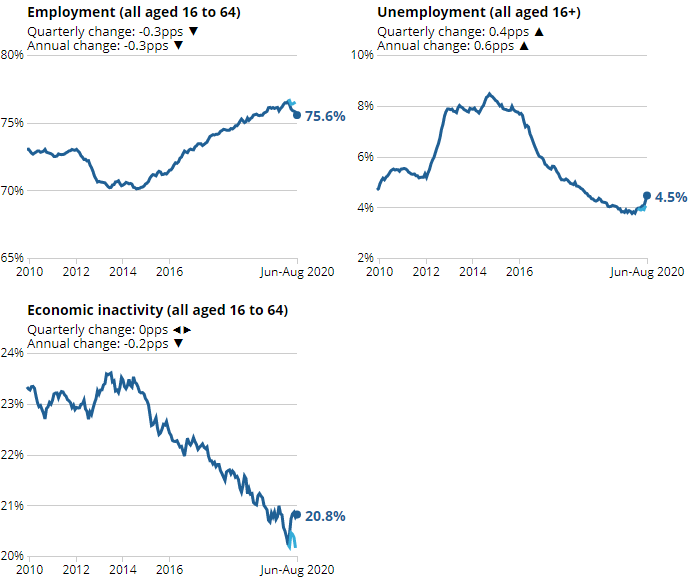

But employment was lower on the quarter and still some 673k below March levels while numbers of welfare claimants continued to rise in September alongside redundancies. The former reached 2.7 million, helping to lift the unemployment rate from 4.1% to 4.5% for the September quarter.

"The labour market looks much weaker following the decision by the ONS to correct a sampling error that had crept into the Labour Force Survey since April," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "Covid-19 forced the ONS to conduct all of its interviews with households over the phone, instead of face-to-face. One side effect of this switch was that the sample of households they were able to contact contained too many owner-occupiers and not enough renters. The latter group are more likely to have lost their jobs this year, given that they typically are younger than owner-occupiers and work more commonly in sectors such as retail and hospitality."

Source: Office for National Statistics.

Redundancies rose by a record 114k during the last quarter to 227k while the number of welfare claimants was equal to more than 7% of the workforce in September, although this isn't reflected by the unemployment rate because many recipients of coronavirus-related benefits are still classed as employed.

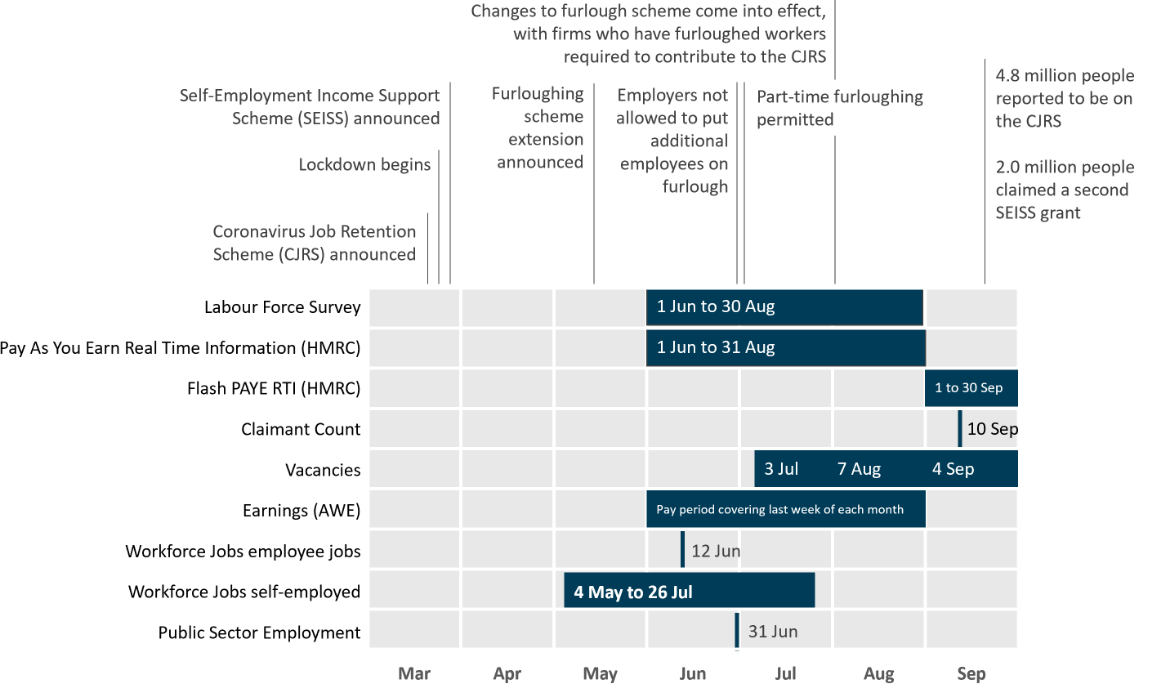

Some of those coronavirus-related benefits however, are due to be withdrawn at the end of October when the government's furlough scheme is officially wound down and replaced by a job support scheme that will pay a lesser proportion of idled workers' wages.

Nearly 10% of workers were signed onto the scheme in the two weeks to September 20, Pantheon's Tombs says.

The forthcoming furlough expiry, at which point the level of government support becomes less generous, has got some economists expecting a wave of redundancies ahead and led them to describe increases in unemployment to date as simply the calm before the storm.

"Unlike in the US, furloughed workers in the UK who receive support via the government’s CJRS (Coronavirus Jobs Retention Scheme) are classed as employed. This distorts the underlying picture. Once the CJRS expires on 31 October, we expect a wave of layoffs across the UK to push the unemployment rate temporarily above 8.0% during Q4 2020, falling thereafter in line with the economic rebound," says Kallum Pickering, a senior economist at Berenberg.

Source: Office for National Statistics.

The official measure of unemployment had fallen until August when it rose from 3.9% to 4.1% around the same time the UK's economic recovery began to slow.

"With the national furlough scheme closing at the end of this month and the new COVID-19 restrictions set to stall the economic recovery, a second bigger wave of unemployment is probably on its way. That may lead to 1m more people losing their jobs and the unemployment rate rising to almost 8%," says Paul Dales, chief UK economist at Capital Economics.

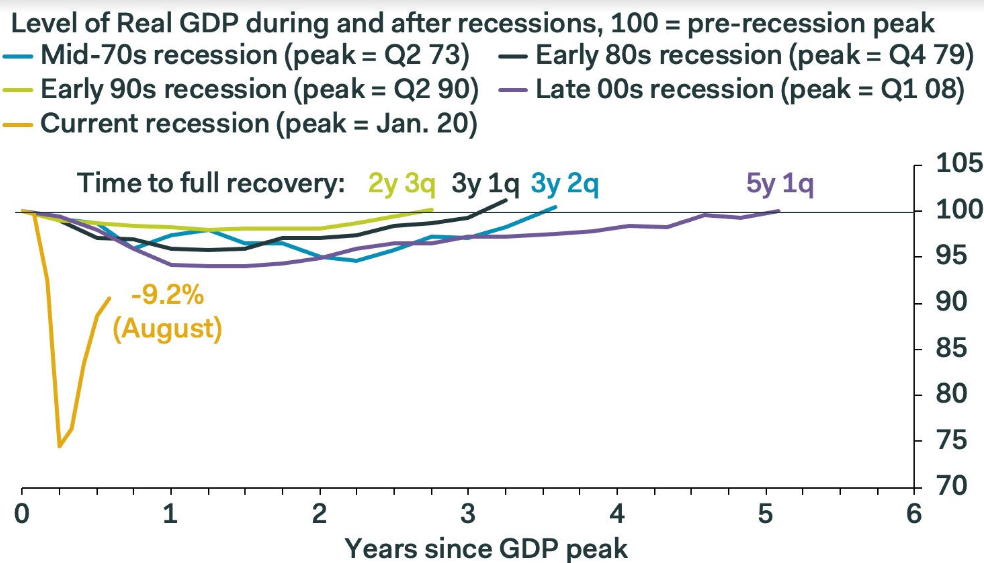

UK GDP growth was just 2.2% in August despite substantial aid from HM Treasury in the furlough and Eat Out to Help Out schemes, and when economists had hoped for more than twice that rate of growth.

The economy had grown by 6.6% in the prior month of July although after August's disappointment expectations are for it to slow further in September ahead of a possible final quarter contraction.

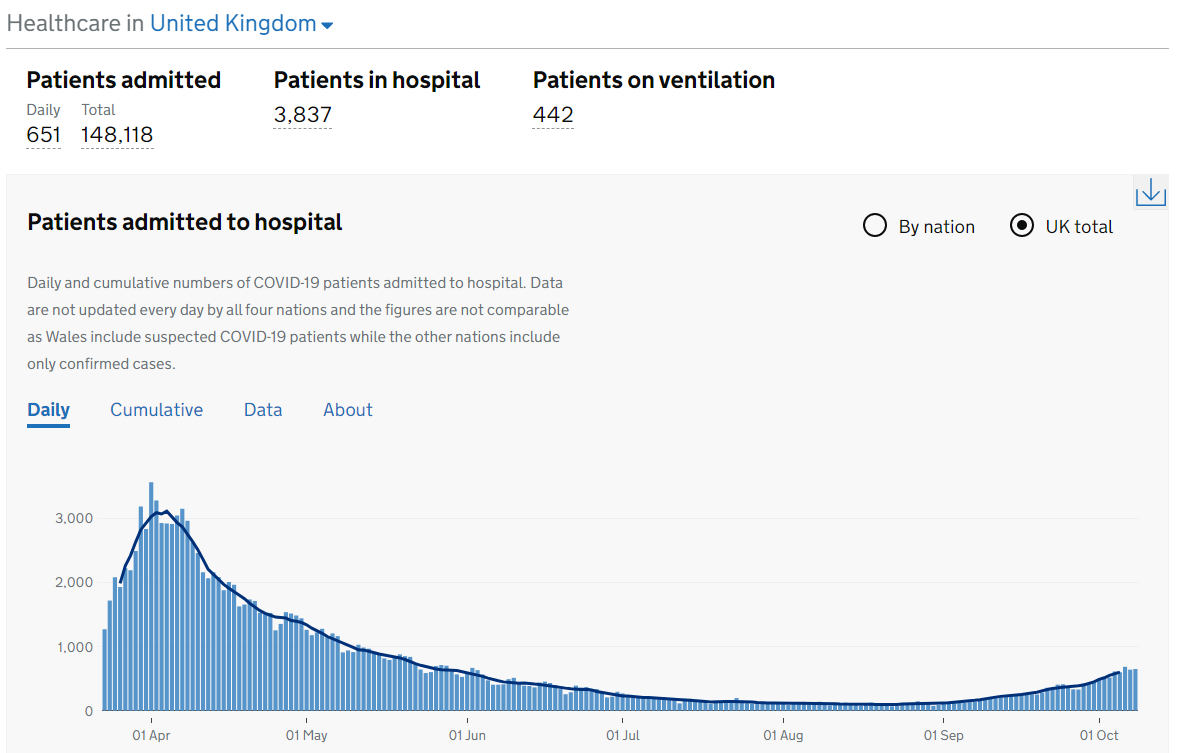

"With each of the last few weeks, greater numbers of people and businesses have been put into more stringent local restrictions. Yesterday’s announcement of a three-tier system, coupled with growing numbers of hospitalisations, is only likely to add to this headwind. However we suspect we have not heard the last of the support schemes from the government, where only last week it announced an enhancement to the JSS. We may well see further mitigations," says Victoria Clarke, an economist at Investec.

Source: Pantheon Macroeconomics.

August's disappointing GDP growth and looming changes to the furlough scheme that's supported close to 10 million jobs in its lifetime already had economists warning of a bleak winter period ahead, although this was before the government began tightening restrictions on activity in parts of the north.

Prime Minister Boris Johnson announced on Monday that parts of Liverpool City region would go immediately into the strictest form of 'lockdown' possible under its new three tiered traffic light system for restrictions due to what it says is an unacceptably high level of increase in the prevalence of coronavirus.

Under the new system pubs and some other hospitality businesses will have to close again for at least the next four weeks, with only the scaled down furlough scheme and a system of scaled down government grants to fall back on.

"Our rough-and-ready calculations, based on 2018 local employment data, indicate that perhaps around 40,000 jobs in the Liverpool City Region (the first in England to see closures) could be affected either fully or partially by the new restrictions. Looking more widely across England, we think there are around 180,000 employees in the directly affected sectors, in areas with weekly Covid-19 case growth in excess of 200 per 100k people, and therefore potentially more at risk of moving into the ‘very high’ category," says James Smith, an economist at ING. "Of course those numbers only tell a small part of the story. There will be businesses that aren't formally required to close, but that are hit indirectly (think hospitality suppliers). And even outside of the Covid-19 hotspots, we're likely to see the recovery in consumer spending falter over coming weeks, either as a result of some of the other restrictions (eg limits on household mixing) or out of renewed caution as the virus spreads."

Source: Coronavirus-related hospitalisations in the United Kingdom. Source: UK Government.