UK Government Boosts Loan Support to UK Businesses

- Written by: Gary Howes

- Even viable firms can now apply for funding

- Bigger business can now access loan support

- 130K enquiries from businesses regarding finance support have been made

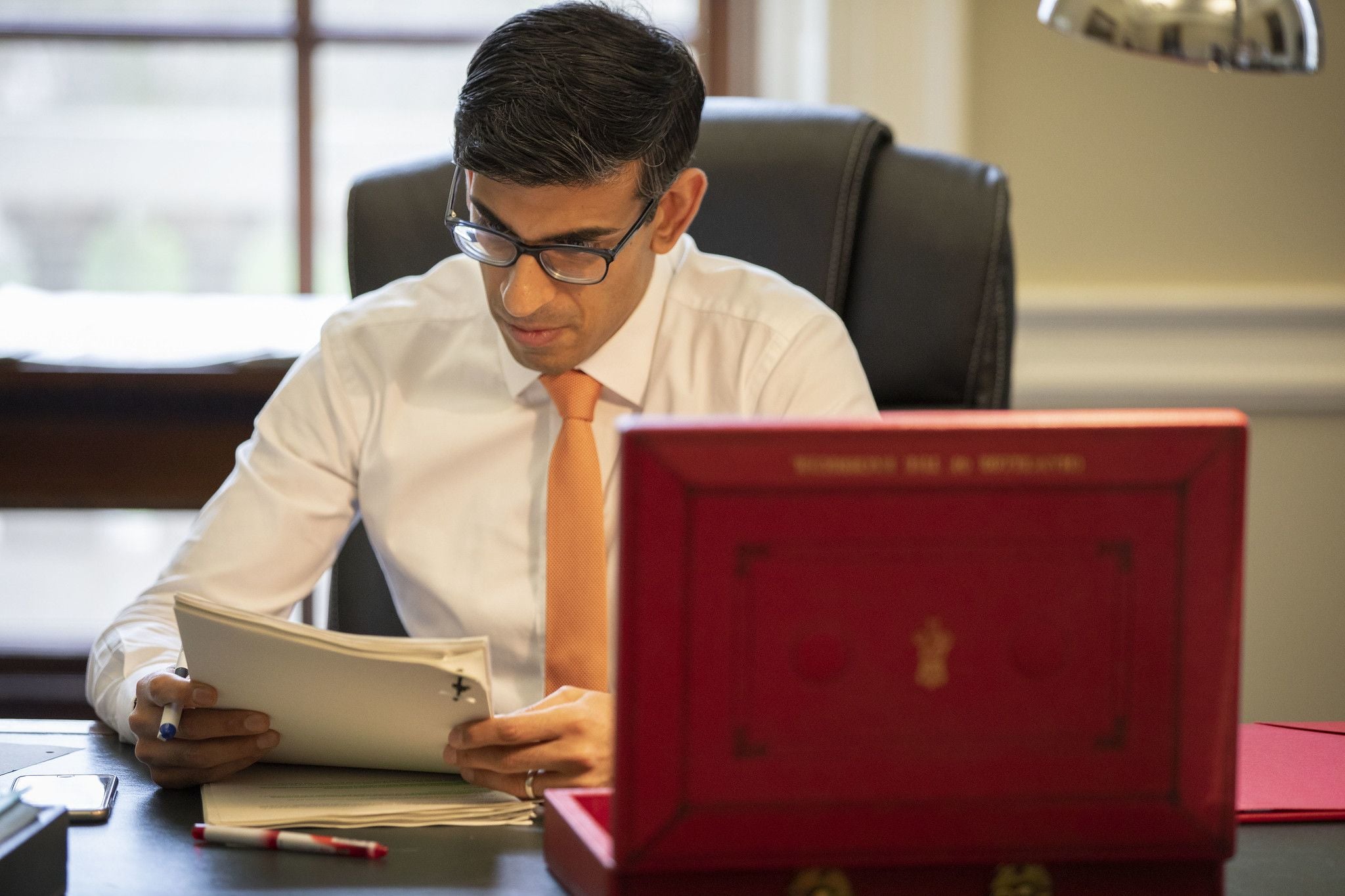

Image © HM Treasury, Gov.uk

The Chancellor of the Exchequer Rishi Sunak has announced further action to support firms affected by the coronavirus crisis by bolstering business interruption loans for small businesses and announcing a new scheme for larger companies.

A new scheme has been announced to bolster support for larger firms not currently eligible for loans. The Coronavirus Large Business Interruption Loan Scheme (CLBILS) will ensure that more firms are able to benefit from government-backed support during this difficult time.

"It will provide a government guarantee of 80% to enable banks to make loans of up to £25 million to firms with an annual turnover of between £45 million and £500 million," read a statement from the Treasury.

The Government revealed £90 million worth of business interruption loans had already been approved for nearly 1,000 smaller firms since the Coronavirus Business Interruption Loan Scheme (CBILS) - which is aimed at assisting smaller businesses - was launched in late March.

However the the Government has announced it is now extending the CBILS so that all viable small businesses affected by COVID-19, and not just those unable to secure regular commercial financing, will now be eligible.

There have now been over 130,000 enquiries from businesses across the country for business interruption loans, according to latest figures from UK Finance.

Some 983 businesses have had finance approved, while banks are processing thousands of loan applications – and scheme changes made today will help them approve loans for the smallest businesses as quickly as possible and the government will continue to cover the first twelve months of interest and fees.

The existing loan scheme was extended so more small businesses can benefit, while lenders have been banned from requesting personal guarantees on loans under £250,000.

What has been hugely reassuring is hearing @RishiSunak saying he will do all he can to support our economy & gov putting £330 billion of capital is hugely important to companies who need it. @RainNewtonSmith says during @CommonsTreasury on economic impact of coronavirus. pic.twitter.com/L0EBe4nkII

— CBI (@CBItweets) April 3, 2020

Meanwhile, £1.9 billion in corporate finance has already been provided to large firms hit by COVID-19, via a scheme operated by the Bank of England..

The moves by the Treasury come amidst growing evidence of a surge in unemployment, with some estimates suggesting there has already been a three percentage point increase in unemployment over the last fortnight, to its highest since June 2014.

Some 950k new claimants have applied for welfare payments in the fortnight between March 16 and March 31, according to the Department for Work and Pensions.

This more than doubles the 477k that were said by Department for Work and Pensions Secretary Theresa Coffey to have registered new claims in the nine days to Wednesday 25.

However, it is hoped that the UK's early initiatives to prevent job losses will contain the lion's share of the damage wrought by the lockdown. The Government has already pledged to pay 80% of workers' salaries up to £2.5K in the event that they are mothballed by their employer.

British Airways is the latest high-profile employer to mothball employees saying 28k people would be furloughed, adding they intend to pay them the 80% of normal pay provided by the government's scheme.