South African Rand: Near-term Budget Benefits But Risk Premia Remains Says Barclays

- Written by: Gary Howes

Above: File image of finance minister Enoch Godongwana. Photos: GCIS, Government ZA.

The South African 2024 Budget offers a "welcome short-term relief" from deteriorating confidence in South Africa's fiscal fundamentals, but structural challenges remain that should ensure risk premia remains embedded in ZAR.

This is according to a post-budget analysis from global investment bank Barclays that welcomed news the National Treasury maintained its estimates of the country’s fiscal deficit for FY23-24 and FY24-25 in the 2024 Budget.

"In the near term, the improvement in fiscal metrics, as well as the transfer of foreign assets worth ZAR150BN may, at the margin, support ZAR and SAGBs, in our view," says Barclays.

The budget presented a risk to the South African Rand, with investors worried the government would opt to increase expenditure to curry favour with voters ahead of the May 29 general election.

But, a clear attempt to balance the budget, which included the squeezing of disbursements to the country's loss-making state-owned enterprises, has eased concerns and offered Rand support.

Revenue declines from the likes of fuel levies are expected to be offset by a large increase in personal income taxes, where it is anticipating a 14% increase that will be driven by its decision not to allow for fiscal drag/bracket creep higher.

(Workers who receive pay increases to account for rising inflation will climb into higher income tax brackets. Often, governments raise the brackets to account for this, but by holding them steady, they are levying an effective tax hike).

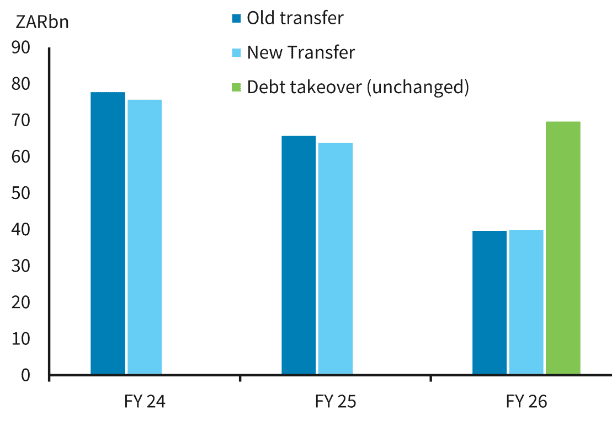

Above: Treasury distributions to Eskom will be ZAR2bn lower during FY 24 and FY 25 than previously. Source: National Treasury, Barclays Research.

The government also opted to tap its reserve of profits from foreign exchange and gold holdings in order to meet increases in outgoings.

The Gold and Foreign Exchange Contingency Reserve Account (GFECRA) will be tapped by R150BN between 2024/25 and 2026/27 to lower the amount the government will need to borrow.

The GFECRA is an account at the South African Reserve Bank which captures gains and losses on South Africa's foreign currency reserve transactions.

The drawdown is expected to see South Africa's total FX reserves slide by about 13%, which Barclays says isn't a huge issue for a country with a free-floating exchange rate.

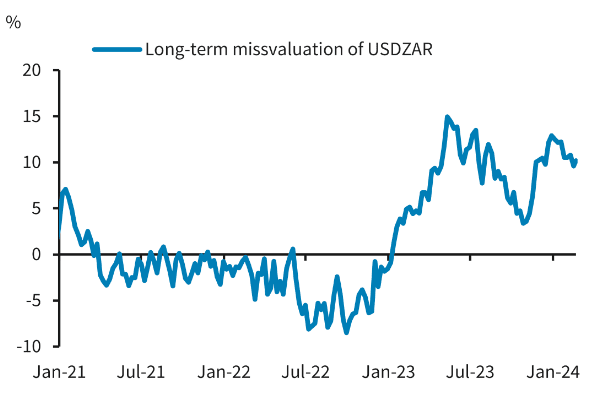

Above: "Risk premium in USDZAR should remain large" - Barclays.

The decision to tap this 'piggy bank' nevertheless papers over some structural issues that, at some point, must be addressed.

"In the long term, we remain negative on South African assets as the structural fiscal issues associated with the large wage bill remain unresolved," adds Barclays.

Barclays explains public sector wages are currently the largest single item in the budget, accounting for almost a third of consolidated government spending and, hence, a dominant driver of debt accumulation.

"Cutting capex and liquidating reserves to fund wages and transfers is not prudent," says Barclays.

Looking ahead, the looming election remains a concern for investors, with South African money markets displaying a political risk premium.

South Africa's government bonds screen as cheap amid large term-premia and fiscal-premia embedded in the multi-timeframe interest rate curve curve, according to Barclays.

This undervaluation will also translate into the Rand's valuation.

How long can the Rand and SA assets remain undervalued? "The wide spread reflects the market's long-lasting worries about the country's fiscal position," explains Barclays.

Strategists at the bank expect valuations to remain at around current levels owing to the looming vote and any political uncertainty that might arise if the ANC fails to secure a majority.

"USDZAR premium has stabilised at around 10% (Figure 5), and, in our view, should fluctuate around this level until we see some resolution around uncertainty regarding the upcoming elections," says Barclays.