Europe Nearing Recession in New European Central Bank Forecasts

- Written by: James Skinner

"Risks to the economic growth outlook are on the downside, especially in the near term" - European Central Bank

© European Central Bank, reproduced under CC licensing

European Central Bank President Christine Lagarde warned in the ECB's final press conference of the year that "a relatively short-lived and shallow" technical recession may be seen in the months ahead due to a growing collection of economic ailments stemming from the energy crisis.

Downgraded forecasts warned on Thursday of a deteriorating outlook for the European economies while President Lagarde noted in the December press conference that a burdensome collection of ailments may be driving a contraction that would meet the technical definition of a recession.

"The euro area economy may contract in the current quarter and the next quarter, owing to the energy crisis, high uncertainty, weakening global economic activity and tighter financing conditions," she said in opening remarks.

"According to the latest Eurosystem staff projections, a recession would be relatively short-lived and shallow. Growth is nonetheless expected to be subdued next year and has been revised down significantly compared with the previous projections," she added.

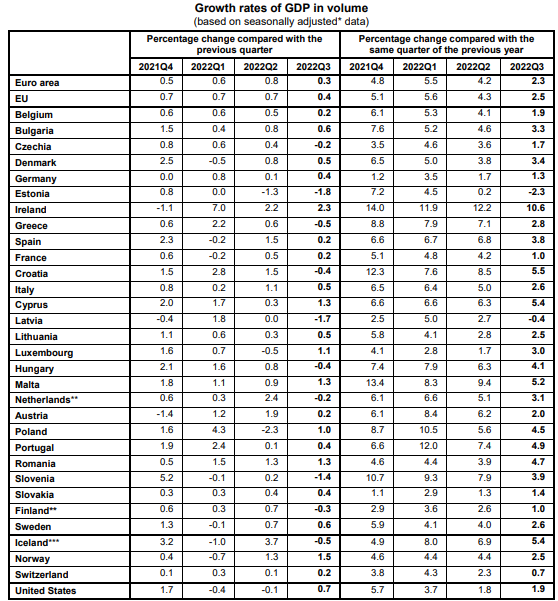

Above: Quarterly and annual GDP growth for economies in Europe. Source: Eurostat. Click image for closer inspection.

Above: Quarterly and annual GDP growth for economies in Europe. Source: Eurostat. Click image for closer inspection.

The forecast for this year was revised from 3.1% to 3.4% following upward-revisions to official estimates for the second quarter and a better-than-expected performance in the third but this year was already expected to give way to a sharp deceleration in 2023 and that's now expected to begin sooner.

"Beyond the near term, growth is projected to recover as the current headwinds fade. Overall, the Eurosystem staff projections now see the economy growing by 3.4 per cent in 2022, 0.5 per cent in 2023, 1.9 per cent in 2024 and 1.8 per cent in 2025," President Lagarde said on Thursday.

"High inflation and tighter financing conditions are dampening spending and production by reducing real household incomes and pushing up costs for firms," she added.

The downgraded growth forecasts came alongside increased projections for inflation and were contained within a monetary policy decision announcing a fourth increase in interest rates since July that has lifted the ECB's once-negative deposit rate to 2.5%, from -0.5% earlier this year.

"The Governing Council decided to raise interest rates today, and expects to raise them significantly further, because inflation remains far too high and is projected to stay above the target for too long," the bank's statement said.

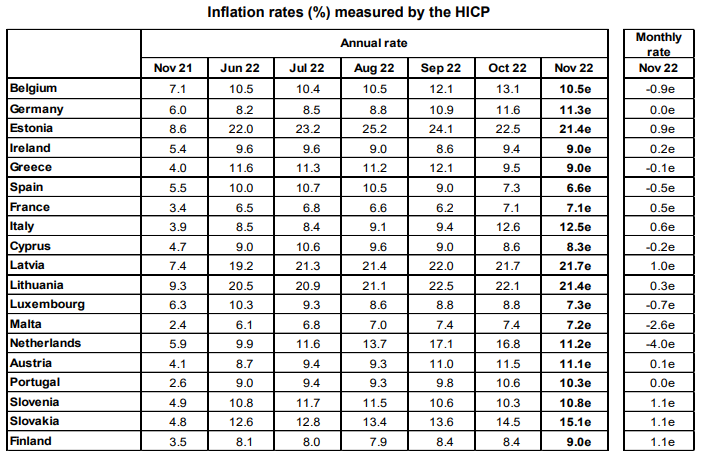

Above: Inflation rates for different economies in Europe. Source: Eurostat. Click image for closer inspection.

Above: Inflation rates for different economies in Europe. Source: Eurostat. Click image for closer inspection.

Eurozone inflation is now seen averaging 8.4% in 2022 before falling to 6.3% next year, reflecting increases from 8.1% and 5.5% back in September, while the projection for 2024 was lifted from 2.3% to 3.4%.

The ECB sees inflation as likely to be sitting around 2.3% at the other end of its forecast horizon in 2025 and at a higher 2.4% if energy and food prices are removed from the basket of goods for which prices are analysed.

"Risks to the economic growth outlook are on the downside, especially in the near term. The war against Ukraine remains a significant downside risk to the economy. Energy and food costs could also remain persistently higher than expected. There could be an additional drag on growth in the euro area if the world economy were to weaken more sharply than we expect," Lagarde said.

"The risks to the inflation outlook are primarily on the upside. In the near term, existing pipeline pressures could lead to stronger than expected rises in retail prices for energy and food. Over the medium term, risks stem primarily from domestic factors such as a persistent rise in inflation expectations above our target or higher than anticipated wage rises," she added.