UK Unemployment to Rise and Inflation to Plunge in 2023, Triggering a Bank of England Reset say Economists

- Written by: Gary Howes

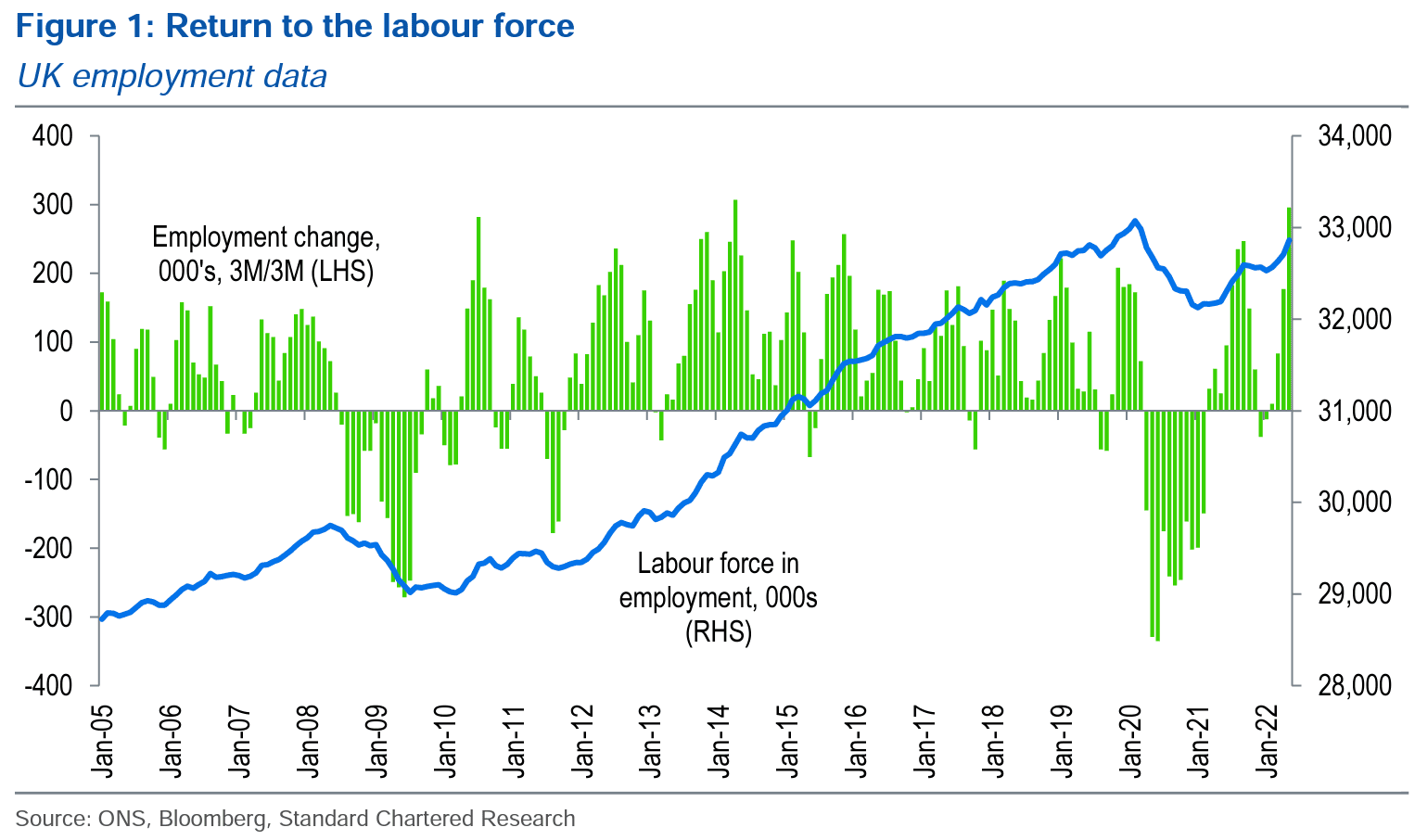

- Workers are returning to the jobs market

- Easing tight labour conditions

- Core inflation has already turned a corner

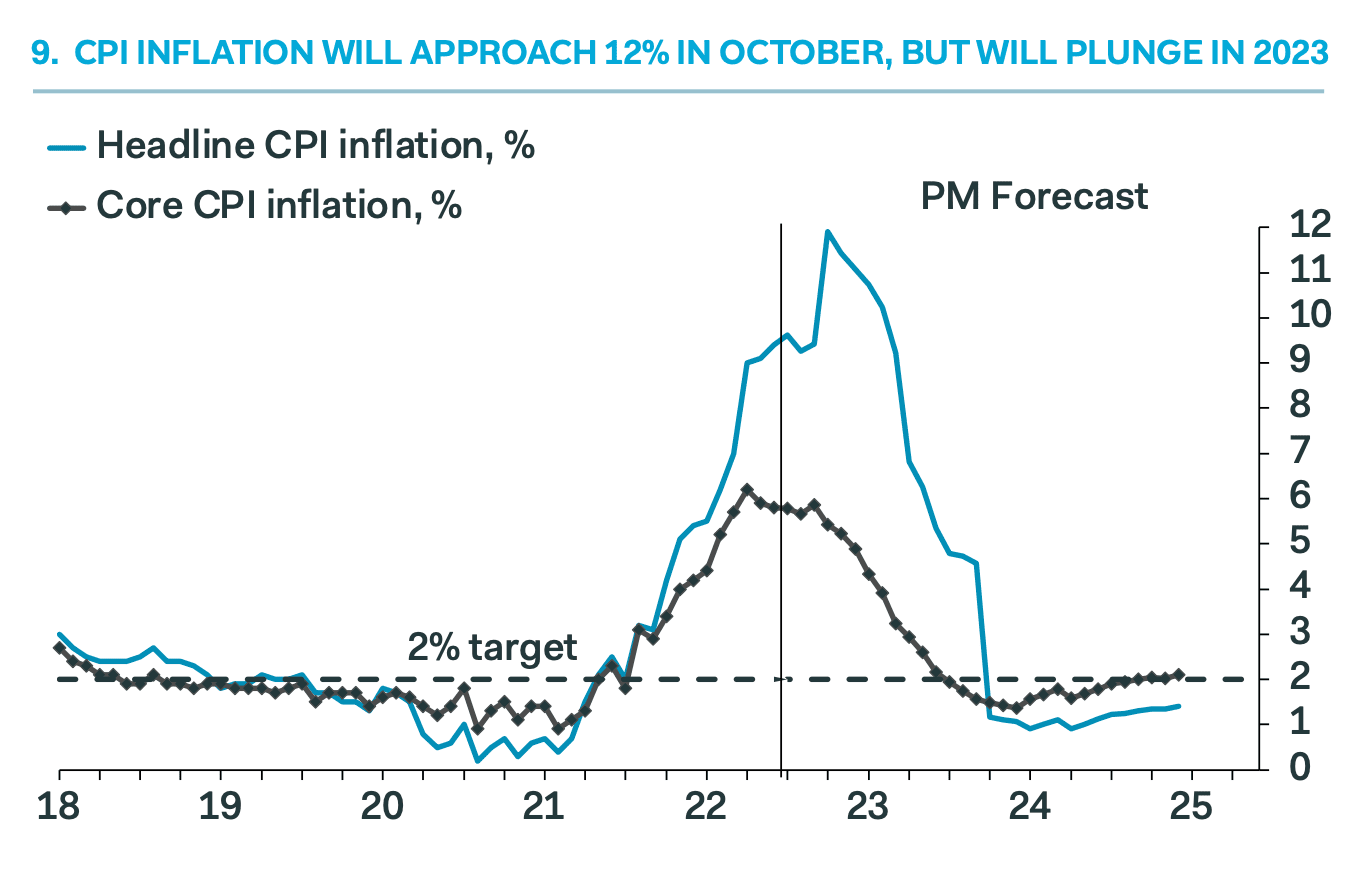

- Headline inflation to plunge in 2023

- Bank of England to end rate hike cycle sooner than expected

Image © Adobe Stock

People are returning to the labour market in greater numbers and inflation will crater in 2023 according to some economists, leading them to expect the Bank of England to miss expectations for it to raise Bank Rate to 3.0% by the end of 2022.

The findings come ahead of the August 04 Bank of England policy announcement where a 50 basis point rate hike could be announced, with some economists even suggesting a subsequent 50bp hikes is likely in September.

Such a lofty interest rate rise is based on incoming data that shows the labour market is 'tight' - a situation where there are more vacancies than workers, which in turn puts upward pressure on wages.

The Bank has said it is now almost entirely data dependent when considering interest rates, placing greater emphasis on incoming data releases.

But Christopher Graham, Europe Economist at Standard Chartered, says this labour market tightness is fast unwinding, making August's jobs report particularly important.

"Recent evidence suggests a more complex picture is emerging for the labour market. Vacancies appear to have turned a corner, suggesting the economy is either beginning to work through the supply-demand distortions created by COVID, or hiring is slowing," he says in a research note out this week.

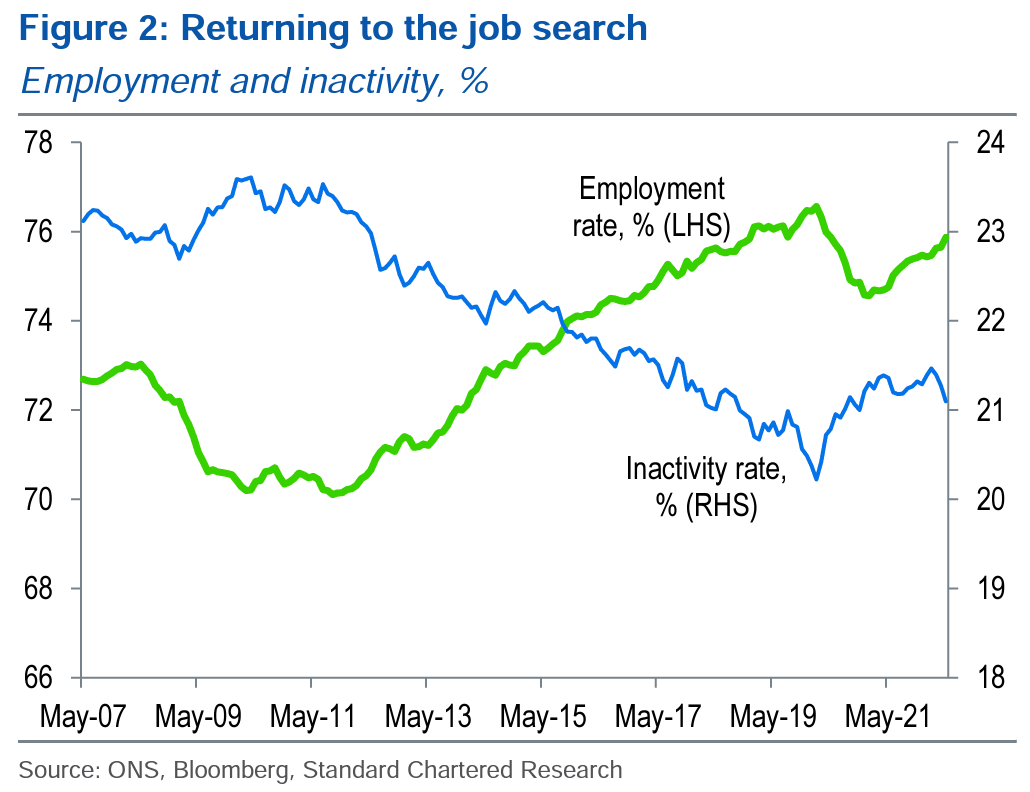

He adds the UK inactivity rate is falling, increasing the size of the labour force; "if these trends persist, they could further ease labour-market constraints, and even serve to raise unemployment and alleviate private-sector wage pressures."

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, agrees: "we think above-average growth in the workforce will be sustained, as immigration rebounds and the combination of the fading of the pandemic and the intense pressure on living standards boosts participation."

Pantheon Macroeconomics expects growth in employment to slow amidst declining vacancies and increased supply of workers.

Increased labour supply amidst steady vacancy numbers inevitably puts downward pressure on wages as more people compete for the same jobs.

And it is wages that the Bank of England places great emphasis on when setting interest rates, as rising wages tend to boost inflation.

Since the pandemic the UK - and indeed other major economies - have grappled with a shortage of workers, with evidence some have retired early, become full-time carers for family members or taken up study.

This has coincided with a surge in nominal wages, albeit real wage growth continues to slow as inflation surges.

But these trends are starting to reverse as people brush up their CVs, in part due to the surging cost of living.

"We think the unemployment rate will drift up in the second half of this year, helping to keep nominal wage growth in check," says Tombs.

The March-May jobs report released on July 19 showed UK employment grew 296k and the inactivity rate also fell to 21.1%, the third consecutive month of decline, having peaked at 21.5% in February.

The report also revealed the first decline in economy-wide vacancies in almost two years was also recorded in the April-June period, down around 3k relative to March-May.

"If workers are returning to the labour force in greater numbers, this is good news from a participation perspective; but it could also suggest near-term tightness in the labour market is easing as those changing from inactive to searching for work could push unemployment up temporarily," says Graham.

Inflation to Make a Final Surge, then Slump

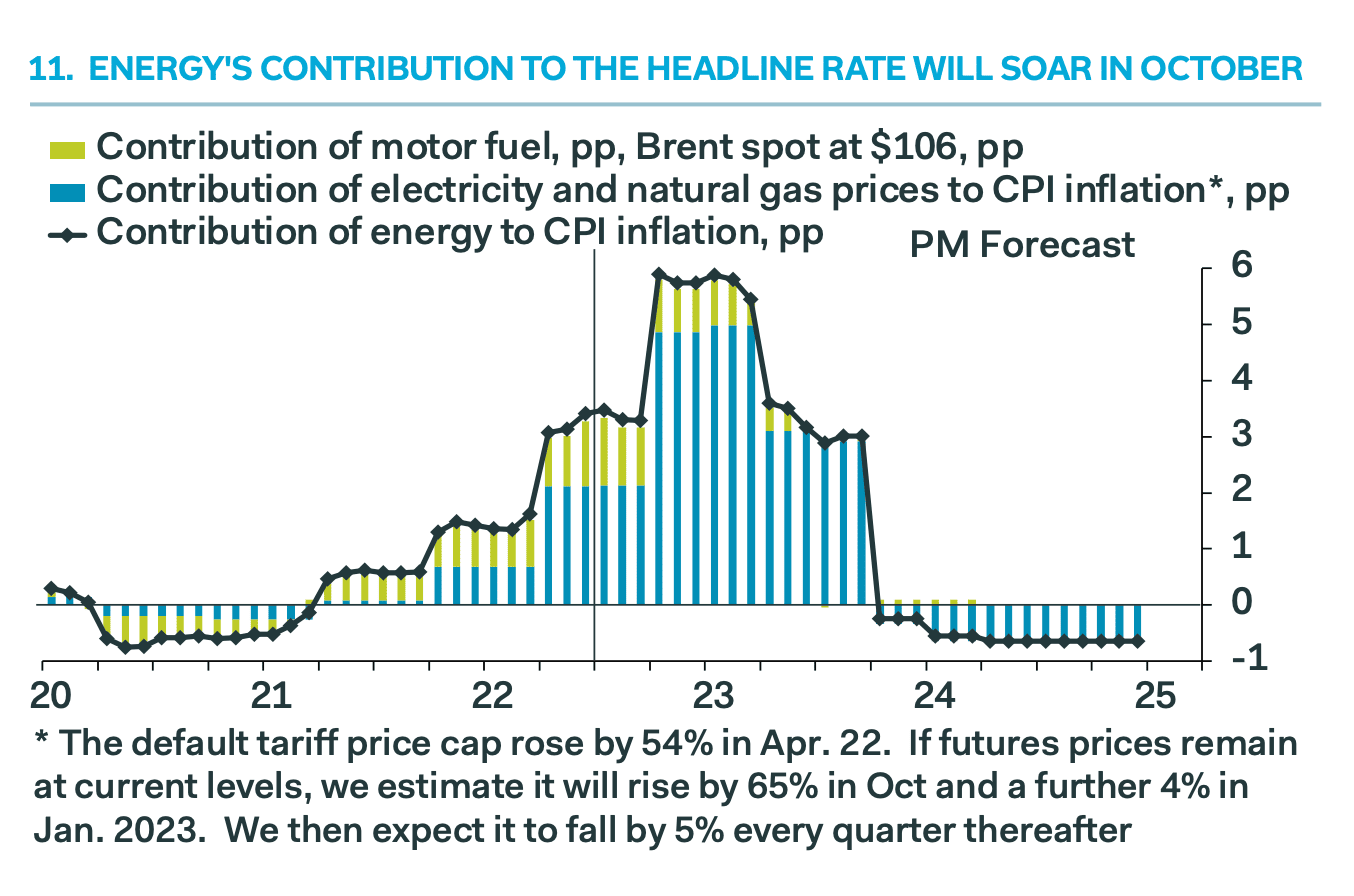

Pantheon Macroeconomics have revised up their forecast for the peak rate of CPI inflation in October to nearly 12%, from just above 11% previously, following a further surge in wholesale natural gas and electricity prices.

Research from BFY Group now shows the rise in wholesale gas prices takes their forecasts for the October 2022 and first quarter 2023 energy price cap rises to new highs.

They now forecast a rise to £3420 and £3850 respectively.

"Based on typical consumption patterns, this means the average consumer, paying by direct debit will now be facing a bill of £500 in January alone," says a note from BFY Group.

Pantheon Macroeconomics expects energy regulator Ofgem to increase its price cap by about 65%, rather than the 50% they had previously expected.

But Pantheon says core CPI inflation has already peaked and producer output price inflation "is about to crater".

This due to a decline in a range of commodity prices over the last two months.

Furthermore, manufacturers now have excess stock and retailers' margins also are contracting in response to weak demand, having increased during the pandemic.

As a result, inflation will fall sharply and rapidly in 2023:

The net result of the easing in labour market conditions and peaking inflation is the Bank of England will soon be in a position to step back from hiking interest rates and likely won't be required to deliver successive 50bp rate hikes.

Market consensus sees the Bank of England hiking 50bp at its next three meetings in August, September and November, and then by a further 25bp in December, leaving rates at 3.0% by the end of this year.

"The mid-August jobs market report will be crucial in deciding whether additional 50bps hikes are required later in the year (as the market expects) or if the pace of monetary tightening can slow back towards 25bps hikes (as we expect)," says Standard Chartered's Graham.

"We think there is sufficient economic evidence to support a 50bps hike at the next monetary policy meeting on 5 August, but that thereafter a combination of slowing economic activity and further evidence that the labour market is cooling should support a slower pace of tightening (25bps hikes each in September, November and December)," he adds.

Pantheon Macroeconomics expects two more 25bp hikes, in August and September, at which point the cycle ends.