Beware the ECB's "False Start" on Interest Rate Normalisation: ABN AMRO

- Written by: Gary Howes

Image © European Central Bank, reproduced under CC licensing

Euro bulls have misread the European Central Bank's intentions on policy normalisation warns a major European bank which sees the Deposit Rate remaining below 0% even once hikes have been delivered.

New analysis from ABN AMRO Bank shows that while the ECB will indeed proceed to raise rates in coming months these hikes will be far smaller than the market is currently anticipating.

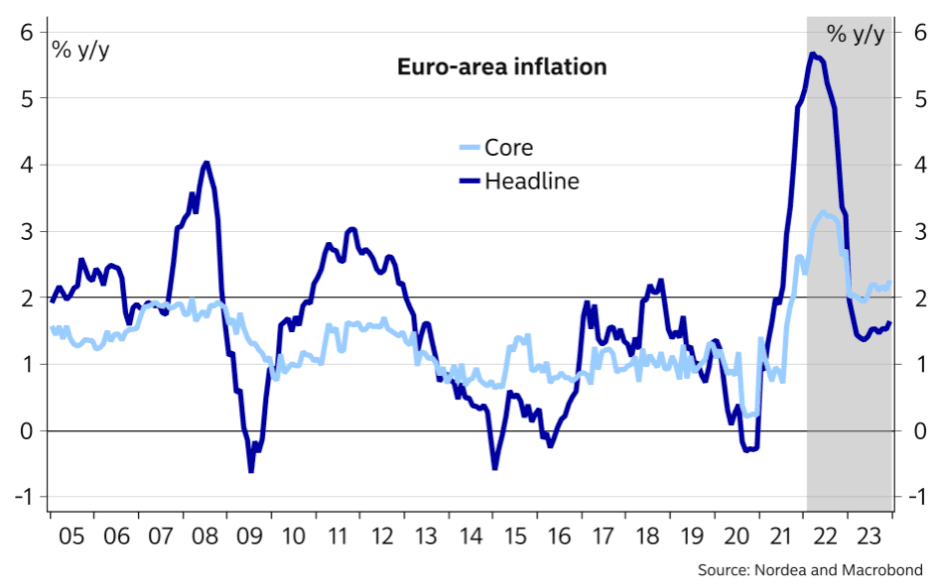

"Inflation will very likely be coming down sharply by the end of this year, and could even be below target around the time the ECB pulls the trigger," says Nick Kounis, Head of Financial Markets at ABN AMRO Bank.

Kounis and his team anticipate the coming rate hike cycle to underwhelm against the market's expectations for up to 50 basis points of hikes before this year ends.

The findings come just days after the ECB set interest rate and exchange rate markets alight by confirming they were marching towards a future of higher interest rates, throwing aside years of repetitive cautioning that rate hikes were unforeseeable.

But Kounis finds that the ECB’s "pivot" is the result of the upward surprise in the preliminary HICP inflation data for January.

He argues the ECB has judged that although energy prices remain the key driver of the inflation surprise, the core rate has not fallen as much as expected.

For the ECB to act it must be sure that external drivers of inflation are starting to impact other measures, delivering what is known as a second-round effect.

But, "despite this ex-post rationalisation, the pivot is difficult to really justify based on the ECB’s previous stance and communication," he adds.

In fact ABN AMRO's research finds the acceleration of inflation seen this year is not linked to "sizzling demand" but rather to supply-side shocks beyond the control of the ECB.

"These shocks are not only pushing up inflation, but are weighing on domestic demand," he warns, adding:

"The ECB seems to be becoming more confident that wage growth will rise this year, on the basis of its own survey of employers as well as positive unemployment surprises."

ABN AMRO finds wage growth remains muted and cite data showing growth of negotiated wages is running at around 1.5%, while a level of 3% is consistent with the ECB’s target.

The ECB's chief economist Philip Lane in January said the key metric to watch going forward would be wage growth, specifically whether it will be able to sustain Eurozone inflation above the ECB's 2.0% target over the longer-term.

He said just days before the ECB's February policy meeting, "so far, we do not see a big response of wages. We do expect a response of wages but what is critical is how big."

- Reference rates at publication:

GBP to EUR: 1.1877 - High street bank rates (indicative): 1.1550 - 1.1632

- Payment specialist rates (indicative: 1.1757 - 1.1810

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

Lane explicitly said wages would need to sit at around 3.0% for the Eurozone's medium-term inflation outlook to anchor around the 2.0% target.

In the third quarter of 2021, the most recent set of wage figures, Eurozone wages rose by 2.5% when compared with the same quarter of the previous year.

"In the absence of second round effects, it makes no sense for central banks to react to supply side shocks by tightening monetary policy. Indeed, the ECB President herself said that this would be ‘exactly the wrong thing to do’ just a few months ago," says Kounis.

ABN AMRO does however acknowledge the tone struck by ECB President Christine Lagarde points to an accelerated withdrawal of stimulus and "that the ECB is heading for the exit".

Economists anticipate the Governing Council to announce in March that it will likely announce a tapering of the APP, with net purchases ending altogether in September.

They expect APP to average €30BN in the second quarter and €15BN in the third quarter.

They have pencilled in a 10bp deposit rate hike in December of this year and an additional one in March of next year.

The ten basis point increments would respect a view that because the ECB cut the Deposit Rate by 10 basis points once it fell below zero it will also hike by similar increments until zero is reached.

This would significantly undershoot the market's expectation for the ECB to deliver two 25 basis point hikes in 2022.

Such a disappointment would likely in turn weight on Euro exchange rates.

"After that we expect rate hikes to be aborted, or at least put on ice, with the deposit rate at -0.3% by the end of 2023," says Kounis.

A terminal deposit rate of -0.30% would be another source of disappointment for Euro bulls given the market is ultimately preparing for a world of normalised policy where rates sit above 0%.

"Essentially, we are predicting somewhat of a false start for policy normalisation," says Kounis.