Sluggish Retail Sales Highlight the UK's Disappointing Economic Rebound

- Written by: Gary Howes

Image © Adobe Images

The UK's 2021 rebound was supposed to be a world-beater, but yet another sign that this might not be the case has dropped.

UK retail sales data for July missed the market's expectations by a wide margin, leading some economists to suggest the UK's economic rebound will be less impressive than might have been expected earlier in the year.

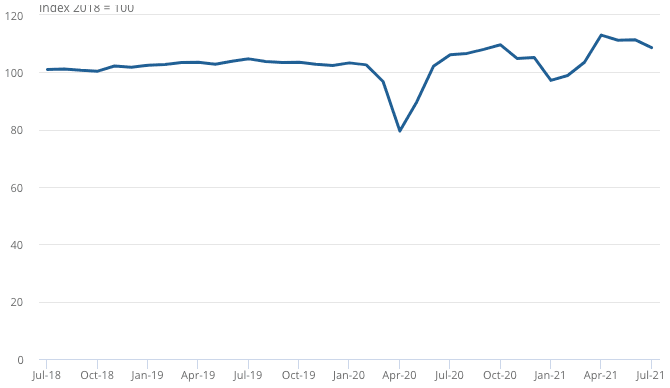

Retail sales grew 2.4% Year-on-Year in July said the ONS, a figure that was sharply lower than the 9.2% reported in June and the 6.0% the market was looking for.

The disappointment owes itself to a month-on-month contraction of 2.5% recorded in July, down on June's 0.2% growth and below the market's expectation for 0.4% growth.

"With the UK’s recovery lagging behind that of other major economies, the return of holidays, social events including weddings and the general easing of restrictions last month hasn’t turbocharged consumer spending in the way many hoped it might have," says Aled Patchett, head of retail and consumer goods at Lloyds Bank.

The decline looks to have been driven by a hefty slump of 4.4% in sales volumes reported by non-food stores between June and July.

Furthermore, reduced mobility - a key indicator of economic growth - appears to lie behind the disappointing data as automotive fuel sales volumes fell by 2.9% over the month, its first monthly fall since February 2021.

Above: ONS retail sales.

Global oil prices cannot be behind the fall: crude rose steadily through June and July's decline should start showing up in forecourt prices in September's data.

Instead, the ONS says heavy rainfall in early July impacted road traffic volumes, meaning automotive fuel sales volumes are now 6.7% below their pre-coronavirus pandemic February 2020 levels.

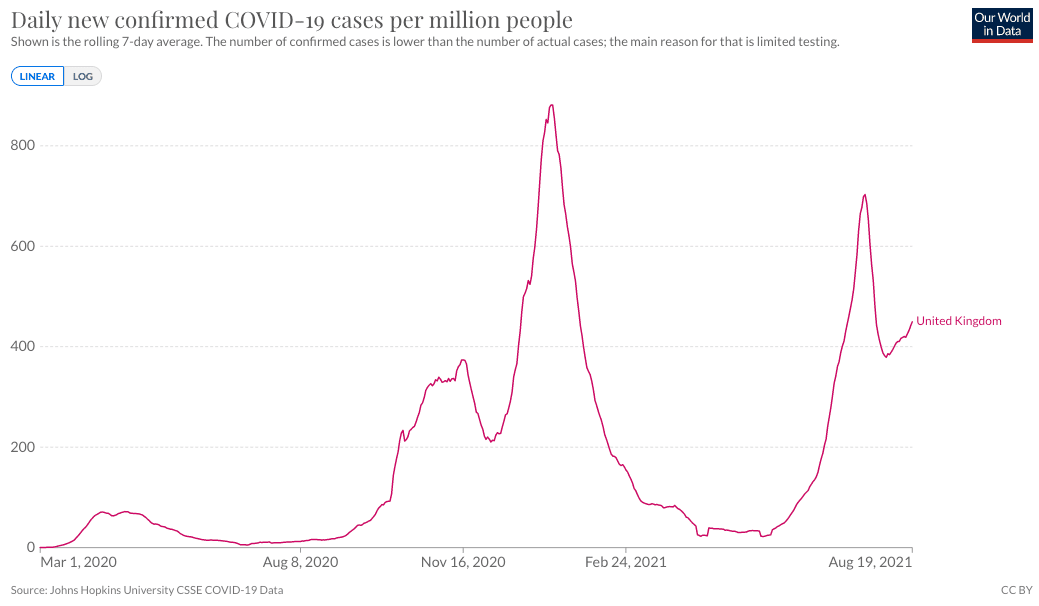

But, Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics blames the soft spending trends on a rise in Covid-19 cases during the period.

"July’s sharp decline in retail sales can be blamed largely on rising Covid-19 cases, which prompted some households to steer clear of shops and forced others into self-isolation," says Tombs.

This observation tallies with the ONS reporting online sales actually increased in the June to July period, despite all restrictions being lifted.

The proportion of retail sales online increased to 27.9% in July from 27.1% in June and remains substantially higher than the proportion of online retail spending in February 2020, notes the ONS.

Above: Covid cases have risen this summer and could continue doing so into the winter.

Looking ahead, Lloyds Bank's Patchett says retailers’ attention will now turn to the upcoming 'golden quarter'.

"Inflation is expected to continue affecting pricing, leaving brands caught between the rock and hard place of deciding between passing on price increases to consumers or sacrificing margin. Meanwhile global shipping issues are already contributing to stock shortages in a range of sub-categories – particularly food and drink," he says.

Pantheon's Tombs says there are some signs that retail sales in August might be on the up.

"For now, the evidence is mixed regarding whether households’ spending has recovered this month," he says. "Encouragingly, retail footfall in the week ending August 14 was just 18% below its level in the same week of 2019, the smallest shortfall since the week ending June 12."

But Tombs also notes the incoming short-term survey data to be mixed: GfK’s composite index of consumer confidence edged down to -8 in August, from -7 in July, while the BoE’s CHAPS data show that the non-seasonally adjusted value of credit and debit card transactions was 6% below its February 2020 level in the week to August 12, no better than at that the same time in July.

"Looking ahead, retail sales probably will simply flatline over the six months," says Tombs. "Households face a combination of the withdrawal of fiscal support and much higher inflation in Q4, which will offset the boost to real disposable incomes from rising employment."

In addition, he cites a recent survey by the Bank of England which revealed that 17% of fully-vaccinated households intend to spend less than they did before Covid-19 due to continued concerns of contracting the virus, while a further 19% plan to spend less due to financial reasons.

"By contrast, only 6% of doubly-vaccinated people reported that they will spend more, despite the huge stock of excess savings amassed since March 2020. Retail sales also are vulnerable to a further rotation by households back towards consuming services, though still-high levels of virus transmission are delaying this shift," says Tombs.