GBP/USD Rate: Potential Next Targets

- Written by: Gary Howes

Month-to-date, Pound Sterling is now the worst-performer amongst the group of the ten major currencies with losses of 1.18% being seen against the Dollar.

The lion's share of that loss came in the week just passed confirming that momentum has swung from positive to negative in the near-term.

Traders have pressed the sell button on Sterling following revelations that the UK public is fast swinging behind the Labour party ahead of the June 8 general election.

This is a surprise to foreign exchange markets; and they don’t like surprises!

"Sterling plunged to three-week lows, getting whacked by a poll showing an evaporating lead for Prime Minister Theresa May ahead of the national vote in less than two weeks on June 8. The original thinking when Mrs. May announced the snap election in April was that she could win a supermajority in Parliament, giving her a strong mandate to call the shots with respect to Brexit negotiations with the EU," says Joe Manimbo, an analyst with Western Union.

Over in the United States the Dollar meanwhile got a boost from the release of better-than-forecast economic statistics.

At the time of writing the exchange rate is at 1.2819, down 0.95% and some initial targets set by technical analysts earlier in the day have already given way.

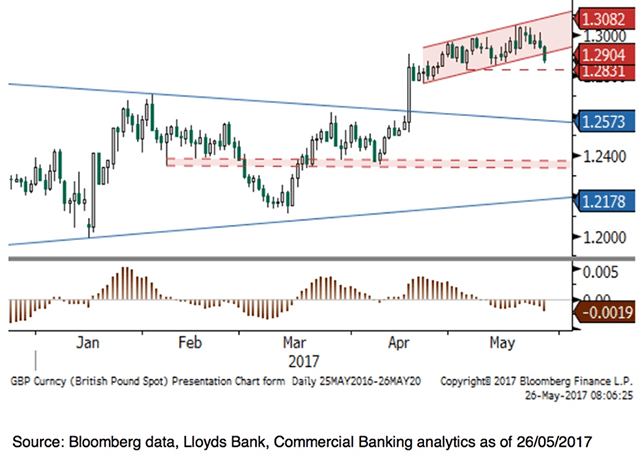

“A sharp decline overnight sees us break through the channel support ~1.2900 and now our focus is on the 1.2830 region,” says Robin Wilkin at Lloyds Bank.

Wilkins says momentum studies remain bearish so while under resistance in the 1.2930/1.2970 region he looks for supports to give way and prices to extend towards the midpoint of the m/t range around 1.2500.

But it's not all bad for those hoping for a stronger Pound.

“A break up through resistance in the 1.3050-1.3080 region would call our current bearish view into question and risk an expansion of the move towards the 1.3500 region,” says Wilkins.

However, this would not change his underlying medium-term outlook of a range, “but rather than being between ~1.20 and ~1.30, we may be moving into a slightly higher range of ~1.25 to ~1.35.”

Others agree that the outlook has deteriorated somewhat for Sterling.

“Political uncertainties should further weigh on the pound following its recent failure to clear the critical mid-term resistance at 1.3044 (major 38.2% retracement on post-Brexit sell-off) against the US dollar,” says Ipek Ozkardeskaya, Senior Market Analyst at London Capital Group.

Ozkardeskaya believes GBP/USD is set to extend weakness to 1.2824 which forms the minor 23.6% retracement on the March – May recovery.

From here, it could go as low as 1.2688 which is the major 38.2% retrace of the recovery.

Bearish Consolidation

Meanwhile analysts at LMAX Exchange believe that this latest push through 1.2775, the December 2016 peak, is a significant development as it potentially ends a period of

bearish consolidation.

It warns of the formation of a more meaningful longer-term base.

“The break ends a multi week consolidation mostly ranging between 1.2000-1.2700 with the bullish move paving the way for a measured moved upside extension equal in size back into the 1.3500 area in the days ahead,” say analysts.

Don’t be surprised if there is a short-term pullback though owing to the oversold conditions in the near-term.

“Any declines are now classified as corrective and should be well supported ahead of 1.2500 in favour of a higher low and bullish resumption,” say LMAX Exchange.

US Dollar Boosted by Data

Data out of the US has meanwhile been good.

Annualised GDP figures for the first quarter read at 1.2% whereas it was reported at 0.7% previously.

Analysts had been expecting a revision higher to 0.9% so the beat is helping the Dollar and piling further pressure on GBP/USD.

"Yellen will find the 0.60% quarterly uptick in consumer spending to be particularly pleasing ahead of what is being enthusiastically priced in by fixed income markets – the implied probability of policy action was above 80% at the last count. Unless Donald Trump repeats his NATO tactics and shoulders his way into the headlines and barring any shock disappointments in the data calendar, no market event appears capable of preventing a mid-June US interest rate hike," says Richard de Meo, Managing Director of Foenix Partners.

Eyes on Weekend Polls

Some caution might be warranted at this stage.

"Such a polling bounce for Labour was also eminently predictable (a similar occurrence took place for the Conservatives in the 1997 election, and we know how that turned out), so we should see some cable buying as the session goes on," points out Chris Beauchamp, Chief Market Analyst at IG.

Is this the blip needed to energise and focus Conservative voters and the party itself?

We will continue to watch the polls, note that the weekend will have a slew of findings coming out for the Sunday papers.

If the Conservatives can show this is a blip we would expect Sterling to stabilise - not necessarily recover fully - when trading commences on the following week.

“With elections only two weeks away the markets will now begin to pay close attention to polling and sterling could become more volatile as a result. For now the pair has topped at the 1.3000 level which will remain key resistance for time being,” says Boris Schlossberg, Managing Director at BK Asset Management in New York.