EUR/USD Rally: Traders Getting Ahead of Themselves

Valentin Marinov at Crédit Agricole Securities in New York has written to his clients warning that the recent rush higher in the Euro is starting to look stretched and that caution is therefore warranted.

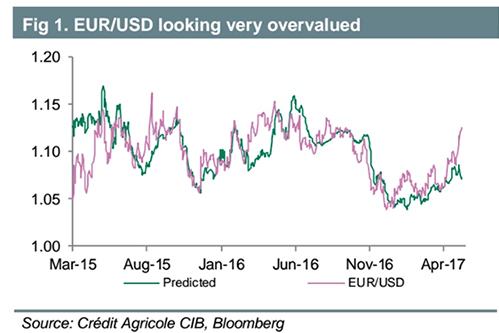

The EUR/USD rally in the aftermath of the French presidential election has run well in excess of the short-term relative fundamentals.

The recent EUR/USD rally stands in sharp contrast with rather muted widening of the EUR-USD 2Y rate spread.

In addition, the FX rebound is running ahead of the gradual tightening in the OAT-Bund 10Y yield spread that has been evident since the French presidential elections.

Clients have built considerable EUR-longs in anticipation of portfolio inflows into Eurozone stock markets and unwinding of EUR-funded carry trades as the ECB moves ever closer to the QE taper. We doubt that these inflows can boost EUR, however, so long as they are hedged.

The hedging behaviour of the investors and, ultimately, the timing and the aggressiveness of the ECB taper will depend on the Eurozone inflation outlook.

We expect the relative fundamental outlook for EUR/USD to deteriorate from here. Starting with EUR, we expect Eurozone inflation to slow down sharply in May (the release is due on 31 May).

This could dash investors’ hopes for a more aggressive removal of accommodation by the ECB, come September.

>> Tactical Play: Fade EUR/USD Strength

>> EUR/USD has Limited Potential say Credit Suisse

In addition, given the impact of FX appreciation on headline HICP inflation, the chances are that a potential sharp slowdown in Eurozone inflation next week could translate into a correction lower of the currency.

To the extent that this translates into lower ECB inflation projections, investors could become more cautious in their EUR-outlook ahead of the June ECB meeting.

This is also where we advise caution given that we expect Eurozone inflation to slow down sharply in the coming months.

We also note that USD has sold off in excess of the recent correction lower in Fed rate hike expectations.

We expect the US growth outlook to improve, political risks to subside and the FOMC to maintain its outlook for further monetary policy tightening, helping USD to recover.

We expect that the Fed will deliver a rate hike in June and reaffirm its expectation that further tightening will be needed later this year.

We also expect the US economic recovery to regain momentum in Q2 and further add credibility to the Fed’s rate outlook.

This much could encourage renewed front loading of Fed rate hike expectations and boost the rate advantage of USD yet again.

An estimate of the short-term fair value for EUR/USD suggests that the pair should be trading well below 1.08 at present.

We advise caution on the near-term outlook for EUR/USD.