Dollar Forecast Lower, Even in Event of U.S. Recession, by BNP Paribas

- Written by: Gary Howes

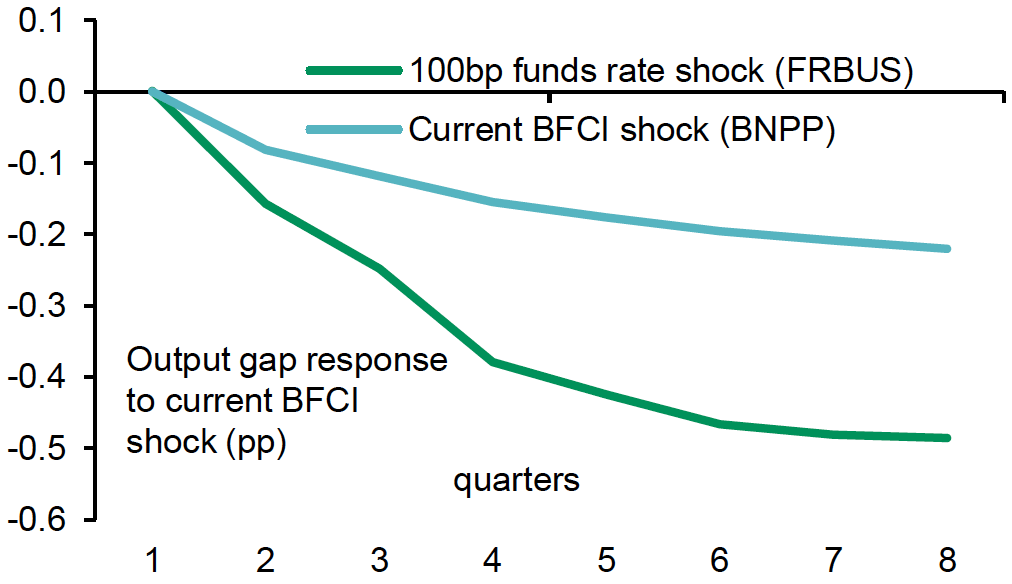

Above: "Tighter financial conditions worth 50bp hike" - BNP Paribas. Sources: Bloomberg, BNP Paribas.

BNP Paribas Securities Corp's Head of Americas Macro Strategy, Calvin Tse, has suggested that the US dollar (USD) could be set for a multi-year structural decline due to several factors.

Tse noted that the USD retraced in March as data started to show a slowdown in the U.S. economy, leading to a fall in US real yields and curve steepening pressures.

He believes that this coupled with positive yields outside the U.S. and a more hawkish European Central Bank (ECB) should spur the repatriation of funds by European and Japanese investors, who have been overweight US assets for much of the past decade.

The findings come in BNP Paribas' latest monthly foreign exchange research briefing.

"We expect the rotation out of U.S. debt to continue, as well as a near-term move out of U.S. equities as Value should outperform Growth this year, which would further weaken the USD," said Tse.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Even in the case of a global risk-off event, USD strength from safe-haven demand would be limited after the Fed made standing central bank liquidity swap lines available daily in March, highlighting that the Fed is acting preemptively in handling tight USD liquidity, which should limit any potential dollar surge.

"All in all, this supports our longstanding thesis that we are at the beginning of a multi-year structural USD decline," Tse added.

Tse's comments come as the dollar index, which tracks the performance of the USD against a basket of other major currencies, fell to its lowest level since November 2020. The index is down a further 1.66% in April at 100, with the greenback weakening against the euro, yen, pound and majority of G10 peers.

Investors will be closely watching the U.S. Federal Reserve's next moves and comments from officials, as well as economic data releases, to gauge the future direction of the USD.

BNP Paribas forecasts EUR/USD to rise to 1.14 and USD/JPY to decline to 127 (previously 121 by end 2023).

The bank projects GBP/USD to rise to 1.28 by the end of 2023.

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |