UK Manufacturing Surges in April as Domestic Orders Grow, Pound Edges Higher

The Pound failed to take advantage of news that the UK's manufacturing sector is growing from strength to strength.

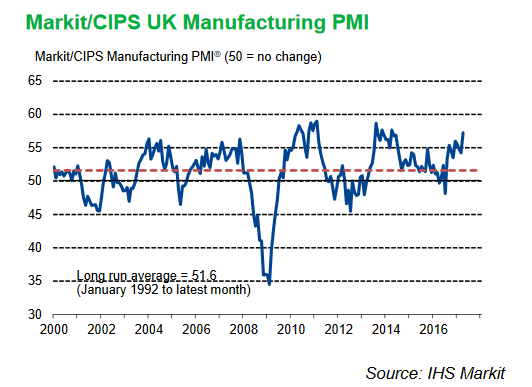

A major barometer of manufacturing activity in the UK, the Purchasing Manager Index, showed a marked gain on Tuesday after it rose to a three-year high of 57.3 in April from 54.2 in the month before.

The Pound retains a somewhat positive bias against the likes of the Euro and Dollar following the release.

The release led to a spike higher in Sterling pairs, including GBP/EUR which went from 1.1811 to 1.1830 in the minutes which followed the release (but then promptly fell back down), and GBP/USD which rose from 1.2885 to 1.2912.

The UK currency remains driven by global investor sentiment, technical market positioning and political considerations at present.

"Sterling briefly enjoyed a small rally this morning as Manufacturing PMI unexpectedly rose to a three-year high, having been forecast to dip. The Pound continues to trade just shy of 1.29 against the dollar and around 1.18 against the euro. Politics continues to outpace economic indicators as a driver of the pound. More broadly, the Pound has continued to see support off the back of an expected Conservative Party win in June's snap elections, although it has eased from Friday's highs," says Alexandra Russell-Oliver, Currency Markets Analyst with Caxton FX.

One can't deny that the latest data on manufacturing has some longer-term positive implications for the currency, if the momentum is shown to be sustainable.

The data seems to support the view - held by certain analysts - such as Stephen Gallo of BMO Capital Markets, that there will be a renaissance in UK economic data due to a lagged tendency for it to follow Eurozone data which has improved markedly recently.

Continued robust inward investment despite Brexit has defied expectations and also supported the economy.

The rise in the PMI was well above analyst’s consensus estimates which had forecast a fall to 54.0.

Manufacturing PMI is a survey of purchasing managers in the Manufacturing sector. Although it is a sentiment based indicator it is seen a strong leading indicator for the sector.

"We believe that manufacturing PMI levels finally reflect improved competitiveness in the wake of currency depreciation and a healthy pick-up in EA demand," says Andrzej Szczepaniak at Barclays.

Of the five subcomponents of the PMI, the two which grew the fastest were New Orders, and Output.

Domestic contracts constituted the bulk of the new business.

“UK manufacturing output was driven higher by the strongest inflows of new work since January 2014, with the domestic market remaining the principal source of new contract wins,” said the report from survey compiler Markit.

Nevertheless, Exports also increased from the previous survey period, reflecting higher demands from clients in, “North America, Europe, Africa and Brazil.”

The low exchange rate had a double-edged effect of both increasing export competitiveness but also raising base costs due to the rise in the expense of imported subcomponents.

“Companies mentioned paying higher prices for a wide range of materials, including chemicals, metals and plastics.

Some of the increase in input costs reflected supply-chain pressures and a “lengthening in average vendor lead times.”

A strong domestic market underpinned the strong April print.

“The UK manufacturing sector made a solid start to the second quarter. Growth of output, new orders and employment all gathered pace, driven higher by the continued strength of the domestic market,” said Rob Dobson, senior economist at IHS Markit.

He added that the challenge now was for the sector, which accounts for 10% of the UK economy to show sustained growth.

“The big question is whether this growth spurt can be maintained, especially given the backdrop of ongoing market volatility and a number of political headwinds such as elections at home and abroad. Other surges seen since the middle of last year have generally proved short-lived, as weak wage growth sapped consumer spending. If this happens again it will inevitably constrain manufacturing, even as the investment and intermediate goods producing sectors continue to expand,” said Dobson.