Pound Sterling in Soft Start, UK Salary Inflation Nears Three-year low

- Written by: Gary Howes

Image © Adobe Stock

The British Pound was softer on the day a much-watched survey of the UK job market confirmed an ongoing trend of cooling wage increases just a day ahead of the official ONS wage data release.

The Pound to Euro exchange rate pulled back from 1.1750 to 1.1730 as the UK currency pared a strong end to the previous week, perhaps aided by the REC/KPMG Report on Jobs revealing the rate of salary inflation for permanent job placements was closing in on a three-year low.

The permanent staff salaries index fell to 55.2 in February from 55.8 in January, having averaged 60.0 in the second half of the 2010s.

"We place weight on the RoJ survey because it has a 25-year track record of accurately predicting changes in the unemployment rate and wage growth," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics. "The Report on Jobs survey continues to suggest that the MPC needs to cut interest rates soon."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

For sure, the Pound was always likely to settle back after the previous week's strong advance, but the Report on Jobs findings come a day ahead of the official ONS wage report, which is expected to confirm UK wage increases are easing, allowing the Bank of England scope to cut interest rates in the summer.

In light of these findings, investors will want to take some risk off the table ahead of the ONS release. The Pound to Dollar exchange rate - fresh off a seven-month high at 1.2893 - eased back at the start of the new week to 1.2840.

The Survey on Jobs data signalled further increases in starting pay rates for both permanent and temporary workers, as employers raised rates of pay "amid the higher cost of living and competition for highly skilled candidates".

However, the rate of salary inflation was the slowest recorded in nearly three years, with a number of recruiters noting that employer budgets were now tighter after a period of rapidly rising pay.

Temporary wage growth also moved further below the long-run trend level during February.

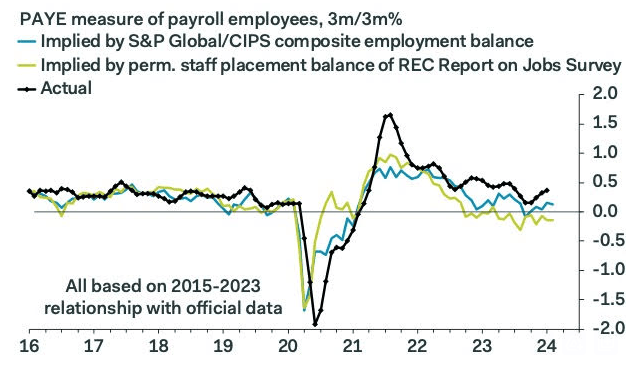

The above image is courtesy of Pantheon Macroeconomics.

Pantheon Macroeconomics cautions that the Report on Jobs does tend to consistently paint a weaker picture than other surveys.

Wood explains the REC has been signalling materially weaker employment growth than the PMI and official data since 2022, while other indicators suggest firmer pay growth.

He notes that companies questioned by the Bank of England in a regular survey said they expect pay settlements to average 5.4% this year, only slightly lower than in 2023.

Firms responding to another Bank of England survey - the Decision Maker Panel survey - said in February they expect to lift wages by 4.9% over the next year.

"The labour market is easing, but probably not as fast as the REC survey suggests," says Wood.