Why the Pound's Upside on Bank of England Shift has Further to Run

- Written by: Gary Howes

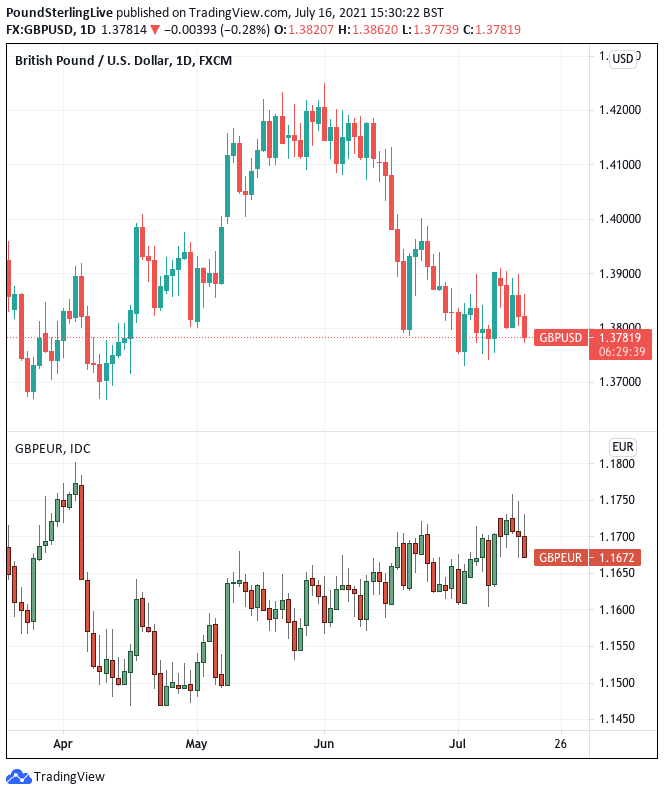

- GBP struggles to appreciate

- Despite signs the BoE is shifting stance

- House of Lords slam Bank's QE programme

- Political pressure could hasten end of QE

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1660 | GBP/USD: 1.3770

- Bank transfer rates: 1.1430 | 1.3480

- Specialist transfer rates: 1.1578 | 1.3675

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound has failed to record gains against the Euro and Dollar despite signs of a possible shift in direction at the Bank of England in response to rising inflation and building political opposition to quantitative easing, although there is ample scope for this underperformance to reverse.

Two recent speeches issued by the Bank suggests a move towards raising interest rates and ending quantitative easing in coming months is afoot.

The Pound did jump following speeches by Monetary Policy Members Ramsden and Saunders - which is the typical FX reaction analysts expected - but the gains failed to stick.

Indeed, the two primary Pound exchange rates actually failed to benefit at all.

The Pound-to-Euro exchange rate ended the previous week a third of a percent lower while the Pound-to-Dollar exchange rate fell by nearly one percent.

The prospect of higher interest rates in the UK in 2022 should be consistent with gains, particularly against the Euro which is burdened by the European Central Bank which looks unwilling to raise interest rates until 2024.

Is the market wrong to keep GBP/EUR bound to the 1.17 area, or is it a matter of time before it rallies?

Above: The Pound is hardly surging, despite the perceived shift in stance at the Bank of England.

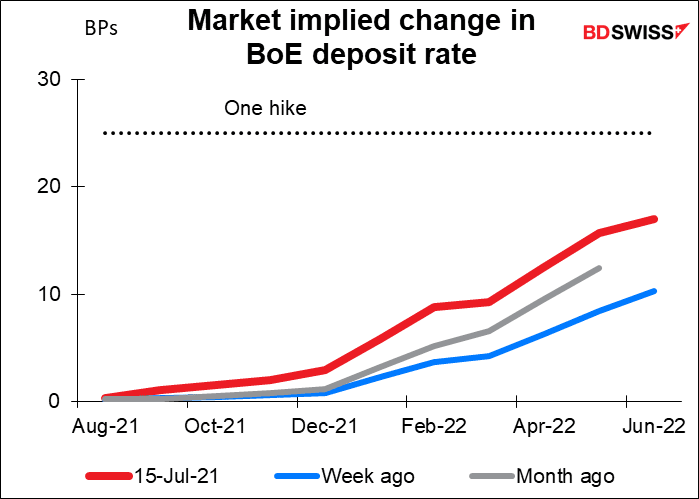

Investors simply aren't buying fully into the notion the Bank will raise rates before mid-2022: money market pricing shows they still don't anticipate a full 25 basis point rise in the Bank Rate by this point.

However pressure on the Bank of England to end its quantitative easing programme - a necessary first step ahead of a rate rise - is certainly growing amidst fears rising inflation rates will not simply fade away.

It is not just shifting economic data that might pull the brakes on the Bank's generous money creation programme, political pressure appears to be building too.

A report released by the House of Lords’ Economic Affairs Committee on Friday meanwhile slammed the Bank for its ongoing pursuing quantitative easing.

The Committee is currently investigating the Bank of England's asset purchase programme and the released their first report on the matter on July 16.

The report's title "Quantitative easing: a dangerous addiction?" gives a strong flavour of what law makers in Parliament's upper chamber think about the policy.

The Committee wants more information from the Bank on how they intend to proceed if inflation proves to be more persistent than currently anticipated.

"Their argument makes sense, with the economy on the upward trajectory that it is, why does the Bank feel a need to maintain such high levels of asset purchases," says a daily briefing note from Hamilton Court FX.

"The Bank of England has become addicted to quantitative easing. It appears to be its answer to all the country’s economic problems," said Lord Forsyth, committee chair.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

He said the scale and persistence of quantitative easing – now equivalent to 40% of GDP – requires significant scrutiny and accountability.

Picking up on the report is prominent Conservative MP Steve Baker who sits on the House of Commons' more powerful Treasury Select Committee.

Baker said the report was "damming".

"At no point has BofE explained why it believes inflationary pressures are only short term or recognised QE’s dangers," says Baker.

"It takes an extraordinary level of economic education to think an economy propped up by QE is sustainable. What is even more extraordinary, is the BofE has set out no plans to reverse QE," he adds..

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Committee almost goes as far as accusing the Bank of simply pursuing quantitative easing to keep the cost of government borrowing lower.

The Bank buys government debt, thereby keeping the repayments on that debt (bond yields) low.

But according to the Committee this puts the Bank's independence - and therefore the credibility of British monetary policy - at risk.

The Bank does nevertheless seem to be shifting stance with Monetary Policy Committee (MPC) member Michael Saunders saying in a speech on Thursday that the strength of the economic rebound and rising inflation suggested there was a case to imminently end quantiative easing.

He said it might "become appropriate fairly soon to withdraw some of the current monetary stimuli in order to return inflation to the 2% target on a sustained basis".

The Bank is currently expected to buy £150BN worth of bonds by year-end.

By abandoning this objective the yield paid on UK sovereign bonds would rise, a supportive development for the Pound.

"The Pound rallied on his suggestion," says Marshall Gittler at BD Swiss Holdings Ltd. "The comments were particularly impressive because he’s historically been one of the most dovish members of the MPC."

But Gittler notes the market is hesitant to fully price in a shift in direction at the Bank.

"Still, the market is not yet pricing in even one 25 bps hike in Bank Rate, so there’s plenty more room to go, in my view," says Gittler.

Image courtesy of BD Swiss Holdings Ltd.

The above shows that the market still has some way to go before a rate rise in the first half of 2022 is fully 'priced in'.

Therefore, money market rates can rise further and so too can the British Pound.

We are not sure why the market and Pound have been hesitant to move but analysts say the recent developments make the August MPC event an incredibly important one.

"The road towards the 5 August BoE meeting looks increasingly challenging," says Jeremy Stretch, a strategist at CIBC Capital Markets.

"Although Short Sterling sold-off post the Saunders comment, seeing Cable test towards 1.39, the cross once again failed to extend through modest overhead resistance in the 1.3900/10 area," he adds.

Attention this week will however turn to the European Central Bank which is to deliver its first policy update following a major review on how it conducts policy.

Analysts are in agreement that there are no major shifts likely and that the ECB will maintain a policy to keep interest rates as low as possible, for as long as possible.

Gittler says if the ECB does take "a more dovish turn as a result of this strategy review, it’s likely to result in a weaker EUR vs USD – unless of course the US also takes a more dovish turn too in response to its strategy review."

"Similarly, EUR could weaken vs GBP too if the consensus on the Bank of England MPC turns," he adds.

However, strategist Mark McCormick at TD Securities is backing the Euro to advance against the Pound.

In a monthly briefing to clients McCormick and his team say:

"We think GBP's vaccine-induced outperformance has drawn to a close, at least against some of its major peers like EUR, USD, and perhaps the JPY.

"EURGBP remains a buy near 0.85."

This makes for a sell on GBP/EUR near 1.1765.

"We note the relative weakness of growth expectations versus the other majors. The UK has lagged most during the recovery, and we flag the recent plunge in mobility in the wake of the COVID spike," says McCormick.