Improving UK Economy To Keep Bank of England Rate Cuts At Bay: BCA

- Written by: Gary Howes

Image © Adobe Images

UK economic activity is shifting up a gear, which, when combined with sticky inflation, means the Bank of England won't cut rates before mid-year.

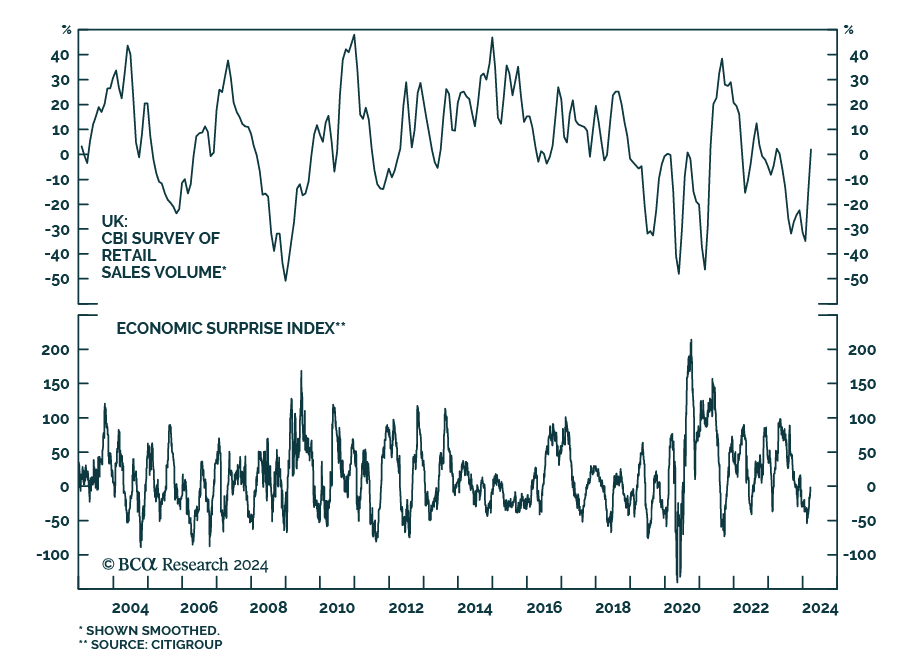

These are the findings of BCA Research, who note the UK's economic surprise index has jumped in 2024, rising from a low of -54 in mid-February to -1.7.

"The latest batch of economic data out of the UK suggests that economic conditions have recently stabilised," says Roukaya Ibrahim, an economist at BCA Research. "Easing inflation is providing a tailwind for consumer spending."

The Bank of England could cut interest rates as soon as May, according to money market pricing. Investors see an approximate 20% chance of a cut, which is higher than the odds of a similar move from the ECB or Fed.

The market sees an 80% chance of a June rate cut and is fully priced for a cut by August.

The odds of early rate cuts rose sharply after last week's Bank of England policy meeting, which saw two members of the MPC drop votes for further rate hikes. The Bank communicated that it could cut rates without risking stoking inflation.

The Pound fell and UK bonds rallied on the developments. If BCA Research is right, and the Bank won't have the luxury of cutting rates in H2 amidst a rebounding economy, the prospect of a recovery in Sterling and a fall in bond prices increases. (That said, BCA's strategists are not inclined to bet on a higher Pound owing to heavily subscribed positioning).

BCA's European Investment strategists say "sticky" UK inflation, coupled with stronger-than-anticipated economic data releases, "will keep the Bank of England from delivering a dovish surprise to markets in the form of a rate cut in the first half of the year".

Numerous economists we follow see an August rate cut as most likely. Meanwhile, the Bank of England's Catherine Mann said Monday that markets were expecting too many rate cuts too soon.

Mann said markets are "perhaps a bit too complacent" about how long the Bank will hold rates. She explained that wage dynamics in the UK are stronger than in the U.S. and Euro area, making it hard to argue that the Bank would be ahead of the ECB and the Fed when it comes to cutting rates.

According to BCA Research, the rise in the UK's economic surprise index is driven by a number of developments, including the flash Manufacturing PMI's stronger-than-anticipated 2.4 point rise in March, taking it to a 20-month high of 49.9.

"A continuation of the uptrend that started in September points to an expansion of manufacturing activity ahead," says Ibrahim.

The Services PMI weakened marginally from 53.8 to 53.4, but is still up over the past six months from a sub-50 reading in September.

The CBI's monthly retail sales report for March delivered a positive surprise on Monday, indicating that retail sales volumes recorded the first year-over-year expansion in 10 months, with a 2% y/y increase, beating consensus estimates that the pace of decline would accelerate from -7% to -14%.

"This is consistent with the positive surprise from the official data for February, which showed that retail sales excluding auto fuel expanded on monthly basis and defied expectations of a contraction," says Ibrahim.

On the inflation front, BCA says while price pressures are moderating, they are still elevated. Services inflation, which is an indicator of domestic price pressures, moderated from 6.5% y/y to 6.1% y/y, ensuring it remains elevated. It also came in slightly hotter than anticipations of 6.0% y/y.