RBC Revises Fed Call, Forecasts Quarterly Rate Cuts Amidst Economic Resilience

- Written by: Sam Coventry

Image © Adobe Stock

RBC Capital Markets has adjusted its Federal Reserve (Fed) call, now forecasting 75 basis points (bp) of rate cuts for 2024, delivered at a quarterly pace.

This change comes as a departure from the previous projection of 125bp of cuts, beginning at the June meeting and implemented at an every-meeting pace.

"We still have a June start as our base case, but we now see a quarterly pace of cuts," stated RBC economist Blake Gwinn. "We think the Fed is still axed to cut by June/July, as the faster-than-expected progress on inflation is likely already enough for the Fed to at least start the process of paring back."

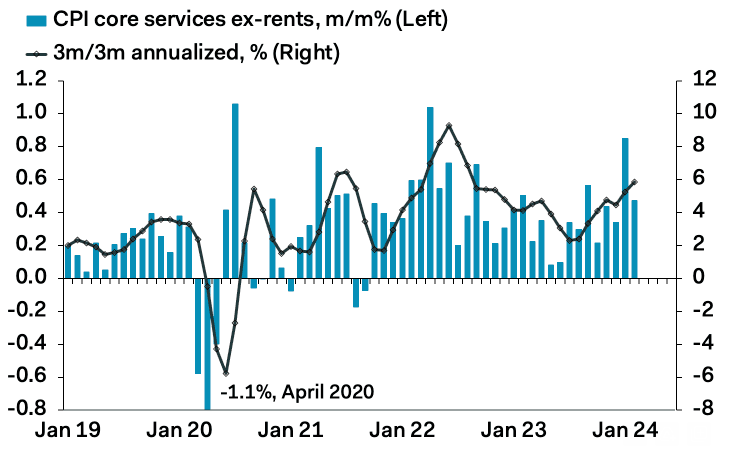

The decision follows concerning details in the February Consumer Price Index (CPI) report, with RBC noting persistent inflationary pressures.

"The diffusion index remained elevated. Supercore improved but remained on the high side," remarked Gwinn. Despite the CPI data not necessarily indicating a disaster, it raises questions about the trajectory of inflation.

Image courtesy of Pantheon Macroeconomics.

"In some ways, our call change today is a product of time decay," added Gwinn. "Every month that ticks by with no sign of growth/labour market headwinds makes it more difficult to envision the type of scenario that would force the Fed in a more dovish direction."

RBC's adjustment also reflects a shift towards a scenario resembling past "adjustment" cycles, such as those observed in 1995, 1998, and 2019.

"We have been increasingly leaning towards a 1995/1998/2019 'adjustment' cycle," explained Gwinn. "In all those instances, the Fed cut 75bp and then held for an extended period."

The forecasted terminal rate has been revised to 4.125%, up 75bp from the previous forecast of 3.375%, reflecting RBC's expectation of a shallower cutting cycle amidst continued economic resilience.

The question remains whether the Fed's median 2024 dot will increase in the upcoming meeting.

"Even after the January CPI/PPI data, most Fed speakers maintained that 75bp of cuts remained the base case," noted Gwinn. "It seems fairly close to a toss-up at this point."