Bank of England Won't Cut Interest Rates Until 2025: HSBC

- Written by: Gary Howes

Image © Pound Sterling Live

The Bank of England will keep interest rates unchanged until 2025, according to one of the UK's biggest banks.

HSBC says the UK's elevated wage growth will ensure inflation remains uncomfortably high for the Bank of England's policymakers, who are tasked with returning inflation back to the 2.0% target.

"With wage growth high and an absence of rapid productivity growth, services companies in particular may need to continue to pass on increased costs to consumers," says Simon Wells, Chief European Economist at HSBC in London.

"Core inflation remains sticky, partly due to high wage growth," he adds, "so we expect the BoE to be on hold through 2024."

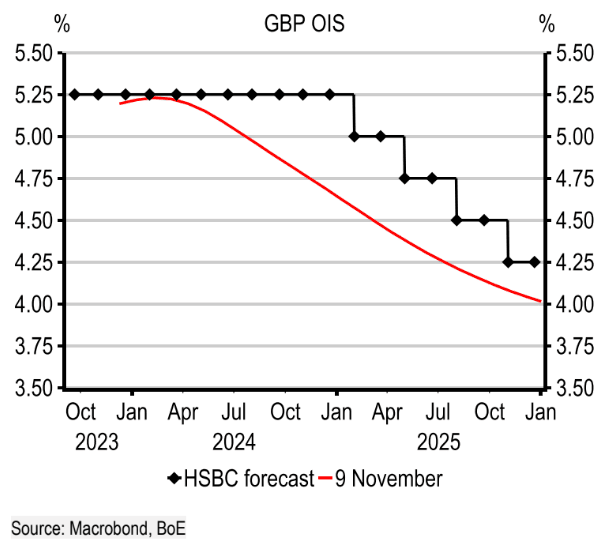

Above: "We expect the BoE to be on hold for longer than the market does" - HSBC.

The forecast defies current market expectations for rate cuts to begin by as early as mid-2024, while consensus amongst the institutional analyst community sees rate cuts commencing around this time, too.

Indeed, some economists reckon a rate cut as early as May 2024 is on the cards as the economic slowdown and rapid descent in inflation prompts the Bank to consider supporting growth via lower interest rates.

Meanwhile, the Bank of England's Chief Economist broke ranks with other members of the Monetary Policy Committee, saying last week that the market's current expectation for rate cuts to commence towards mid-2024 looked about right.

HSBC notes that although inflation has fallen, it looks set to remain high and could still be well above that seen in many of Europe’s other large economies, leaving the Bank on hold for the entirety of next year.

"With wage growth high and an absence of rapid productivity growth, services companies in particular may need to continue to pass on increased costs to consumers," says Wells.

HSBC's economists note that falling energy prices mean inflation's journey from 11% to 4% is likely to be easier than that from 4% to 2%.

"In view of this, we think the BoE will be on hold for longer than the market currently expects," says Wells.

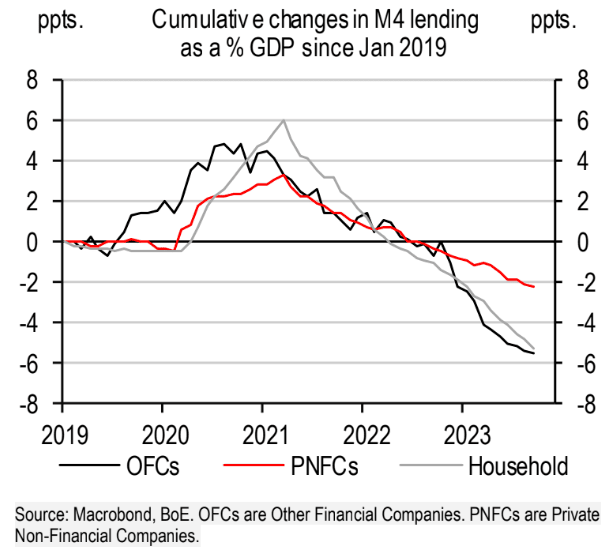

Above: "Credit conditions are tightening, as might be expected" - HSBC.

"With Bank Rate currently at 5.25% and inflation (on our forecast) expected to average 4.0% next year, the real-terms policy rate is not historically high. To go from double-

digit inflation sustainably back to 2% with the real policy rate peaking at just over 2.5% would be historically unusual to say the least," says Wells.

HSBC notes some positive developments of late, including business investment, which has recently picked up despite the rising interest rates.

Business investment has grown by more than 8% through the first half of the year:

"Some of this was due to one-off factors, meaning investment dropped back in Q3. But even after this, it still looks resilient. Firms may have been using internal finance to invest, particularly given the rising cost of labour," says Wells.

Households are meanwhile past the worst of the real wage squeeze as wages increase faster than inflation, which can support consumption.