Bank of England to Skip a September Rate Hike? This is What Would Have to Happen

- Written by: Gary Howes

Image © Adobe Stock

Markets currently see non-negligible odds of 20% that the Bank of England skips a rate hike in September, a development that could potentially result in a decent decline in the value of the Pound.

ING Bank has done the strategising and says it still expects a September rate hike but has considered a potential scenario whereby the Bank pauses in September.

"A pause isn't our base case, but we think investors are right to be thinking about one," says James Smith, Developed Markets Economist at ING Bank.

The Bank emphasised at its August policy update it was moving towards a policy that focuses not necessarily on the peak in interest rates, but the longevity of rates at elevated levels.

In short, it will be keen to ensure markets don't start raising bets on interest rate cuts in 2024.

The Bank of England will have watched the Federal Reserve's policy of skipping rate hikes to elongate its own hiking cycle, something that keeps bond yields elevated and financing conditions tight enough to keep inflation expectations at bay.

Contrast this strategy to the Reserve Bank of New Zealand which called a halt to its hiking cycle but has had to contend with rising market bets that it will be amongst the first to cut. Note too how this stance has contributed to the New Zealand Dollar's underperformance.

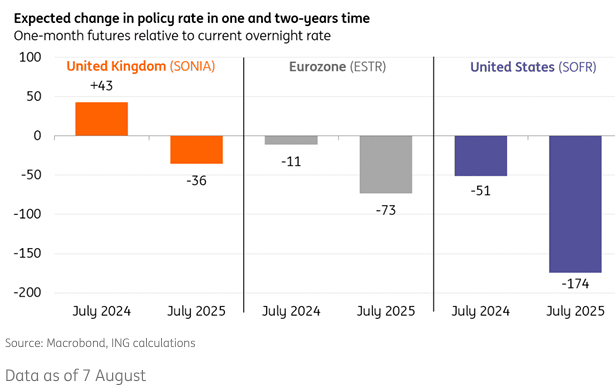

Above: "Markets are pricing fewer rate cuts in the UK relative to the eurozone/US" - ING.

The Bank of England will want to avoid the RBNZ scenario and mimic the Fed by hinting at pauses in the rate hiking cycle while keenly fending off expectations for cuts.

"The Bank is likely to become less focused on how high rates need to go, and instead the central goal will increasingly be to keep market rates (with say two/three-year tenors) elevated long after it stops hiking," says Smith.

But there are also two important labour and inflation data releases between now and the September MPC that could sway the Bank into a hold.

ING's strategising has a pause being more likely if CPI inflation falls from 7.9% to around 6.7% in August and 6.3% in September and private sector wage growth falls from 7.7% to 7.2% in August and 6.9% in September.

ING's base case is however that the Bank hikes again in September and pauses in November as wage growth is likely to prove stubbornly elevated, falling to 6.0% by year-end.

"This is likely to become a central argument for keeping rates higher for longer," says Smith.

A November rate hike will meanwhile be unnecessary as inflation will continue to fall as the impact of retreating gas prices works its way through businesses and households, even weighing on the stubborn services inflation component.

"By November, we expect this story to be more evident, and we should have seen a further gradual improvement in worker supply. Not only that, but assuming both the Fed and ECB appear to have finished hiking by then, the Bank risks being the last hawk standing. Our base case is therefore that the Bank hikes again in September but that this marks the top of the tightening cycle," says Smith.