Pound-New Zealand Dollar Rate Cools From Overbought Conditions

- GBP/NZD has rallied two weeks in a row now

- But GBP/NZD left looking overbought

- NZD finds support on Chinese data

Image © Adobe Stock

- GBP/NZD spot rate at time of writing: 1.9666

- Bank transfer rates (indicative guide): 1.8978-1.9489

- FX specialist rates (indicative guide): 1.9500-1.9480

- More information on FX specialist rates here

The Pound-to-New Zealand Dollar exchange rate is trading softer at the start of the new week and month at 1.9706, however short-term momentum remains firmly with Sterling bulls and any weakness is likely to be short-lived based on current technical and fundamental setups.

The GBP/NZD exchange rate rose 0.88% on Friday alone, taking its weekly advance to 2.50% which makes for the second consecutive weekly advance in the pair and underscores a view that the March-June period of rapid decline might now have faded.

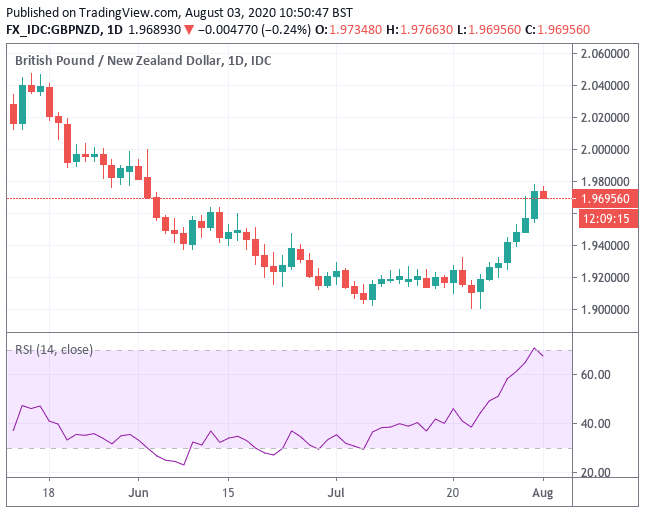

The Pound started August overbought and the softer exchange rate on Monday is therefore warranted from a technical point of view. Financial analysts favour the Relative Strength Index (RSI) when trying to establish an assets momentum and whether it is overbought or oversold.

The RSI on the daily GBP/NZD chart touched 71 on Friday, a development that accompanied that sharp 0.88% gain. Importantly, any reading above 70 is considered to signify overbought conditions as the RSI rarely stays above 70 or below 30 for protracted periods of time.

Above: Daily GBP/NZD chart, with RSI in lower panel

With GBP/NZD ending the week overbought the prospect for a decline and a period of consolidation this week was always a likely prospect, and we would therefore not be surprised to see the rally fade somewhat.

However, momentum on GBP/NZD remains positively aligned in the short term according to most technical readings and we would favour further advances once the overbought conditions are corrected somewhat.

And it is not just GBP/NZD where conditions are overbought, we note too that the headline GBP/USD exchange rate also reached similar conditions last week and a pullback here could well translate into softer conditions on a host of other Sterling exchange rates over the short-term.

"With momentum stretched after an accelerating bull run, the bulls will need to react to Friday’s stalling candlestick to prevent what could be a corrective move developing on GBP/USD," says Richard Perry of Hantec Markets. "A candlestick that hinted at exhaustion on Friday, was arguably a shooting star, came after a succession of strong bull sessions. The RSI is historically stretched around 80 and with traders coming back in on Monday morning to see a consolidation, there is a battle for control."

If GBP/USD retreats further, we could well expect GBP/NZD to follow suit.

Sterling saw a notable recovery through the second half of July, recording gains against all its major peers apart from the Swedish Krona, with analysts failing to identify a clear catalyst for the move.

However, some have noted that UK economic data are starting to outperform that of its peers as the economic benefits of exiting lockdown start to be felt. There is also the view that fears EU and UK negotiators would fail to reach a post-Brexit trade deal are overdone, with confirmation last week that the two sides would continue to work through August and September in order to strike a compromise.

Negotiations are far from breaking down, as had been a widely-held interpretation by many analysts and political commentators. As markets increase odds for a deal to be struck, even if it is a 'bare bones' deal, we would imagine Sterling would find itself better supported.

However, the GBP/NZD exchange rate is likely to also remain highly prone to external drivers as the New Zealand Dollar tends to perform according to the prevailing sentiment of the global investor community, rising when markets and commodity prices are increasing in value and falling when the reverse is true.

With this in mind, a potential explanation for the weaker GBP/NZD exchange rate at the start of the week is the improvement in investor sentiment thanks to the better than expected China Caixin Manufacturing PMI which read at 52.8 in July, ahead of expectations for a reading of 51.3.

China is a key export destination for New Zealand produce and goods, therefore news that China's manufacturing sector is recovering has aided the currency.

The NZ Dollar was one of the better performing currencies in the April-June period as global markets put in a sizeable recovery from the sharp and brutal drops suffered in the February-March period and China's stimulus-lead recovery is likely to be a key source of support going forward.

However, July saw the currency's recovery ultimately fade as investors started to demand concrete signs of economic recovery in the economic data, and there are concerns the New Zealand economy might be a laggard in this regard.

"While the borders of NZ’s trading partners remain closed, NZ’s economy will continue to struggle given the negative impact these lockdowns have had on its important tourism and education sectors. The RBNZ will also cap gains in the NZD by continuing to threaten further easing if the NZD strengthens with this easing potentially including negative rates as well as foreign bond buying," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

New Zealand's government successfully got on top of its domestic covid-19 outbreak and ultimately stopped community transmission of the disease which allowed the country to fully unlock, delivering a distinct economic outperformance advantage. However, a small and open country such as New Zealand requires global trade and strong incoming visitor numbers to operate at full capacity.

With New Zealand's borders closed, and global trade still yet to fully recover owing to the ongoing global battle with the virus, the prospect of further intervention from the Reserve Bank of New Zealand (RBNZ) remains elevated.

The RBNZ has committed to buying NZ$60BN in bonds under its Large Scale Asset Purchase (LSAP) programme, making it one of the most aggressive interventions amongst developed economies. The general rule of thumb in foreign exchange is the larger the intervention, the weaker the currency and any further increases in the quantitative easing programme will likely hamper the NZ Dollar.