Pound Sterling Dips on Brexit 'Deadlock' but Barnier sees Brexit Negotiation Breakthrough in the Next Two Months

Image (C) European Commission Press Office.

The Pound fell in response to news little progress had been made in the fifth round of Brexit negotiations between the European Union and United Kingdom.

"We are in a position of deadlock," says the European Union’s chief Brexit negotiator Michel Barnier who has refused to recommend to European leaders that negotiations move on to issues of trade.

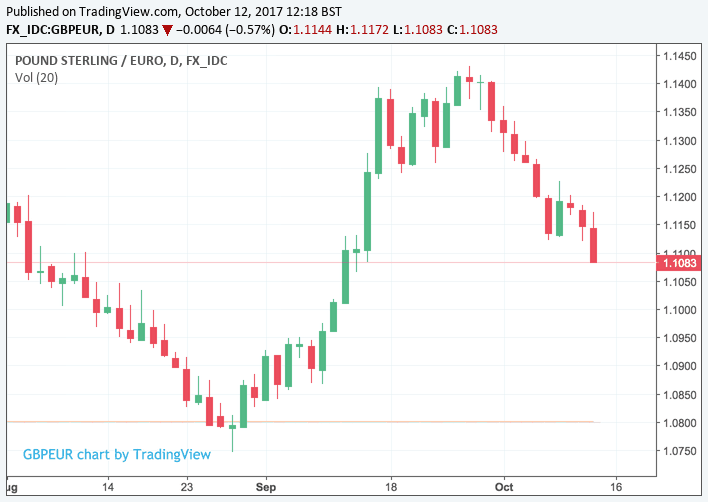

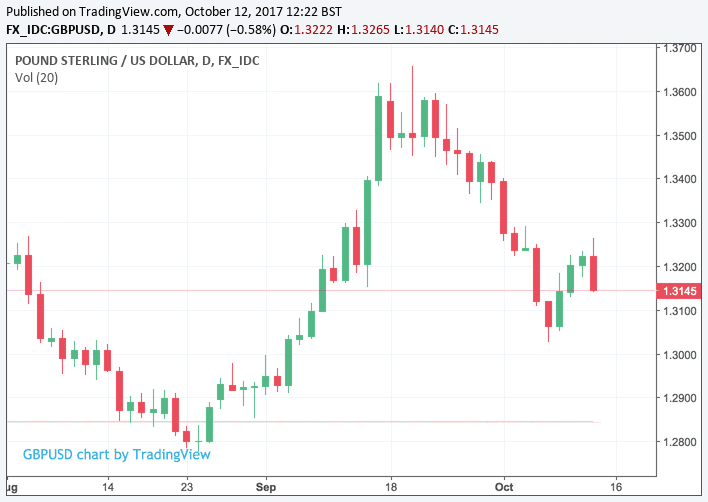

Sterling fell in response with the Pound-to-Euro exchange rate trading down to 1.1091 having been as high as 1.1172 earlier and the Pound-to-Dollar exchange rate trading to 1.3158 having tradded as high as 1.3264 earlier.

However, declines were arrested by Barnier's suggestion that enough momentum exists in the process to ensure a breakthrough will be made within the next two months.

David Davis also agrees that an agreement will be achieved soon despite the deadlock.

The export of benefits, the voting in local elections and bringing family members to the UK appear to be sticking points with regards to the rights of European citizens in the future.

There also appears to be little progress on the jurisdiction of the European Court of Justice following Brexit while the financial settlement is also in stalemate.

But Davis reckons the EU and UK have come closer to reaching settlement on legalities regarding EU and UK citizens.

Going forward, Davis also hopes Barnier will convince the leaders of the European Union to allow him more flexibility to take discussions forward and achieve shared objectives.

$EURGBP moves higher on #EU chief negotiatior Barnier's statement that #Brexit talks have reached deadlock on divorce bill pic.twitter.com/NYeX9bsgXs

— Danske Bank Research (@Danske_Research) October 12, 2017

In response to the events in Brussels, financial analysts are pondering the implications for Sterling.

"Pound takes a knock against a Euro - €/£0.90 - Quel surprise! It will continue to drift through uncertainty - nothing new there!" says a sanguine David Buick of Panmure Gordon.

'Drifting' implies Buick believes the Pound will remain in familiar territory observed on longer-term timeframes.

Short-term, we note Sterling's downtrend - in place for much of October - has been reinforced by the move and a close around current levels, or lower, would hint at yet further declines in the near future:

The Dollar meanwhile appears to be toying with a break of its longer-term uptrend:

The knee-jerk response lower by the Pound to the talks is understandable as talk of deadlock implies to traders that the prospect of a messy exit from the European Union by the United Kingdom has grown.

It also pushes back the earliest possible opportunity for a transitional deal to be agreed - something businesses need to plan adequately for coming years.

However, hints of a breakthrough being possible within the next two months will surely put a floor under the Pound as it suggests markets can wait for further developments.

Heading into today expectations for a breakthrough were already low so the disappointment relative to expectations is not massive, we expected a lukewarm briefing and said such would represent the business-as-usual outcome that would see Pound Sterling muddle in a sideways direction.

“So why aren’t we seeing gradual GBP weakness every time we hear negative news from Britain?,” says Ulrich Leuchtmann at Commerzbank in Frankfurt. “Because it is not the direct economic effects of the Brexit that are of concern, they are already priced into the current GBP levels.”

Leuchtmann warns that, just because Sterling has avoided a “depreciation spiral”, markets would be complacent to think that such a thing cannot still happen.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.