Tax Boost Helps Chancellor with the Biggest January Budget Surplus on Record

- Written by: Gary Howes

Above: Philip Hammond, © Foreign & Commonwealth Office, reproduced under CC licensing

The UK's public finances recorded their largest-ever January surplus, in what amounts to a welcome boost to the Chancellor of the Exchequer Philip Hammond mere weeks ahead of Brexit.

Borrowing in January 2019 was in surplus by £14.9BN, a £5.6BN greater surplus than in January 2018; this was the largest January surplus on record (records began in 1993).

Markets had forecast a surplus of £11.05BN to be reported.

Driving the improved performance of UK finances was a strong round of self-assessed Income Tax and Capital Gains Tax receipts.

Combined, these two sources of income saw the Treasury rake in £21.4BN in January 2019, which is £3.1BN more than in January 2018.

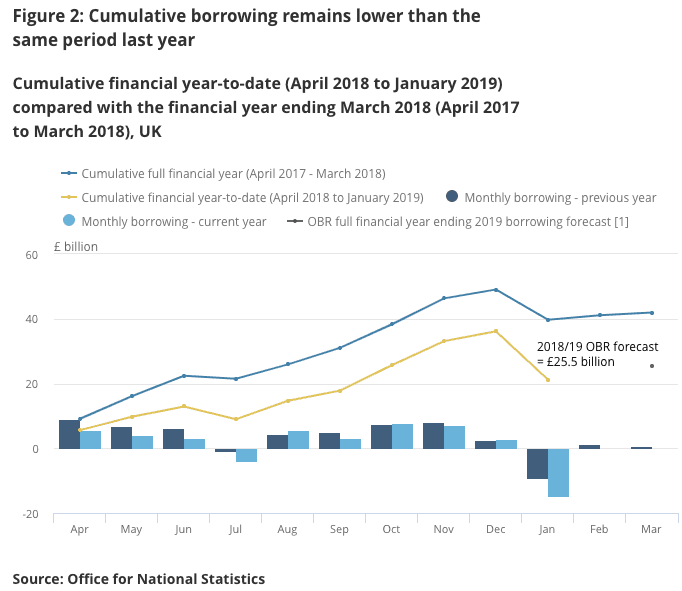

In the current financial year-to-date (YTD) (April 2018 to January 2019), public sector spending exceeded the money received in taxes and other income. This meant the public sector had to borrow £21.2 billion; that is, £18.5 billion less than the same period in the previous financial year-to-date. Borrowing so far this financial year has been the lowest for any April to January period for 17 years.

"So far the public finances seem to have been largely immune to the adverse effects of Brexit-related uncertainty, because this has mostly affected business investment. More tax-rich areas of economic activity, notably earnings from employment and consumer spending, have held up better over the past ten months," says John Hawksworth, chief economist at PwC. "This is reflected in central government receipts rising by around 5% in the financial year to date compared to a year earlier, as compared to an increase of only around 3% in central government spending over the same period. As a result, the budget deficit has fallen sharply."

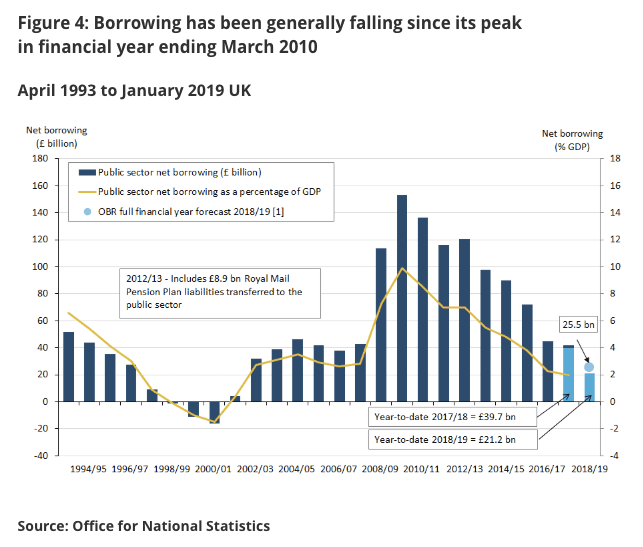

The trend in the UK's public finances appears to be a constructive one, with the government delivering on its commitment to return finances to sustainable levels.

In the latest full financial year (April 2017 to March 2018), the £41.9 billion (or 2.0% of gross domestic product (GDP)) borrowed by the public sector was around one-quarter of the amount seen in the FYE March 2010, when borrowing was £153.1 billion (or 9.9% of GDP).

"Public sector borrowing now likely will come in slightly below the OBR’s full-year Budget forecast, helping to maintain the fiscal headroom that the Chancellor could draw on in future to stimulate the economy, while still meeting his targets," says Samuel Tombs, UK Economist with Pantheon Macroeconomics.

Pantheon Macroeconomics say borrowing will total £22.4B this year, just over £2B below the OBR’s £25.5B forecast, if the year-to-date trend is maintained.

"The October Budget plans incorporated £15B of fiscal headroom in meeting the 2020/21 borrowing target of 2% of GDP. As a result, we continue to think that the Chancellor will be able to set fiscal policy to boost the economy modestly again in 2020 in the Budget later this year. But with the economic outlook highly uncertain at present, next month’s Spring Statement probably will be a holding operation," says Tombs.

The outcome of the ongoing Brexit negotiations with the EU are expected to heavily influence the trajectory of UK finances, with economists expecting an ongoing improvement in the event of a deal being struck. However, questions will be raised in the event of no deal being reached owing to the uncertain impact such an outcome will have on the economy.

"If a Brexit deal is secured, we think that a pickup in economic growth in 2019 will increase the size of that headroom. And if there is a no deal Brexit, the Chancellor should have plenty of scope to support growth, and if needed to the Chancellor would sacrifice his fiscal rules for the economy," says Thomas Pugh, UK Economist with Capital Economics.