Bearish Case for Swiss Franc Builds: Saxo

- Written by: Charu Chanana, Head of FX Strategy at Saxo Bank

Image © Adobe Images

The market is starting to look for competitive pivots, and expectations around SNB rate cuts coming before the ECB and Fed could continue to gain traction. A strong franc could also be a worry for the economy, and a shift in SNB's FX stance can bring further franc downside.

Switzerland’s inflation readings surprised on the downside for January, a clear divergence to US CPI that came in hotter-than-expected yesterday. CPI accelerated by 1.3% YoY in January vs. expected and previous print of 1.7%.

On a MoM basis, inflation was 0.2%, coming in well below the 0.6% expected. Meanwhile, core inflation slid to 1.2% YoY in January, the lowest level since January 2022.

That is a major win for the Swiss National Bank (SNB), which kept rates unchanged at 1.75% at its last meeting in December and was expected not to pivot before other major central banks.

But the narrative has shifted considerably, and the market is increasing the odds of an SNB rate cut now as early as March.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes

Comments from SNB President Jordan earlier this week hinted at the negative effects of nominal appreciation of the franc on the economy.

He sounded confident that inflation could stay within the target range of 0-2% despite any acceleration risks.

Elevated inflation in 2022 made the SNB's FX bias shift towards strengthening the franc to ward off imported inflation. The battle on inflation appears to be over now, and given the economic growth risks taking over concerns, the FX bias could likely shift towards weakening the franc.

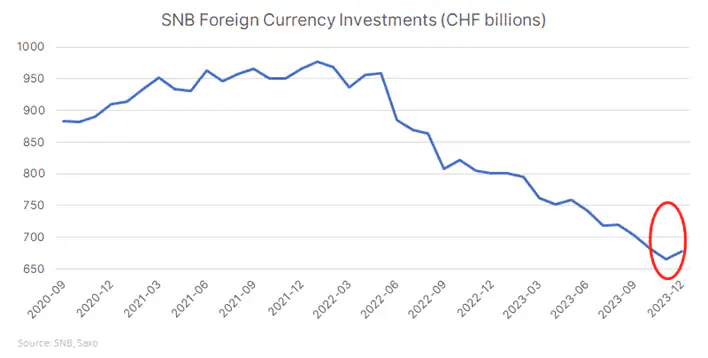

Above: Is the SNB starting to sell CHF again? Image courtesy of Saxo Bank.

This is also evident in how the SNB has been active in the FX markets. The central bank has been running down its reserves until November but reversed course from December.

The FX language has also shifted from "focus is on selling foreign currency" to "SNB is willing to be active in foreign exchange market as necessary" in December, implying a subtle shift in its FX stance.

Positioning No Headwind to Further CHF Weakness

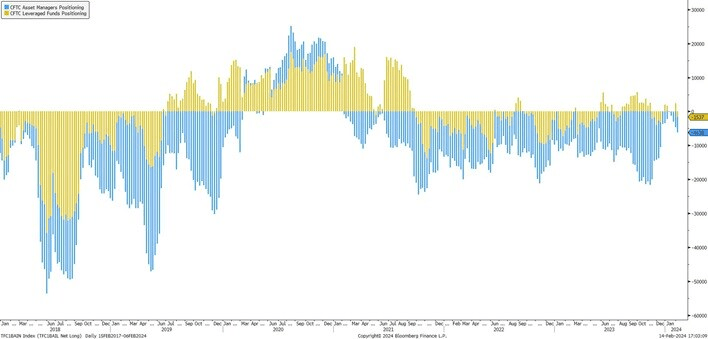

While overall positioning in the franc remains short, leveraged funds have mostly covered their shorts and most of the aggregate short positioning remains with asset managers.

Most recent CFTC data for the week of February 6 saw leveraged funds turning back to a short position in the franc in an abrupt change from a net long position in the week before as they potentially positioned for a weaker CPI and a consequent shift in central bank tone.

Positioning is no impediment to further CHF downside. Image courtesy of Saxo Bank.

CFTC data show leveraged funds held 1,537 contracts tied to bets the franc will fall, the most since mid-December. That’s down from 2,433 long bets the week prior, which was the highest level since early November.

Until the SNB adopts a clear FX signal, positioning could remain volatile. But short positioning is far from stretched for now, and pre-2020 levels of short positioning could pose significant franc downside from here.

A Candidate for the Competitive Pivot Trade As Bank of Japan Exits Negative Rates

The competitive pivot narrative will likely be back to the forefront with a hot January US CPI prompting a pushback to Fed rate cut expectations.

If Swiss inflation remains below 2%, there is an increasing chance for the SNB to cut rates in March and pre-empt the ECB and the Fed. Back in June 2022, the SNB hiked 50bps, a month ahead of ECB’s first-rate hike.

EURCHF has rallied to 0.95 but is still below its 200DMA, currently seen at 0.9580, which would also be a key test to break above from the downward channel that has been in place for most of 2023.

Above: EUR/CHF is still pointed lower on a technical basis.

Given the broad dollar strength so far in 2024, it is no surprise that USDCHF is already up close to 5.5%. However, the pair was down 9% in 2023, so there is more room for franc weakness as pivot bets are brought forward for SNB but delayed for the Fed.

Finally, it’s important to consider that SNB interest rates at 1.75% are the lowest in G-10, barring the negative interest rate offered by Bank of Japan. A rate cut from the SNB would make franc as an even more popular funding choice for carry trades, especially in light of the expectations around BOJ tightening.

Additionally, for those looking to position for the removal of negative interest rates from the BOJ and the consequent appreciation of the yen, Swiss franc offers the least negative carry. However, any deterioration in geopolitics and a resultant risk-off move could still bring tactical strength back to franc.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes