Australian Dollar: Positive 2024 Awaits Says ANZ

- Written by: Gary Howes

Image © Adobe Images

"Upside ahead," says an Australian banking and capital markets giant laying out its predictions for the Australian Dollar.

ANZ says positive developments in global financial markets, China and the domestic economy will all conspire to make the Aussie a darling of foreign exchange markets in 2024.

"Positive risk sentiment in 2024 will support the AUD and NZD," says Mahjabeen Zaman, an analyst at ANZ.

The Australian Dollar's varied performance in 2023 was a result of prevailing USD direction and developments in China, where the post-Covid rebound failed to materialise and boost China proxies, of which the Aussie is considered.

"Looking ahead, we expect these two factors to dominate," says Zaman, who anticipates a broad weakening in the U.S. Dollar that should boost procyclical trends on global markets, which is traditionally supportive of the Australian Dollar.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"Global risk sentiment is positive as we look into 2024, with global inflation moderating and global central banks easing. This sentiment is feeding into risk assets, and the AUD, being a high beta currency, stands to benefit," says Zaman.

But the Reserve Bank of Australia (RBA) will also offer a hand: "given our view that RBA rate cuts will only begin at the end of 2024, it is likely that the carry advantage that the AUD will have against currencies where interest rates have eased aggressively will matter," says Zaman.

Other supportive domestic props include a current account surplus resulting from strong industrial commodity exports, which helps maintain a floor for the currency.

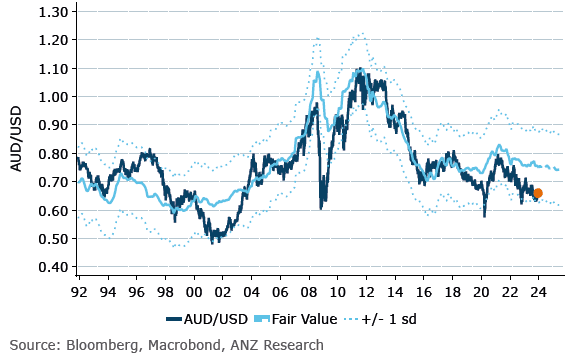

Above: "AUD/USD is undervalued based on our Fair Value model" - ANZ.

For the Australian Dollar to U.S. Dollar exchange rate (AUD/USD), ANZ reckons the floor was reached when 0.6270 was printed back in October.

Projections show ANZ pencils in 0.68 for the end of March 2024, 0.69 for the end of June, 0.70 for the end of September, and 0.7 for the year's end.

The corresponding Pound-Dollar profile is 1.30, 1.32, 1.33, 1.34, giving a Pound to Australian Dollar profile of 1.91, 1.91, 1.90 and 1.91.

The flat Pound-Aussie profile reflects expectations for a stronger Pound, which looks set to keep the exchange rate relatively contained.

Elsewhere, a Euro-Dollar profile of 1.11, 1.13, 1.14 and 1.15 gives a Euro to Australian Dollar exchange rate outlook of 1.63, 1.64, 1.63 and 1.64.

Track GBP with your own custom rate alerts. Set Up Here.